Capital gains represent one of the most significant components of investment income, playing a pivotal role in wealth accumulation and portfolio management. They arise when an asset is sold for a price higher than its original purchase cost, yielding a profit. However, the tax implications attached to capital gains are equally crucial, influencing investors’ decisions and eventual returns. This article explores the nuances of capital gains, different types, tax treatments, and strategies to optimize tax liabilities, providing clarity through practical examples and comparative insights.

Defining Capital Gains and Its Types

Capital gains occur when an individual or entity sells a capital asset—such as stocks, bonds, real estate, or other investments—for a profit. These gains are broadly classified into two categories: short-term and long-term capital gains. The primary difference lies in the holding period of the asset before the sale.

Short-term capital gains arise when an asset is held for one year or less before being sold at a profit. These gains typically fall under the same taxation bracket as ordinary income, which can be considerably higher than long-term capital gains tax rates. Conversely, long-term capital gains correspond to assets held for more than one year, usually attracting more favorable tax treatment to encourage longer investment horizons.

For example, if an investor buys shares of a company at $1,000 and sells them within six months for $1,500, the $500 profit is considered a short-term capital gain and taxed accordingly. If the shares were sold after holding them for 18 months, the gain would be considered long-term, generally subjected to lower tax rates.

Capital Gains Tax Rates and Their Variations

The tax rates applied to capital gains vary significantly across jurisdictions and even within a single country based on holding periods, income brackets, type of asset, and specific exemptions or incentives. In the United States, for instance, the IRS categorizes capital gains tax rates as follows:

| Type of Gain | Holding Period | Tax Rate Range (2024) |

|---|---|---|

| Short-term | 1 year or less | 10% – 37% (ordinary income tax rates) |

| Long-term | More than 1 year | 0%, 15%, or 20% based on income |

High-income taxpayers might face an additional 3.8% Net Investment Income Tax, further increasing the total tax burden on capital gains. These progressive rates aim to balance revenue generation and encourage long-term investments.

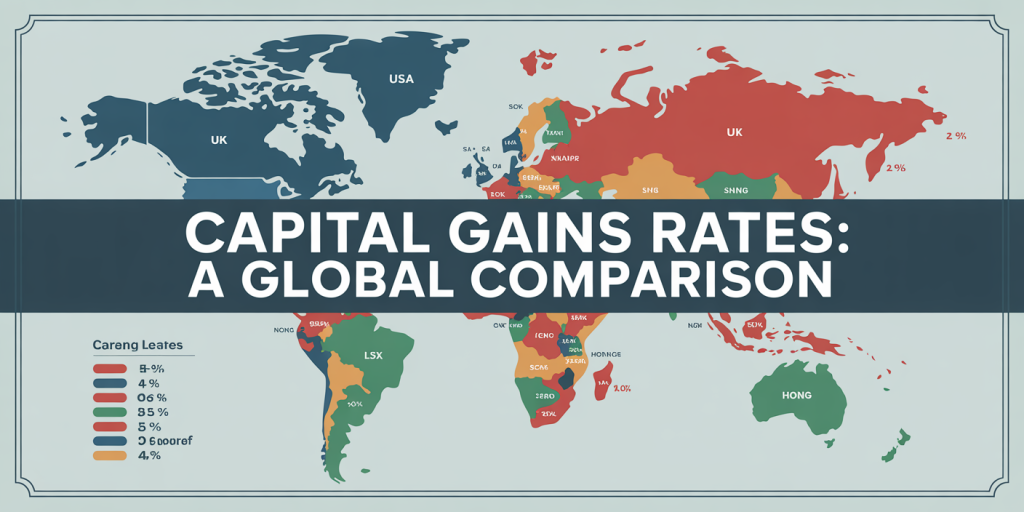

Internationally, tax treatments differ. For example, the United Kingdom currently taxes capital gains at 10% or 20% for most assets, depending on total taxable income, with additional rates for property gains. Countries like Singapore and Hong Kong do not levy capital gains taxes, making them attractive for investors seeking to retain the maximum value from asset appreciation.

It is vital for investors to understand their local tax regulations, as well as bilateral treaties that may exempt or reduce capital gains taxation on cross-border investments, thereby optimizing after-tax returns.

Practical Examples: Real Case Studies

Consider the case of Sarah, an investor residing in the U.S., who purchased 100 shares of a tech company at $50 per share in January 2022. By March 2023, the stock price rose to $120 per share, prompting Sarah to sell all her shares for a total of $12,000. Initial investment: $5,000 (100 shares x $50) Sale price: $12,000 (100 shares x $120) Capital gain: $7,000

Because Sarah held the shares for more than one year, her gain qualifies as a long-term capital gain. Assuming Sarah falls under the 15% long-term capital gains tax bracket, she would owe approximately $1,050 in taxes (15% of $7,000).

In contrast, if Sarah sold the shares within one year of purchase, the $7,000 would be subject to her ordinary income tax rate. If Sarah’s marginal tax rate was 24%, her tax liability on this gain would be $1,680, significantly higher than the long-term scenario.

Another example highlights real estate. John bought a rental property five years ago for $300,000. He recently sold it for $450,000, resulting in a $150,000 capital gain. However, John had made $50,000 worth of capital improvements during ownership, which are deductible from the gain, reducing taxable capital gains to $100,000.

John may also have to pay depreciation recapture tax on the depreciation claimed during rental use, adding complexity to the overall tax picture. Understanding these nuances helps real estate investors better estimate tax obligations and net profits.

Tax Planning Strategies to Minimize Capital Gains Liability

Effective tax planning is key to maximizing after-tax returns from capital gains. One common strategy is tax-loss harvesting, where investors sell underperforming assets at a loss to offset gains realized elsewhere in the portfolio. This method can reduce taxable capital gains in a given tax year or carry forward losses to offset future gains.

For instance, if an investor realizes $20,000 in capital gains but also sells another asset at a $10,000 loss, the overall net gain subject to tax would be $10,000. Such strategic harvesting is widely used at year-end to optimize tax positions.

Another approach involves taking advantage of tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or Roth IRAs in the U.S., where capital gains on investments grow tax-deferred or tax-free. By holding investments within these accounts, investors can avoid annual capital gains taxes, effectively compounding returns.

Timing also plays a crucial role. Investors might delay selling appreciated assets until crossing into a lower income tax year or until qualifying for long-term capital gains treatment. For instance, retirees with reduced taxable income might realize capital gains at lower rates post-retirement.

Estate planning provides another avenue, where heirs typically receive a “step-up” in basis for inherited assets, eliminating capital gains tax on appreciation during the deceased owner’s lifetime. This feature has significant implications for wealth transfer and tax liability.

Comparing Capital Gains to Other Forms of Investment Income

To truly grasp the impact of capital gains taxes, it helps to compare them with other forms of investment income, such as ordinary income and qualified dividends. The following table summarizes various income types and their typical tax treatments in the U.S.:

| Income Type | Description | Tax Rate Range | Notes |

|---|---|---|---|

| Ordinary Income | Wages, salaries, short-term gains | 10% – 37% | Highest tax bracket applies |

| Short-Term Capital Gains | Gains on assets held ≤1 year | Same as ordinary income | No preferential treatment |

| Long-Term Capital Gains | Gains on assets held >1 year | 0%, 15%, 20% | Preferential tax rates apply |

| Qualified Dividends | Dividends meeting specific IRS criteria | 0%, 15%, 20% | Taxed at long-term capital gains rates |

From this comparison, the advantage of long-term holdings becomes evident. For example, in 2023, the top ordinary income earners face a 37% marginal rate but only a 20% long-term capital gains rate, effectively reducing the tax liability on investment appreciation.

Qualified dividends—dividends paid by U.S. corporations and some foreign entities, provided certain conditions are met—also benefit from long-term capital gains tax rates, encouraging investment in dividend-paying stocks.

Future Perspectives: Changes and Trends in Capital Gains Taxation

Capital gains taxation is continuously evolving, influenced by economic policies, political climates, and budgetary needs. Governments worldwide periodically review tax codes to enhance fairness, protect revenue streams, or incentivize investments.

In the United States, proposals to increase capital gains tax rates for high-income individuals have gained traction in recent years to address wealth inequality and fund social programs. For instance, discussions around taxing unrealized capital gains or aligning capital gains tax rates with ordinary income rates highlight potential paradigm shifts.

Technology and data advances also enable more rigorous enforcement of capital gains reporting and compliance, reducing opportunities for tax avoidance. Additionally, the rise of cryptocurrencies and digital assets introduces new categories of capital gains with emerging regulatory frameworks.

Environmental, social, and governance (ESG) investing trends are influencing tax policies as well, with some jurisdictions considering tax incentives for socially responsible investments.

Investors should monitor legislative developments and consult tax professionals to stay informed and adapt strategies accordingly.

—

Understanding capital gains and their tax implications is essential for effective financial planning and wealth maximization. By grasping the differences in gains types, tax treatments, and available planning tools, investors can make more informed decisions that align with their financial goals while adhering to tax regulations. As the global tax landscape continues to shift, staying proactive about capital gains tax planning will remain a vital aspect of successful investing.

Deixe um comentário