In recent years, cashback and rewards programs have become popular tools for consumers to save money and maximize value from their everyday purchases. According to a 2023 survey by Statista, approximately 75% of credit card users in the United States participate in some form of rewards or cashback program. While these offers can provide significant benefits, many consumers fall into the trap of overspending to chase rewards, ultimately nullifying the potential savings. Learning how to use cashback and reward systems strategically requires discipline, planning, and a clear understanding of one’s spending habits.

This article explores practical methods for leveraging cashback and rewards without succumbing to overconsumption. From distinguishing genuine deals from enticing offers to understanding points valuation, readers will gain actionable insights to enhance their financial well-being. By adopting a strategic approach, consumers can enjoy the perks of rewards programs while maintaining sound budgeting practices.

—

Understanding Cashback and Rewards Programs

Cashback and rewards programs come in various forms, including credit card offers, store loyalty points, and promotional discounts. Cashback typically means receiving a percentage back on qualifying purchases, whereas rewards programs might offer points redeemable for merchandise, travel, or statement credits.

For example, a credit card may offer 1.5% cashback on all purchases, 3% on dining, and 5% on gas. Another might provide 2 points per dollar spent, with points redeemable at 1 cent each toward flights or gift cards. Understanding the structure of these programs is key to optimizing their benefits.

According to a 2022 report by Nilson, global credit card rewards spending exceeded $1.3 trillion in 2021, underscoring their growing importance in consumer finance. However, the value received depends on how carefully one aligns purchases with the highest reward categories and avoids fees or unnecessary spending.

—

Aligning Rewards with Your Spending Habits

One fundamental step in using cashback and rewards strategically is to select programs that align closely with your existing spending patterns. It is unwise to choose a rewards card centered on travel if you rarely fly, or a grocery store loyalty card if you usually shop at a variety of outlets.

For instance, consider a household that spends $600 monthly on groceries, $400 on gas, and $300 on dining out. A credit card offering 6% back on groceries and 2% on gas would likely be more beneficial than a travel rewards card offering 3 points per dollar on airfare.

Analyzing your actual expenses over three to six months can help identify where you spend the most. Many personal finance apps, such as Mint or YNAB, can assist in categorizing spending to make informed decisions. By focusing on rewards categories that naturally match your habits, you maximize returns without incentivizing extra spending.

To highlight the benefits, the table below compares two hypothetical cards based on monthly spending.

| Expense Category | Monthly Spend | Card A Cashback Structure | Card A Monthly Cashback | Card B Cashback Structure | Card B Monthly Cashback |

|---|---|---|---|---|---|

| Groceries | $600 | 6% cashback | $36 | 2% cashback | $12 |

| Gas | $400 | 2% cashback | $8 | 3% cashback | $12 |

| Dining | $300 | 1% cashback | $3 | 1% cashback | $3 |

| Total Cashback | $47 | $27 |

In this scenario, Card A aligns better with spending habits, offering $20 more cashback monthly without additional outlays.

—

Avoiding Overspending: Discipline and Budgeting

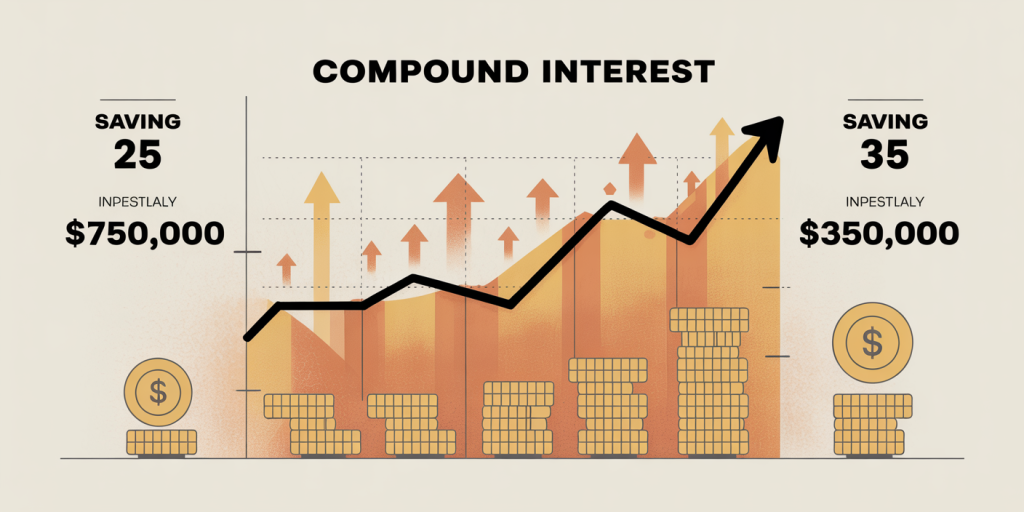

The greatest risk of rewards programs is that chase for points or cashback can encourage overspending. A study published by the Journal of Consumer Research found that consumers tend to spend up to 20% more when incentivized by rewards compared to regular spending patterns. Therefore, having a disciplined approach to budgeting is essential.

Set clear spending limits based on your typical monthly budget. Use rewards as a bonus rather than an excuse to buy unnecessary items. For example, if your grocery budget is $600, do not increase it to $700 just to earn higher cashback at a particular store.

Practical tools include creating separate accounts or virtual cards solely for rewards-earning purchases, tracking expenses carefully, and reviewing monthly statements to identify any spending creep. Additionally, avoid the common pitfall of paying interest on credit cards used for rewards, as interest charges often overshadow the monetary value of rewards earned.

Using apps or spreadsheets to monitor cash inflows and outflows can help maintain control. For instance, suppose you earn $50 in cashback but pay $60 in credit card interest due to late payments or carrying balances. In that case, you have lost more money than you gained.

—

Maximizing Rewards Through Timing and Promotions

Strategically timing your purchases can amplify the value of cashback and rewards programs. Many credit cards offer rotating categories with elevated cashback rates during specific quarters or promotional periods. Retailers often run bonus point events or discount days tied to loyalty programs.

For example, Discover credit cards typically offer 5% cashback on designated categories each quarter, such as gas stations or department stores, up to a quarterly spending cap. Planning large necessary purchases within these windows can maximize returns.

Moreover, some banks provide sign-up bonuses or limited-time offers worth hundreds of dollars if you meet specific spending thresholds within the first few months. Aligning these requirements with planned expenditures—like paying bills, buying appliances, or booking vacation costs—can help unlock significant rewards without additional expenses.

Retailers such as Amazon offer periodic “Prime Day” events and targeted promotions where loyalty members earn extra points. Tracking newsletters and app notifications ensures you don’t miss out on these opportunities.

—

Redeeming Rewards Efficiently: Value and Flexibility

Understanding how to redeem rewards efficiently is just as important as earning them. Different programs offer varying redemption options, and not all are created equal in terms of value.

For instance, airline miles might have variable value depending on the route and timing of booking. Sometimes, redeeming points for gift cards or merchandise results in a lower value per point. Conversely, redeeming cashback as a statement credit or direct deposit often provides a simple, consistent value.

Consider the following approximate redemption values for points in a single rewards program:

| Redemption Option | Value Per Point | Notes |

|---|---|---|

| Statement Credit | 1 cent | Straightforward, flexible use |

| Travel Booking | 1.2–1.5 cents | Optimal value but requires planning |

| Gift Cards | 0.8–1 cent | Moderate flexibility |

| Merchandise | 0.5–0.7 cents | Often lower value, less flexible |

To maximize value, choose redemption options that fit your needs and provide the highest returns. If you want simplicity, cashback credits are typically best. For frequent travelers, booking flights through the rewards portal may yield more value but requires booking flexibility.

Real-world case: A 2022 analysis by NerdWallet revealed that cardholders who redeem points for travel receive approximately 15–20% higher value per point compared to merchandise redemptions, emphasizing the importance of strategic redemptions.

—

Leveraging Multiple Rewards Programs Wisely

Using multiple cashback and rewards programs simultaneously can be advantageous but requires organization and vigilance. For example, one might have a primary credit card for general purchases, a grocery store loyalty card, and a fuel rewards card.

Each program may have specific benefits, but overlapping offers can cause complexities. For instance, some store loyalty programs do not allow cashback card benefits to stack, or credit card rewards may be limited on certain retailer purchases.

A practical approach includes: Listing all active rewards cards and programs Categorizing each card’s strengths and limitations Assigning specific cards or programs to purchase categories Regularly reviewing statements to ensure rewards are applied correctly

A simplified decision table may look like this:

| Purchase Category | Preferred Card/Program | Notes |

|---|---|---|

| Groceries | Grocery Store Loyalty + Card A | Combine store discounts with cashback cards |

| Gas | Fuel Rewards + Card B | Fuel-specific loyalty plus cashback layers |

| Online Shopping | Card C with online bonus | Higher points on e-commerce |

By methodically managing cards and loyalty programs, consumers can optimize overall value without duplicated efforts or confusion.

—

The Future of Cashback and Rewards Programs

The landscape of cashback and rewards is rapidly evolving, driven by technological innovations and changing consumer preferences. Digital wallets, AI-based personalized offers, and real-time cashback through mobile apps are becoming increasingly prevalent.

For example, companies like Rakuten and Honey offer browser extensions that automatically apply coupons and cashback on e-commerce purchases, simplifying the process without requiring multiple cards or manual tracking. According to Business Insider, tech-driven cashback platforms grew by 30% annually between 2020 and 2023, indicating growing consumer adoption.

Furthermore, evolving data analytics allow issuers to tailor rewards programs based on individual spending behavior, creating customized categories that maximize relevance and savings. Artificial intelligence also facilitates fraud detection and improves reward redemption experiences.

Blockchain technology is beginning to emerge in loyalty programs, enhancing transparency and interoperability across multiple programs—potentially allowing consumers to consolidate points from disparate sources into a single wallet.

Consumers should remain adaptable and informed about these trends. Embracing new tools and staying updated on program terms can ensure maximum benefit from cashback and rewards without falling into common pitfalls like overspending.

—

By strategically aligning cashback and rewards programs with genuine spending habits, exercising disciplined budgeting, timing purchases effectively, and optimizing redemption methods, consumers can unlock substantial financial advantages. The key lies in seeing these programs as complementary tools to existing financial management rather than reasons to increase expenditures unnecessarily. With ongoing technological advancements and program innovations, savvy consumers will find even more ways to benefit in the near future.