Building a diversified investment portfolio is a fundamental strategy for minimizing risk and maximizing returns. However, many new investors hesitate to start because they believe diversification requires substantial capital. In reality, you can create a well-balanced, diversified portfolio even with limited funds. This article explores practical methods and real-world examples to guide investors who want to diversify their investments without needing large sums of money.

Understanding Diversification and Its Importance

Diversification means spreading your investments across different asset classes, industries, and geographies to reduce the impact of any single asset’s poor performance. Historically, diversified portfolios tend to experience smoother returns over time, cushioning investors from volatile market swings.

For example, during the 2008 global financial crisis, portfolios heavily concentrated in financial stocks plummeted dramatically. In contrast, those diversified across bonds, consumer staples, and international stocks endured the downturn with less erosion in value. According to a study by Vanguard, globally diversified portfolios delivered approximately 20% less volatility compared to domestic-only portfolios between 2000 and 2020.

For investors with limited capital, achieving such diversification might feel challenging. Yet, thanks to technological advancements and financial innovation, diversification is no longer reserved for the wealthy. Understanding how to allocate modest sums wisely is crucial in building a resilient investment framework.

Leveraging Exchange-Traded Funds (ETFs) and Index Funds

One of the most cost-effective ways for small investors to diversify is through Exchange-Traded Funds (ETFs) and index funds. These funds pool money from many investors to buy a broad assortment of assets, providing built-in diversification without needing to buy hundreds of individual stocks.

For instance, with just $100, an investor can purchase shares of a broad-market ETF like the Vanguard Total Stock Market ETF (VTI), which holds over 3,500 U.S. stocks. This single purchase spreads risk across a wide equity universe rather than relying on the fortunes of one or two companies.

Index funds operate similarly; they track specific market indices such as the S&P 500. Since their investment objective is to replicate the index’s performance, they inherently offer diversification. The low expense ratios of ETFs and index funds (typically below 0.1%) mean more of your money remains invested rather than being eaten by fees.

A comparative table below illustrates key features investors should consider when selecting ETFs and index funds with limited capital:

| Feature | ETFs | Index Mutual Funds |

|---|---|---|

| Minimum Investment | Price of one share (often <$50) | Varies, often $500-$3,000 |

| Trading Flexibility | Trade anytime during market hours | Purchased at end-of-day NAV |

| Expense Ratio | 0.03% – 0.20% | Around 0.10% – 0.25% |

| Diversification Range | Very broad, sector-specific, bond | Broad market or specific sectors |

| Fractional Shares | Available on some platforms | Generally not available |

Platforms like Robinhood, Fidelity, and Charles Schwab now offer commission-free ETF trades and fractional shares, making it even easier to get started with minimal money.

Using Robo-Advisors for Automated Diversification

Another approach suited for investors starting with small amounts is using robo-advisory services. Robo-advisors automate the process of portfolio construction, rebalancing, and diversification based on your risk profile and investment goals. Many require low or zero minimum deposits, removing traditional barriers to diversification.

For example, Betterment and Wealthfront allow users to open accounts with as little as $10. These platforms invest in a mix of ETFs covering U.S. and international stocks, bonds, real estate, and other asset classes. They adjust allocations over time, helping maintain optimal diversification and risk control.

Real case studies show that investors using robo-advisors can create diversified portfolios similar to those managed by human advisors but at a fraction of the cost. A 2023 study by the Investment Company Institute found that robo-advised portfolios often contained 8-12 ETFs, blending equity and fixed income to suit risk preferences.

The automated rebalancing feature is especially useful. For example, if stocks perform well and bonds lag, the portfolio will rebalance by selling some stocks and buying bonds to maintain target allocation. This discipline helps maintain diversification without active monitoring.

Incorporating Fractional Shares and Micro-Investing Apps

Fractional shares allow investors to buy a portion of a stock or ETF rather than a whole share, making expensive stocks more accessible. This is particularly valuable when aiming to diversify with little money.

Consider Amazon (AMZN) stock priced around $130 per share. Buying a whole share is expensive for small investors, but fractional shares enable investing any dollar amount—such as $20—thus spreading risk across multiple companies without needing large sums.

Moreover, micro-investing apps like Acorns and Stash facilitate diversified portfolios with minimal funds by rounding up purchases to the nearest dollar and investing the “spare change.” These platforms invest collected amounts into diversified ETF portfolios aligned with your risk appetite.

A summary table illustrates the potential impact of fractional shares versus whole shares for an investor with $100:

| Investment Option | Number of Stocks Purchased | Coverage Across Sectors | Initial Diversification Level |

|---|---|---|---|

| Whole Shares Only | 2 (e.g., AMZN and TSLA) | Low | Limited |

| Fractional Shares | 5+ (including AMZN, TSLA, AAPL, MSFT, VTI) | Higher | Enhanced |

Data from a 2022 FINRA survey indicates that 46% of millennials cite fractional shares as a key reason to start investing, highlighting its pivotal role in democratizing diversification.

Diversifying with Bonds, REITs, and Alternative Assets on a Budget

Equities often dominate beginner portfolios, but true diversification requires exposure to other asset classes such as bonds, real estate investment trusts (REITs), and alternative investments.

Small investors can access bond ETFs like iShares Core U.S. Aggregate Bond ETF (AGG) for broad exposure to U.S. investment-grade bonds. Bonds typically exhibit lower volatility than stocks and provide income through interest payments, which can stabilize returns during equity market downturns.

Similarly, REIT ETFs such as Vanguard Real Estate ETF (VNQ) offer diversification into real estate without needing to buy property directly. REITs often provide attractive dividends and can serve as a hedge against inflation.

Some platforms also offer access to alternative assets like commodities, precious metals, or cryptocurrencies in small amounts. For instance, SPDR Gold Shares ETF (GLD) lets investors diversify into gold with a share price under $200. Cryptocurrencies can be purchased fractionally on exchanges like Coinbase or Binance, though they come with higher risk and volatility.

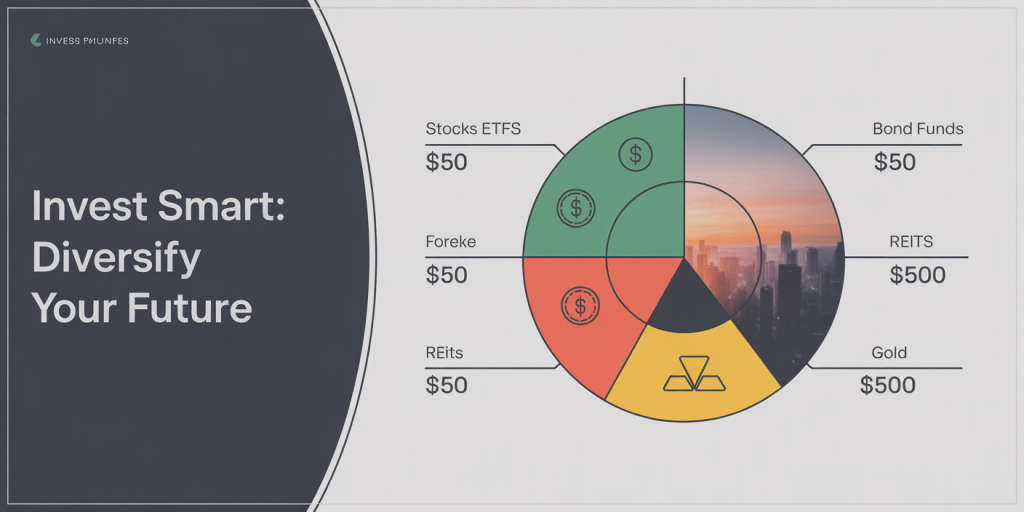

An example portfolio for someone with $500 might look like:

| Asset Class | Instrument | Allocation | Approx. Amount ($) |

|---|---|---|---|

| U.S. Stocks | Vanguard Total Stock ETF (VTI) | 40% | 200 |

| Bonds | iShares Aggregate Bond ETF (AGG) | 30% | 150 |

| Real Estate | Vanguard Real Estate ETF (VNQ) | 20% | 100 |

| Gold | SPDR Gold Shares (GLD) | 10% | 50 |

This allocation balances growth potential and risk mitigation across multiple asset classes, achievable with modest capital.

Future Perspectives: Technology and Innovation Shaping Diversification

The trajectory of investing innovations promises even greater ease in building diversified portfolios with minimal funds. Artificial intelligence and machine learning are starting to personalize investment recommendations, analyzing individual financial situations to create precisely tailored diversified strategies.

Additionally, blockchain technology is facilitating decentralized finance (DeFi) platforms that enable fractional ownership of nearly any asset class—from real estate to artwork—opening up new diversification avenues for small investors.

Global investing is also becoming more accessible, with ETFs and robo-advisors expanding international options. Diversifying geographically helps protect portfolios from domestic economic downturns and taps into emerging market growth.

Financial literacy initiatives and increasing access to no-fee trading platforms will continue reducing barriers for low-net-worth investors. According to a 2024 report by Deloitte, the growth of fintech solutions is expected to increase retail participation in diversified investing by 35% over the next five years.

Investors who leverage these tools and stay informed about evolving technologies will be well-positioned to build strong, diversified portfolios while starting with limited capital. Early adoption of innovative investment strategies can yield significant long-term benefits by balancing risk and maximizing returns efficiently.

Creating a diversified portfolio with little money is not only possible but practical through the use of ETFs, robo-advisors, fractional shares, and broad asset class exposure. Modern technology continues to democratize investing, allowing individuals at any income level to build resilience and pursue their financial goals. By carefully allocating resources and utilizing the right platforms, small investors can enjoy the benefits of diversification without the need for large sums of money.

Deixe um comentário