Setting clear and achievable investment goals is essential for building wealth, securing financial stability, and achieving personal milestones. However, merely having vague goals like “save more” or “invest wisely” won’t lead to success. That’s where the SMART framework comes into play. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound—criteria that add clarity and structure to your financial ambitions. This article delves into the process of setting SMART investment goals, enriched with examples, case studies, and comparative analysis to help investors make informed decisions.

Why Clear Investment Goals Matter

Before jumping into the SMART criterion, it’s essential to understand why clearly defined investment goals matter. Research by Gallup shows that only about 30% of American adults have long-term financial plans, and those with written goals are 42% more likely to accumulate wealth effectively. Clear goals guide your investment strategy, helping you choose suitable assets while managing risks associated with market volatility.

Consider the example of two investors, Anna and Brian. Anna invests without clear goals, reacting impulsively to market trends. Brian, however, sets a SMART goal: “Save $50,000 within five years for a down payment on a house by investing in a diversified portfolio with an expected annual return of 7%.” Brian’s structured approach enables focused investments and consistent monitoring, leading to better financial outcomes.

Defining Specific Investment Goals

Specificity is the foundation of a SMART goal. Vague objectives like “grow my money” offer no actionable direction. Instead, specificity involves identifying precisely what you want to achieve with your investments. This means detailing the financial amount, purpose, and investment type.

For instance, rather than saying, “I want to invest for retirement,” a specific goal would be, “I want to accumulate $1 million in retirement savings by age 65 through a mix of index funds and bonds.” Specific goals enable clearer paths for action and reduce the chance of each decision feeling arbitrary.

In practice, specificity helps distinguish between short-term and long-term priorities. A person might have separate goals for buying a car (short-term, e.g., $20,000 in 3 years) and retirement savings (long-term, e.g., $1.5 million in 30 years). These distinctions influence asset selection, risk tolerance, and contribution schedules.

Measuring Progress and Success

Measurability is crucial for tracking progress and maintaining motivation. A measurable investment goal includes quantifiable benchmarks — such as target amounts, investment returns, or timelines — that allow you to evaluate success.

Suppose you aim to save $100,000 in five years by contributing monthly to an ETF portfolio. The measurable elements are evident: the $100,000 target, the five-year timeline, and monthly savings increments. Using compound interest calculators or portfolio trackers, you can monitor whether contributions and returns align with your goal.

Comparative Table: Measuring Investment Goals

| Goal Element | Example 1: Vague | Example 2: Measurable |

|---|---|---|

| Amount | “Grow my savings” | “Save $50,000” |

| Timeframe | “Eventually” | “Within 7 years” |

| Progress Indicators | “I’ll know when I’m rich” | “Monthly contributions of $500, 7% return” |

Measurable goals ensure you can spot deviations early and pivot strategies accordingly. For example, if the portfolio underperforms for several quarters, you may decide to adjust contributions, diversify assets, or seek professional advice.

Achievability: Balancing Ambition with Reality

An achievable investment goal is realistic considering your current finances, risk tolerance, knowledge, and market conditions. Setting unattainable goals leads to frustration and potential abandonment of investing altogether.

To determine achievability, analyze your income, expenses, and potential savings rate. Data from the U.S. Bureau of Economic Analysis states that the average personal savings rate has fluctuated between 5% and 8% over the past decade. Expecting to save 50% of your income without a significant lifestyle change might be unrealistic for most.

Practical Example: John wants to invest $200,000 in five years but currently has no savings and an income of $50,000/year. Achieving this would require extraordinary savings beyond typical capabilities, suggesting John revise his goal to $50,000 or extend the timeframe.

Investment platforms like Vanguard offer goal calculators that estimate how much you need to invest monthly given expected market returns and time horizon, helping set realistic goals.

Relevance: Aligning Investments with Personal Priorities

Relevance ensures your investment goals align with your broader life objectives and current financial situation. It’s vital that your aspirations reflect your genuine priorities, whether that is retirement, education funding, buying property, or starting a business.

An illustrative case is that of Maria, a 35-year-old with young children. She initially set a goal to become a real estate investor. After evaluating her needs, she pivoted to prioritize her children’s education funds, recognizing the more immediate family responsibility.

For relevance, consider the following questions: Does this investment goal support my life plans? Will achieving this goal improve my financial and emotional well-being? Is this goal feasible given my current obligations?

By focusing on relevant investments, you avoid diluting resources and attention, increasing the chances of success.

Time-Bound Investment Planning

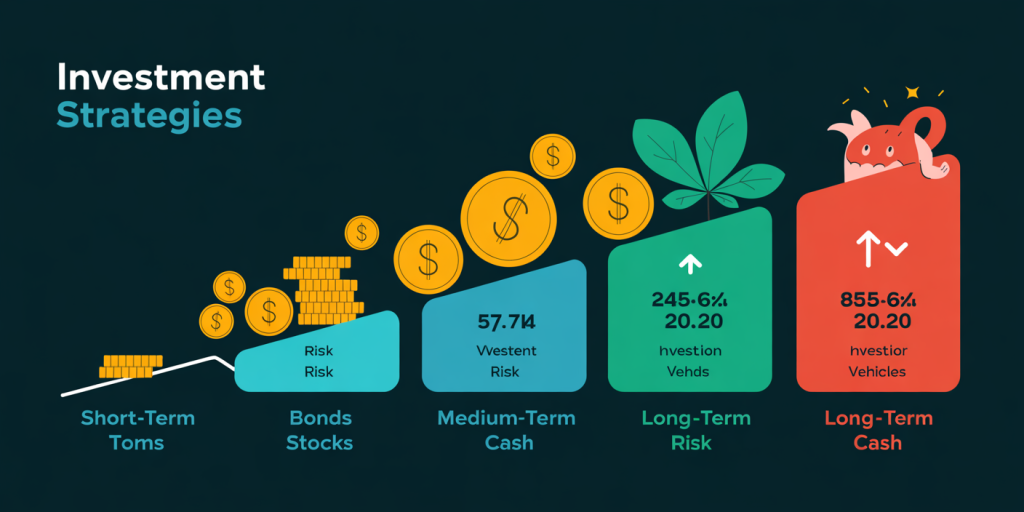

The time-bound component introduces deadlines, making goals urgent rather than indefinite. Deadlines help prioritize investments that match your timeframe and risk tolerance. For example, short-term goals (1-3 years) would typically emphasize safer, more liquid assets, while long-term goals (10+ years) may tolerate higher risk for greater returns.

Statistically, data from J.P. Morgan suggests that over a 20-year horizon, equities historically delivered an average annual return of 8-10%, whereas short-term treasury bills offered 2-3%. Knowing your deadline helps tailor asset allocation accordingly.

Consider Emily, who plans to buy a house in three years. She allocates most funds to low-risk bonds and savings accounts to preserve capital. Meanwhile, Carl, aged 25, with a 30-year retirement goal, invests primarily in growth stocks to maximize returns.

Comparative Table: Asset Allocation Based on Time Horizon

| Time Horizon | Typical Asset Allocation | Expected Risk Level | Typical Investment Vehicle |

|---|---|---|---|

| Short-term (1-3 years) | 70% Bonds, 30% Cash | Low | Savings accounts, CDs, Treasury bills |

| Medium-term (4-10 years) | 50% Stocks, 50% Bonds | Medium | Mutual funds, index funds |

| Long-term (10+ years) | 80% Stocks, 20% Bonds | High | ETFs, growth stocks |

Case Study: Setting SMART Goals in Practice

To illustrate, let’s look at a real-world example. David, a mid-level manager, wanted to set investment goals after reading about SMART criteria. His initial objective was vague: “I want to have enough for retirement.” Applying SMART principles, he revised it as, “I want to accumulate $800,000 for retirement by age 65 by investing $500 per month in a diversified portfolio with an average annual return of 6%.”

David’s goal was: Specific: $800,000 target for retirement Measurable: Monthly $500 contributions tracked via his investment app Achievable: Budgeting confirmed he could save $500/month without sacrificing essentials Relevant: Retirement savings aligned with personal priorities Time-bound: Targeting the age of 65 (20 years away)

By periodically reviewing his portfolio and adjusting contributions, David stayed on course, demonstrating how SMART goals empower disciplined investing.

Future Perspectives on SMART Investment Goals

Looking ahead, setting SMART investment goals will become increasingly essential as financial markets grow more complex and diverse. The rise of robo-advisors, AI-driven financial planners, and data analytics tools means that personal investors can craft more precise and dynamic SMART goals with continuous real-time evaluation.

Moreover, demographic shifts and evolving financial needs—such as longer life expectancies and changing retirement ages—will require investors to redefine relevance and timelines more frequently. ESG (Environmental, Social, Governance) investing is also gaining traction, meaning relevance might increasingly incorporate individual values alongside financial returns.

The COVID-19 pandemic highlighted the importance of adaptable and measurable investment strategies. Future investors will benefit from planning that embraces flexibility within the SMART framework, potentially incorporating scenario analyses and stress testing to build resilient portfolios.

Financial literacy initiatives by governments and organizations continue to emphasize goal-setting frameworks like SMART to empower more people to invest confidently and responsibly. According to a 2023 CFA Institute report, investors who set clear goals are less likely to succumb to behavioral biases like panic selling or overconfidence.

Ultimately, mastering the art of setting SMART investment goals equips individual investors with the tools needed to navigate uncertainties and realize their financial aspirations. By combining specificity with agility and continuous learning, investors can build sustainable wealth to meet both current needs and future ambitions.

Deixe um comentário