Feeling stuck in life is a common experience that can affect anyone, regardless of age, background, or circumstances. This sensation of being trapped—whether in a career rut, a personal relationship, or a general state of dissatisfaction—can lead to frustration, decreased motivation, and a sense of helplessness. Recognizing this phenomenon is the first step toward reclaiming control and reigniting one’s personal growth.

According to a 2023 survey by the American Psychological Association, approximately 62% of adults reported feeling stuck in some aspect of their lives at least once in the previous year. This widespread issue underscores the importance of practical strategies and mindset shifts to break free from stagnation. This article explores ways to identify feelings of stagnation and proposes actionable methods to move forward.

—

Understanding the Feeling of Being Stuck

Being stuck often involves a mix of emotional and cognitive patterns that create barriers to progress. Psychologists describe it as a state where individuals experience diminished motivation, lack of clarity, and a reduced sense of purpose. This can manifest differently depending on one’s circumstances—for example, a mid-career professional might feel trapped due to a lack of promotion opportunities, whereas a college graduate might feel paralyzed by uncertainty about career choices.

A real-life example is Sarah, a 34-year-old marketing manager who felt stuck after five years in the same role. Despite good salaries and job security, she experienced constant dissatisfaction and low energy levels. Her challenge was not about external success but internal fulfillment. This example illustrates that being stuck is not always external but can stem from misalignment between personal values and daily actions.

Identifying the root cause is crucial. Causes often include fear of change, lack of clarity regarding goals, burnout, or external life circumstances such as financial constraints or family obligations. Without pinpointing these, efforts to move forward may remain ineffective.

—

Practical Steps to Overcome Life Stagnation

Step 1: Conduct a Personal Audit

Begin by analyzing your current life situation—career, relationships, physical and mental health, and personal growth. This audit should include honest reflection on what aspects feel unsatisfying and why. Tools like journaling or mind-mapping can help articulate nebulous feelings.

Consider the case of John, who used a journaling app to write down daily reflections. Over months, patterns emerged showing that his dissatisfaction stemmed primarily from his job environment, not the work itself. This insight motivated him to explore different departments within his company, ultimately finding a role better suited to his interests.

Step 2: Set Small, Achievable Goals

Often when feeling stuck, the future appears overwhelming. Breaking down ambitions into small, achievable goals provides a sense of progress and control. For example, if your aim is to switch careers, a practical goal would be to update your resume or enroll in an online course rather than diving immediately into a career shift.

Data from the University of Scranton shows that individuals who write down their goals are 42% more likely to achieve them than those who don’t. Setting SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals is also a proven approach to maintaining motivation.

Step 3: Seek Support Networks

Isolation can amplify feelings of being stuck. Sharing thoughts and challenges with trusted friends, mentors, or support groups provides fresh perspectives and emotional validation. The value of networking extends beyond career advancement—it taps into collective wisdom and encouragement.

Real cases illustrate this well: Emma, an aspiring entrepreneur stuck in indecision, joined a local business network and found mentors who helped her plan her startup launch. This external support was crucial in transitioning her from indecision to action.

—

Mindset Shifts to Foster Growth

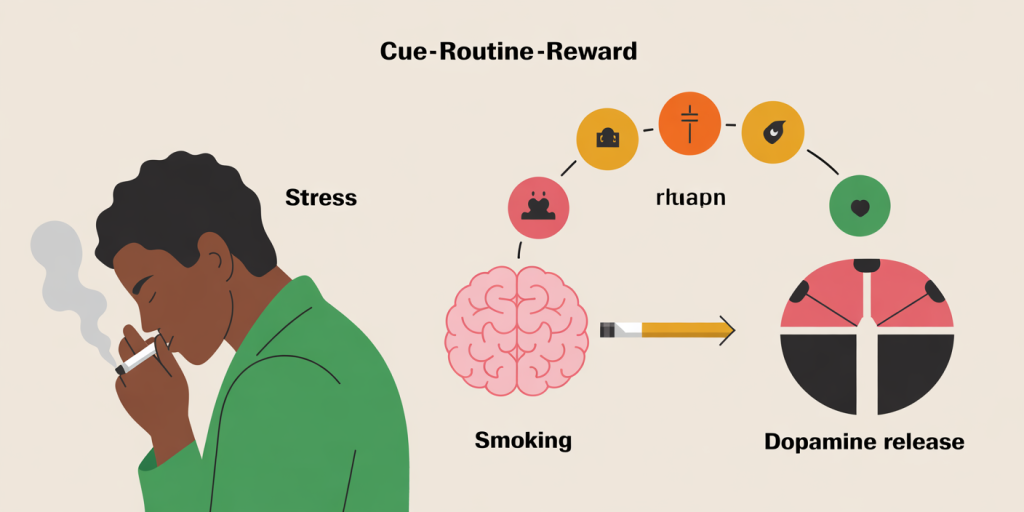

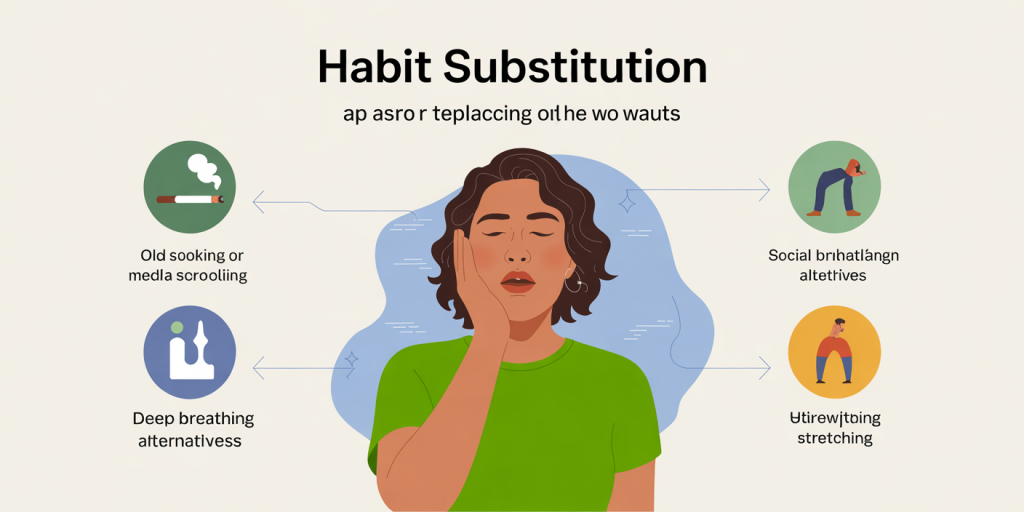

Changing how you think about your situation is fundamental to breaking free from stagnation. Cognitive Behavioral Therapy (CBT) techniques, such as challenging negative thoughts and reinforcing positive behaviors, can be highly effective.

For example, replacing “I can’t change my career” with “I can take one step today towards exploring new paths” reduces paralysis and builds momentum. Mindfulness practices also help individuals stay present and reduce anxiety about the future, a common barrier to progress.

A comparative table below highlights two key mindset approaches when dealing with stagnation:

| Approach | Description | Practical Outcome | Example |

|---|---|---|---|

| Fixed Mindset | Belief that abilities and situations are unchangeable | Inaction and resignation | “I’m stuck because I lack skills.” |

| Growth Mindset | Belief that skills and situations can improve with effort | Willingness to try new things and persist | “I can learn new skills to advance.” |

Studies from Stanford University confirm that individuals who adopt a growth mindset exhibit higher resilience and better problem-solving abilities.

—

Lifestyle Adjustments to Regain Momentum

Sometimes external changes can help reset internal feelings. Regular physical exercise, improved sleep routines, and balanced nutrition positively influence mental health. According to the World Health Organization, regular physical activity reduces symptoms of depression and anxiety by nearly 30%.

Setting routines that incorporate self-care practices—such as meditation, creative hobbies, or simply spending time in nature—can create a rejuvenating environment for the mind and body. These lifestyle habits equip individuals with better cognitive resources to tackle life’s challenges.

A practical example is David, a software engineer who felt stuck and overwhelmed due to sedentary work and isolation. By integrating daily walks, cooking healthy meals, and joining a weekend art class, he not only improved his wellbeing but also found new social connections and inspiration for his professional projects.

—

When to Seek Professional Help

If feelings of being stuck are accompanied by persistent sadness, anxiety, or loss of interest in daily activities, it may be necessary to consult mental health professionals. Clinical depression and anxiety disorders often present as life stagnation but require expert intervention.

Cognitive Behavioral Therapy, coaching, and sometimes medication can assist in restoring emotional balance and providing strategies to address underlying issues. Studies reveal that early intervention reduces long-term negative impacts on quality of life and productivity.

For instance, Jane, a recently graduated student feeling utterly directionless, found relief through therapy, which helped her identify anxiety as the core problem and develop coping mechanisms. This example highlights how professional support can be transformative, especially when self-help strategies feel insufficient.

—

Looking Forward: Harnessing the Power of Change

Feeling stuck is often an indicator that growth is possible but hindered by current circumstances or mindsets. Embracing change involves patience, self-compassion, and a proactive spirit. Future perspectives suggest that personal stagnation can be an opportunity for self-discovery rather than a permanent roadblock.

Emerging tools such as AI-driven personal coaching apps and virtual reality environments for therapy are revolutionizing how individuals overcome inertia. According to a 2024 report by Gartner, 45% of adults plan to use digital tools for personal development within the next five years. These technologies provide accessible and personalized means to reignite motivation and redefine goals.

Moreover, cultivating adaptability and lifelong learning continues to be vital in a rapidly changing world. The ability to reassess priorities, acquire new skills, and embrace novel experiences equips individuals with resilience against recurring stagnation.

In summary, feeling stuck in life is a complex yet manageable challenge. Through a clear understanding of one’s emotions, practical goal-setting, mindset shifts, lifestyle improvements, and the right support, it is possible to move beyond inertia and toward a fulfilling path. With emerging technologies and continued research, future strategies promise to be even more effective in helping individuals reclaim momentum and thrive.