Discovering an unexpected financial windfall, whether it comes in the form of a bonus, gift, inheritance, or lottery win, can be both exciting and overwhelming. Many people dream of the possibilities and freedoms such money can offer, yet without a clear, strategic plan, the benefits may be short-lived. Managing a sudden influx of money wisely requires thoughtful decisions that balance immediate desires with long-term stability and growth.

Studies suggest that nearly 70% of people who receive a financial windfall tend to spend it rapidly or make impulsive decisions, often ending up worse off financially than before (The Journal of Behavioral Finance, 2021). This article provides well-rounded guidance grounded in practical steps and real-world examples to help you transform your financial windfall into a foundation for lasting prosperity.

—

Assessing Your Financial Situation

Before making any decisions, it’s crucial to take a comprehensive look at your current financial landscape. This includes analyzing debts, savings, investments, and your monthly cash flow. David Ramsey, a renowned personal finance expert, advocates the “debt snowball” method, which encourages paying off small debts first to gain motivation and momentum. Researchers at Experian also note that individuals with high credit card debt are more likely to squander an unexpected sum if they don’t allocate funds to clear or reduce liabilities.

For instance, imagine receiving a $20,000 year-end bonus. If you have credit card debt with an average interest rate of 18%, using the bonus to pay off or substantially reduce this debt can save you about $3,600 in interest over 18 months—funds that can instead be invested or saved. Comparing options like debt repayment versus investing reveals notable differences in returns and risk:

| Option | Expected Annual Return | Risk Level | Benefits |

|---|---|---|---|

| Debt Repayment | Equivalent to interest saved (e.g., 18%) | Low (guaranteed savings) | Immediate reduction in liabilities and improved credit score |

| Stock Market Investment | 6-10% long term average | Moderate to High | Potential higher returns, but market fluctuations risk |

| Savings Account | 0.5-2% current average | Very Low | Liquidity and safety, but low returns |

A balanced approach might involve paying off high-interest debt first and then directing some amount toward investments or emergency funds.

—

Establishing an Emergency Fund

Many people overlook establishing or replenishing an emergency fund when they suddenly have extra cash on hand. Personal finance experts like Suze Orman emphasize that a solid emergency fund acts as a financial cushion to prevent future windfalls from being depleted by unexpected expenses.

An emergency fund typically covers three to six months of essential living expenses. For example, if your monthly expenses total $3,000, an emergency fund of $9,000 to $18,000 ensures that temporary hardships such as job loss or urgent medical bills won’t force you into debt again. According to a 2023 Bankrate survey, only 41% of Americans have enough savings to cover three months of expenses. This points to the widespread vulnerability individuals face without adequate reserves.

In practice, using part of a $15,000 inheritance to build up or augment your emergency fund reflects financial prudence. Unlike paying off debt or investing, money allocated here remains liquid and accessible. This both protects your financial health and provides psychological peace of mind, reducing stress in uncertain times.

—

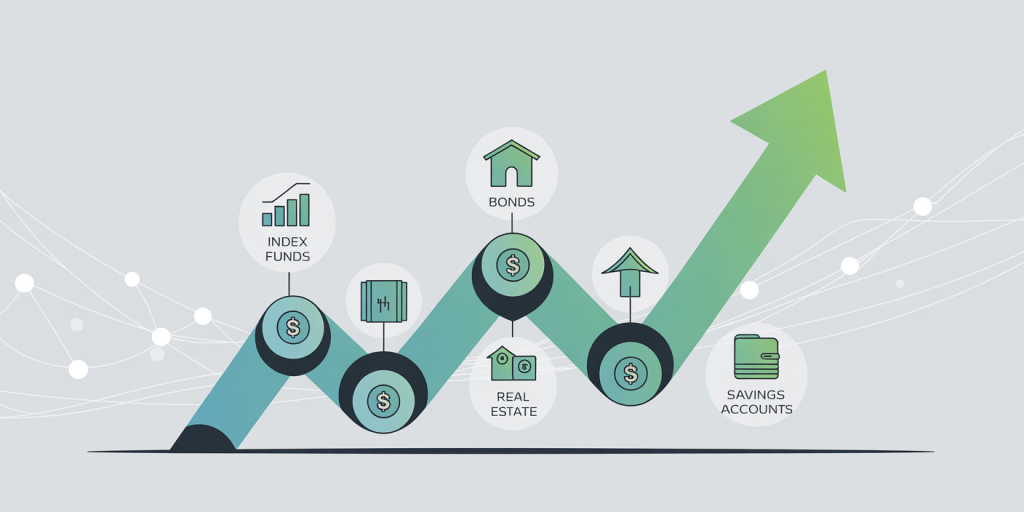

Investing For Long-Term Growth

Once debt is managed and emergency savings secured, investing your windfall should be a priority to harness compounding growth. Warren Buffett famously stated, “The stock market is a device for transferring money from the impatient to the patient.” Patience and strategic allocation are keys to maximizing wealth.

Consider the case of two friends receiving $10,000 each as a financial gift. Friend A spends the money on short-term pleasures, while Friend B invests it in diversified index funds. Over 20 years, assuming an average annual return of 7%, Friend B’s investment would grow to approximately $38,700, illustrating a significant impact of patient and informed investing.

To aid in decision-making, here’s a simplified comparative overview of common investment vehicles:

| Investment Type | Average Annual Return | Risk Profile | Liquidity | Ideal For |

|---|---|---|---|---|

| Index Funds | 7-10% | Moderate | High | Long-term growth with diversification |

| Bonds | 3-5% | Low to Moderate | Moderate | Stability and income generation |

| Real Estate | 8-12% (variable) | Moderate to High | Low | Appreciation and rental income |

| Savings Account/CDs | 0.5-3% | Very Low | High (savings) to Low (CDs) | Safety and liquidity |

A diversified portfolio tailored to your risk tolerance and financial goals will typically outperform any single investment.

—

Paying Off or Upgrading Your Home

For many households, real estate represents the largest asset. Using a windfall to pay down your mortgage faster or to make value-adding home improvements can produce both short-term and long-term benefits. According to Zillow, homes with upgraded kitchens and bathrooms consistently increase in value by 5-10%, proving home improvements can be a strategic use of funds.

Consider Michael, who used his annual bonus of $25,000 to renovate his kitchen and pay an extra $10,000 toward his mortgage principal. The improvements increased his home’s market value by $35,000 within a year, while paying down the mortgage earlier saved thousands in interest payments, boosting his overall net worth.

It’s important, however, to distinguish between upgrades that add real value and those driven solely by personal taste. Consulting a real estate professional before making significant investments helps ensure the dollars spent translate into measurable equity gains.

—

Supporting Personal Growth and Experiences

While financial prudence emphasizes stability and growth, the purpose of money also includes enhancing quality of life. Allocating a portion of your windfall towards personal development—education, travel, or hobbies—can yield intangible yet valuable returns through increased knowledge, satisfaction, and well-being.

For example, writer Elizabeth Gilbert credits a small financial windfall in helping fund a writing workshop abroad, which launched her highly successful career. Similarly, a Gallup poll shows that 79% of adults who invested in learning new skills or experiences with bonus money reported higher life satisfaction.

Balancing fiscal responsibility with personal enrichment nurtures a more fulfilling existence and may open doors to new career opportunities or relationships that have financial upside in the future.

—

Looking Ahead: Building Sustainable Wealth

Taking a future-oriented perspective is essential to maximize the benefits of a financial windfall. Creating a comprehensive wealth plan that incorporates goal-setting, tax optimization, and legacy planning ensures the gain won’t be fleeting. Engaging with certified financial planners and tax experts can uncover strategies aligned with your unique circumstances.

For instance, reinvesting gains tax-efficiently through retirement accounts like 401(k)s or IRAs, or establishing trusts to protect assets for future generations, represent pathways for both wealth accumulation and preservation. According to Fidelity Investments, those who actively plan their financial futures are 56% more likely to achieve retirement goals comfortably.

Looking forward also means preparing for market volatility and adapting your plan as life evolves. Regular reviews and adjustments enable you to respond to changing economic conditions and personal priorities.

—

Final Thoughts

When managing a financial windfall, combining immediate financial needs with long-term strategies produces the most rewarding outcomes. Thoughtfully assessing your situation, eliminating debts, securing emergencies, investing wisely, improving assets, and enriching personal growth form the cornerstone of sustainable financial success. Embracing future planning cements the pathway toward ongoing prosperity, turning a temporary windfall into lifelong empowerment.

Deixe um comentário