The 80/20 rule, also known as the Pareto Principle, is a powerful concept that has been widely applied across business, productivity, and personal development disciplines. It posits that roughly 80% of outcomes arise from 20% of causes. When applied to personal finance, this principle can help individuals identify the most impactful habits, investments, or expenses, enabling them to make smarter decisions and achieve financial success more efficiently.

In the complex world of managing money, the ability to focus on the activities with the greatest return becomes crucial. Whether it’s reducing unnecessary expenses, increasing income, or optimizing investments, the 80/20 rule serves as a blueprint for prioritization. This article unpacks how you can leverage this principle to enhance your financial life. From budgeting and investing to debt management and income generation, you will find actionable strategies backed by real examples, data-driven insights, and clear, professional advice.

Understanding the 80/20 Rule in Financial Contexts

The 80/20 rule was first identified by economist Vilfredo Pareto in the early 20th century when he noticed that 80% of Italy’s wealth was owned by 20% of the population. While originally a social observation, its application has expanded significantly. In finance, the principle means that you can expect that about 80% of your financial success will come from roughly 20% of your financial behaviors or decisions.

For example, a study by Fidelity found that 20% of investors’ actions (such as making timely investment changes or focusing on tax-efficient strategies) accounted for over 80% of their portfolio growth. This underscores the importance of identifying and cultivating the high-impact 20% rather than spreading efforts thinly across less productive activities.

By focusing on this vital minority, you can dramatically improve your financial outcomes. It’s not about perfection; it’s about strategic efforts in areas that truly drive results.

Streamlining Your Budget: Less is More

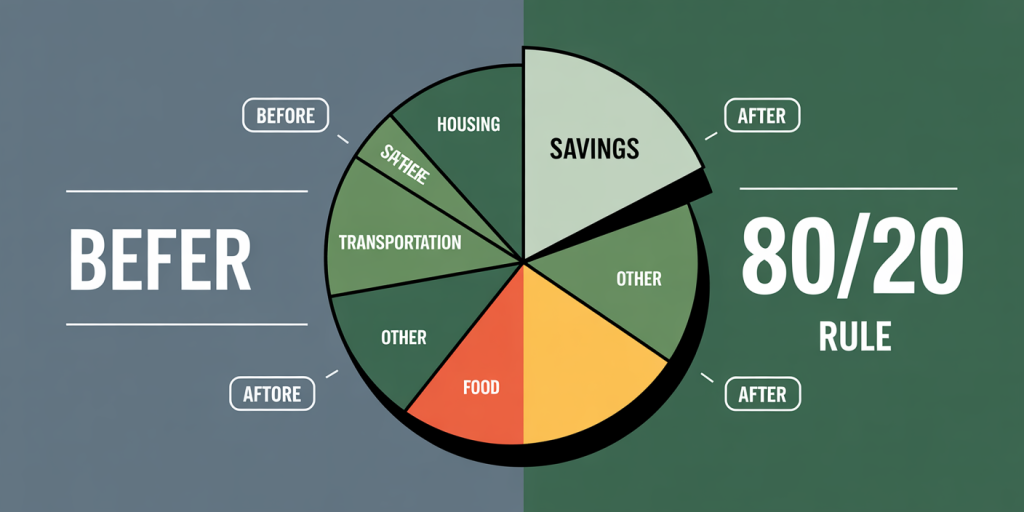

One of the most common financial challenges people face is managing spending. Often, a large portion of a person’s budget is eaten up by a small number of expense categories. According to the Bureau of Labor Statistics’ Consumer Expenditure Survey, about 64% of average American household spending goes towards just four categories: housing, transportation, food, and healthcare.

Applying the 80/20 rule here means identifying which 20% of your expenses consume 80% of your monthly income and finding ways to either reduce or optimize them. For example, if your housing or transportation costs consume the vast majority of your budget, consider strategies like refinancing loans, downsizing, or using public transit to reduce expenses.

Table 1: Example of Expense Distribution Before and After Applying 80/20 Rule

| Expense Category | % of Monthly Income (Before) | % of Total Expenses | Optimized Expense (After) | % of Total Expenses |

|---|---|---|---|---|

| Housing | 40% | 40% | 30% | 35% |

| Transportation | 25% | 25% | 12% | 14% |

| Food | 15% | 15% | 10% | 12% |

| Entertainment | 10% | 10% | 5% | 6% |

| Miscellaneous | 10% | 10% | 3% | 4% |

In this example, by targeting the main expense categories and identifying waste, the person reduces their fixed expenses drastically, freeing up more cash for savings or investment.

Boosting Income by Focusing on High-Yield Activities

On the income side, not all sources or efforts yield equal returns. Many individuals engage in countless side hustles or job activities, yet only a few contribute the majority of their earnings. The 80/20 rule encourages concentrating on the most lucrative or scalable projects.

For instance, consider an entrepreneur who explores multiple income streams including freelance writing, selling crafts, and consulting. Over time, they realize that consulting sessions, though time-consuming, generate 80% of their income, whereas writing and crafts combine to produce only 20%. By pivoting to focus primarily on consulting and outsourcing or reducing efforts in the other areas, they significantly improve their financial efficiency.

Data from Upwork reveals that top freelancers earn over 70% of the total freelancing income on the platform, emphasizing that focusing on high-demand, high-fee skills can drastically increase income potential.

Accelerating Debt Reduction with Targeted Payments

Debt is one of the biggest obstacles to financial freedom, and many struggle with where to start tackling repayments. The 80/20 rule helps by emphasizing that not all debts are equal in their impact on your financial health. Prioritizing the debts that cause the most financial strain can reduce overall cost and stress.

For example, focusing on high-interest credit card debts first (usually representing the 20% of debts causing 80% of the interest burden) can save you thousands. According to a 2022 report by the Federal Reserve, the average credit card interest rate is about 17.14%. By concentrating payments on these balances before smaller, lower-interest debts, individuals reduce the total interest paid and shorten the payoff timeline.

Here’s a comparative look at two approaches to debt reduction:

Table 2: Debt Repayment Approaches

| Approach | Total Interest Paid | Time to Debt Freedom | Psychological Impact |

|---|---|---|---|

| Snowball (paying smallest debts first) | $5,600 | 36 months | Motivating wins but slower savings |

| Avalanche (paying highest interest first) | $3,200 | 24 months | Higher savings, requires discipline |

While the snowball method provides psychological wins by clearing debts quickly, the avalanche method aligns with the 80/20 rule by focusing on the small number of debts costing the most, producing the greatest overall benefit.

Optimizing Investments with Pareto Focus

Investing can be overwhelming with thousands of options available, but applying the 80/20 rule can simplify portfolio management. For many investors, a small subset of assets generates the bulk of their returns, while too many holdings dilute performance and increase fees.

A 2023 study by Morningstar showed that the top 20% of funds in diversified portfolios often accounted for over 80% of positive returns. This indicates that a focused approach on well-researched, high-performing investments can enhance portfolio growth.

Beyond asset selection, tax efficiency and minimizing fees serve as additional 20% activities that drive 80% of net investment gains. For instance, utilizing tax-advantaged accounts like IRAs or 401(k)s and minimizing turnover to reduce capital gains taxes can dramatically improve net returns.

Too much diversification without strategy can erode performance. Investors can simplify by selecting core ETFs or mutual funds representing major market sectors and eschewing less productive holdings.

Real-Life Success Stories Applying the 80/20 Rule

To understand the practical impact of the 80/20 rule on personal finance, consider these case studies: Case 1: Sarah, a marketing professional with multiple debt sources, applied the avalanche debt repayment strategy. By focusing on her highest-interest credit card, she reduced her total interest payments by 40% and cleared debts within two years instead of four. Case 2: Mark, a software developer pursuing side projects, used Pareto analysis to identify that 80% of his freelance income came from 20% of his clients. By nurturing these clients and dismissing unprofitable work, he increased his income by 30% without increasing hours. Case 3: A family reviewed their monthly expenses and found that high grocery bills and eating out amounted to 75% of discretionary spending. By meal planning and reducing restaurant visits, they saved over $600 monthly, redirecting funds towards investments.

These examples illustrate that the 80/20 principle is not a theoretical concept but a real-world tool capable of delivering significant impact when systematically applied.

Future Perspectives: Embracing 80/20 for Long-Term Financial Success

The financial landscape is constantly evolving with new technologies, investment products, and economic pressures. Applying the 80/20 rule helps individuals stay agile by encouraging continuous evaluation of efforts against outcomes. Rather than spreading resources thin in unfocused ways, focusing on the highest-impact financial behaviors will remain a winning strategy.

Artificial intelligence and data analytics will further facilitate identifying the critical 20% activities that yield the greatest financial benefit. Personalized financial planning apps can analyze spending, saving, and investing habits, highlighting areas where the 80/20 focus can produce better results.

Moreover, as ecosystems shift—such as investing in sustainable or social impact funds—prioritizing the most effective ventures within these areas will become essential. The principle also adapts well to life cycle changes, such as retirement planning, where focusing on key assets or income streams simplifies decisions.

Ultimately, mastering this principle equips individuals and families to make smarter financial choices that compound over time, fostering wealth accumulation and financial security with minimal wasted effort.

Deixe um comentário