In the world of investing and personal finance, a critical decision that investors face is whether to reinvest their gains or withdraw profits. This choice can significantly impact the long-term growth of an investment portfolio, overall wealth accumulation, and financial stability. While withdrawing profits may provide immediate liquidity and satisfaction, reinvesting gains harnesses the true power of compounding, which has been proven to exponentially increase wealth over time. Understanding the dynamics between these two strategies is essential for investors aiming to maximize returns and achieve sustainable financial success.

This article delves into the practical implications of reinvesting versus withdrawing profits by examining the benefits, risks, and real-world outcomes associated with each approach. Using data-driven insights, comparative tables, and illustrative case studies, we will explore how investors can make informed decisions aligned with their financial goals and risk tolerance.

—

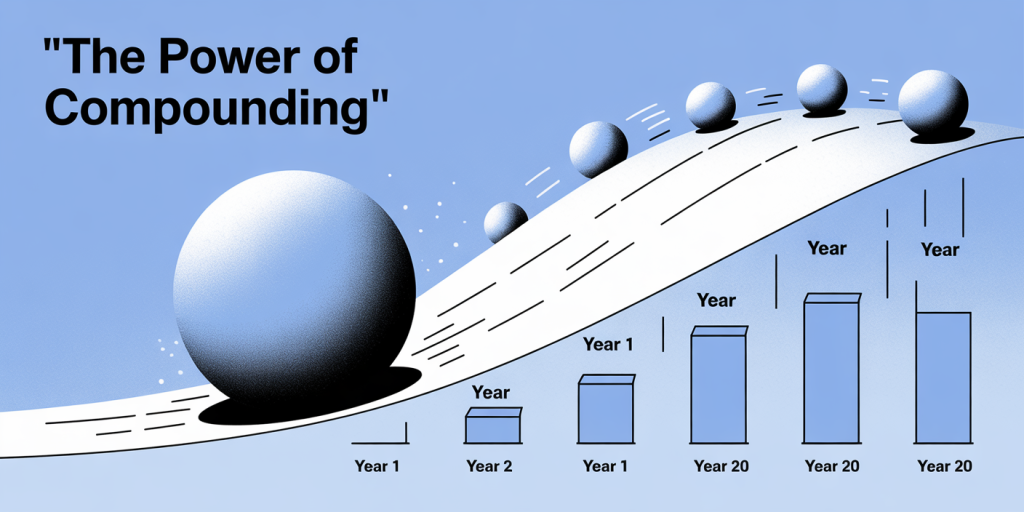

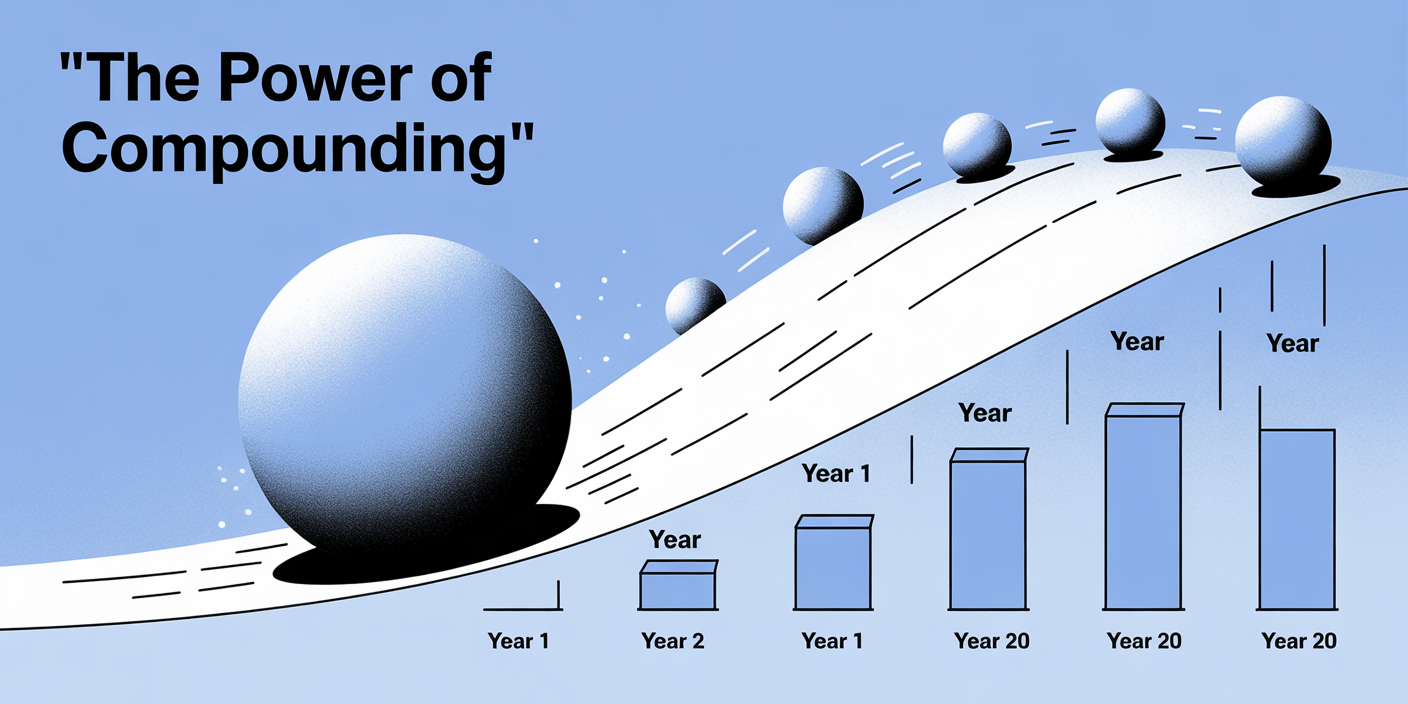

The Power of Compound Growth Through Reinvesting

Reinvesting gains primarily means taking dividends, interest, or capital gains earned from an investment and using those returns to purchase additional shares or assets instead of cashing out. One of the foremost advantages of this strategy is the acceleration of compound growth—where earnings generate further earnings, creating a snowball effect on total returns.

According to a study by the Financial Times, an investment reinvested consistently over 30 years can grow up to 10 times larger than one where profits are periodically withdrawn. For example, consider an initial investment of $10,000 in the S&P 500 index fund with an average annual return of about 8%. Reinvesting dividends annually can turn the initial $10,000 into roughly $100,000 after 30 years. Conversely, withdrawing all dividends annually limits the investment largely to price appreciation, reducing the potential portfolio value significantly.

Another practical example is found in retirement accounts such as the 401(k) or IRAs, where dividends and interest are automatically reinvested without tax implications until withdrawal at retirement age. This setup benefits investors by maximizing growth within the tax-advantaged framework, which couldn’t be achieved if profits were withdrawn regularly.

—

Immediate Financial Needs vs. Long-Term Wealth Accumulation

A key factor influencing whether investors choose to reinvest gains or withdraw profits is their immediate financial need. Regularly withdrawing profits provides liquidity, supporting lifestyle expenses, debt payments, or emergency funds. For retirees or income-focused investors, withdrawing dividends or interest to meet monthly cash flow needs is not only practical but often necessary.

However, consistently taking money out of an investment portfolio reduces the capital base that generates future returns. This creates a trade-off between short-term financial security and long-term wealth growth. Investors who withdraw profits regularly may notice portfolio stagnation or even reduction over time, especially if withdrawal rates exceed returns.

A comparative table below illustrates the difference in portfolio growth for two investors with $50,000 initial investments over 20 years, assuming an 8% annual return, with one reinvesting all gains and the other withdrawing 4% annually:

| Year | Reinvesting Gains ($) | Withdrawing 4% Annually ($) |

|---|---|---|

| 0 | 50,000 | 50,000 |

| 5 | 73,466 | 56,672 |

| 10 | 108,000 | 63,181 |

| 15 | 158,816 | 67,715 |

| 20 | 233,220 | 68,455 |

This table underscores how reinvestment dramatically increases the portfolio’s value while withdrawals diminish growth potential, often leading to a plateau in total wealth.

—

Psychological Aspects and Behavioral Finance

Investing psychology plays a pivotal role in whether individuals choose to reinvest or withdraw profits. The temptation to “lock in gains” when markets are favorable often leads to premature selling or withdrawal of profits. This behavior, influenced by loss aversion and the fear of market downturns, may undermine long-term financial goals.

Behavioral finance research suggests that investors who systematically reinvest gains are more likely to benefit from market recoveries and compounding. For instance, a 2017 Vanguard study indicated that investors who maintained consistent reinvestment strategies experienced 1.5% higher annual returns on average than those who frequently withdrew profits or timed the market.

Moreover, immediate gratification from profit withdrawals can overshadow the discipline required for long-term investing. Encouraging habits such as regular reinvestment and automatic dividend reinvestment plans (DRIPs) can help investors overcome emotional biases, leading to more favorable outcomes over decades.

—

Case Studies Highlighting Practical Outcomes

Several real-life investment stories emphasize the importance of reinvesting gains versus withdrawing profits. Warren Buffett, renowned for his compounding approach, has famously refrained from large personal profits withdrawals, instead reinvesting Berkshire Hathaway’s earnings to fuel exponential growth. Buffett’s ability to compound earnings has resulted in extraordinary wealth accumulation over multiple decades.

Another illustrative case is the story of Ronald Read, a janitor and gas station attendant who amassed an $8 million fortune by consistently investing and reinvesting dividends in blue-chip stocks over his lifetime. His story exemplifies how modest income levels paired with disciplined reinvestment, patience, and market understanding can build substantial wealth without high-risk ventures.

In contrast, many investors who cash out profits during market highs often miss out on subsequent growth. For example, retail investors who exited equities prematurely during the 2008 financial crisis, only to re-enter later at higher prices, experienced significantly diminished total returns.

—

Risks and Diversification: When Withdrawal May Be Necessary

Though reinvesting gains holds significant advantages, it is not without risks. Market volatility, economic downturns, or changes in personal circumstances sometimes necessitate withdrawing profits for diversification, risk management, or liquidity.

Investors exposed to concentrated holdings may prefer partial profit-taking to rebalance portfolios, reduce risk, and safeguard capital, especially if the underlying asset reaches perceived overvaluation. Similarly, withdrawing profits to reallocate funds into other asset classes can aid in maintaining an optimized, diversified portfolio aligned with evolving financial goals.

Also, tax considerations may compel investors to withdraw profits strategically, particularly in taxable accounts where capital gains taxes apply upon sale. Balancing tax efficiency and growth requires thoughtful planning, possibly including rotational withdrawals or using tax-advantaged accounts.

—

Future Perspectives: Optimizing Profit Use for Sustainable Growth

Looking ahead, technological advancements and financial innovations are reshaping how investors approach reinvestment and profit withdrawals. Robo-advisors and algorithm-driven platforms now offer automated dividend reinvestment, tax-loss harvesting, and dynamic withdrawal strategies personalized to investor profiles.

Artificial intelligence-based tools can simulate future portfolio scenarios, helping investors decide optimal times and amounts for profit withdrawal without compromising compounding benefits. Moreover, growing interest in sustainable and impact investing encourages reinvestment of gains into socially responsible projects, merging financial growth with ethical goals.

Financial education continues to be critical; as younger generations embrace digital finance, fostering long-term reinvestment habits combined with informed withdrawal strategies will be essential. Emphasizing disciplined reinvestment, periodic reassessment of withdrawal needs, and diversified investment approaches can empower investors to navigate economic uncertainties while maximizing returns.

In summary, striking the right balance between reinvesting gains and withdrawing profits is pivotal for wealth building and maintenance. Tailored strategies that consider personal goals, risk tolerance, tax implications, and market conditions will enable investors to benefit from the unparalleled power of compounding while meeting their immediate financial needs. Through responsible, informed decision-making, investors can optimize the trajectory of their financial futures.

Deixe um comentário