In today’s fast-paced financial environment, merely saving money is no longer sufficient to secure long-term wealth and financial stability. While saving is an essential habit that builds the foundation of financial discipline, transitioning into strategic investing offers the potential to significantly grow wealth and beat inflation. Becoming a strategic investor requires shifting mindset, acquiring new skills, and utilizing practical tools to maximize returns while managing risks effectively.

The difference between savers and investors lies in their approach to money management and wealth creation. Savers often prioritize safety and liquidity, preferring low-risk accounts such as savings accounts or certificates of deposit (CDs). Investors, however, focus on goal-based growth through diversified assets like stocks, bonds, real estate, and alternative investments. This article explores practical ways to bridge that gap, offering actionable steps supported by data, comparisons, and real-world examples.

—

Recognizing the Limitations of Saving in Building Wealth

Individuals who stick exclusively to saving typically accumulate emergency funds or earmark money for short-term needs. However, the returns on conventional savings vehicles tend to be low. According to the Federal Reserve Economic Data (FRED), the average interest rate on savings accounts hovers around 0.06% annually (2023 data). Meanwhile, inflation rates in the United States have averaged approximately 2-3% per year over the past decade, effectively eroding purchasing power for those relying solely on savings.

For example, imagine someone who saves $10,000 in a standard savings account earning 0.06% interest per year while inflation sits at 2%. After one year, the real value of their money effectively decreases because the inflation rate outpaces the interest earned, leading to a loss in purchasing power.

Savers also tend to be overly cautious, avoiding risks that could yield higher returns. While risk aversion is prudent to an extent — particularly for short-term goals — the inability or unwillingness to explore diversified investment options often prevents the accumulation of wealth necessary for long-term security such as retirement.

—

Adopting the Investor Mindset: Goals, Risk, and Time Horizon

The first essential step toward becoming a strategic investor is redefining financial goals with a long-term perspective. Unlike saving, which usually focuses on short-term safety, investing entails setting milestones over several years or decades.

Let’s consider two fictional individuals: Anna, a saver, and Mark, a strategic investor. Anna prioritizes keeping $20,000 in her savings account for retirement in 20 years, while Mark invests that same amount in a balanced portfolio of stocks and bonds.

Using the historical average return of the S&P 500 at about 10% annually over the long term (source: NYU Stern School), Mark’s investment could grow substantially. Assuming annual compounding, Mark’s $20,000 investment could grow to approximately $672,000 in 20 years, while Anna’s savings account might earn only around $242, given low interest rates.

A clear understanding of time horizon and risk tolerance allows investors to make informed decisions—in Mark’s case, accepting market volatility in exchange for higher expected returns. It’s essential to evaluate risk capacity realistically and aim for diversified investments to cushion against market downturns.

| Aspect | Saver (Anna) | Strategic Investor (Mark) |

|---|---|---|

| Initial Amount | $20,000 | $20,000 |

| Time Horizon | 20 years | 20 years |

| Annual Return | 0.06% (Savings Account) | 10% (Average Stock Market) |

| End Value | ~$20,242 | ~$672,000 |

| Risk Level | Minimal | Moderate to High |

—

Educating Yourself: Key Investment Concepts and Tools

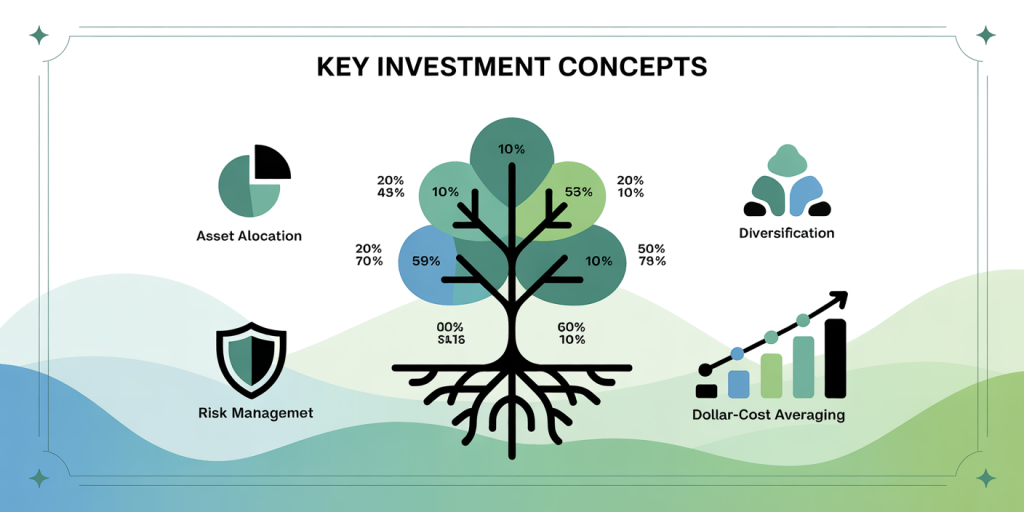

Transitioning into an investor involves acquiring a solid foundation of financial literacy. Understanding fundamental concepts such as compounding, asset allocation, diversification, and risk management is crucial.

Resources such as online courses, books, podcasts, and investment simulators provide practical learning opportunities. For instance, platforms like Coursera and Khan Academy offer comprehensive programs on investment basics. Reading classics like “The Intelligent Investor” by Benjamin Graham or following trusted financial news sources can sharpen decision-making.

Practical application includes learning how to assess investment vehicles—stocks, bonds, mutual funds, ETFs, or real estate trust funds—and how each fits personal goals and risk tolerance. Beginners often benefit from starting with low-cost index funds or ETFs, which provide broad market exposure and reduce unsystematic risk.

Many investors use online brokerages with intuitive interfaces and research tools. Compared to traditional financial advisors, these platforms often offer lower fees and greater control.

| Investment Vehicle | Average Return | Risk Level | Minimum Investment | Liquidity |

|---|---|---|---|---|

| Savings Account | 0.06% | Very low | None to Minimal | High |

| Bonds (10-year) | 2-3% | Low to Moderate | Often $1,000+ | Moderate |

| Index Funds/ETFs | 7-10% | Moderate | $100 – $1,000 | High |

| Individual Stocks | Variable (7-12%) | High | No minimum | High |

| Real Estate | 8-12% | Moderate to High | $5,000+ or more | Low to Moderate |

—

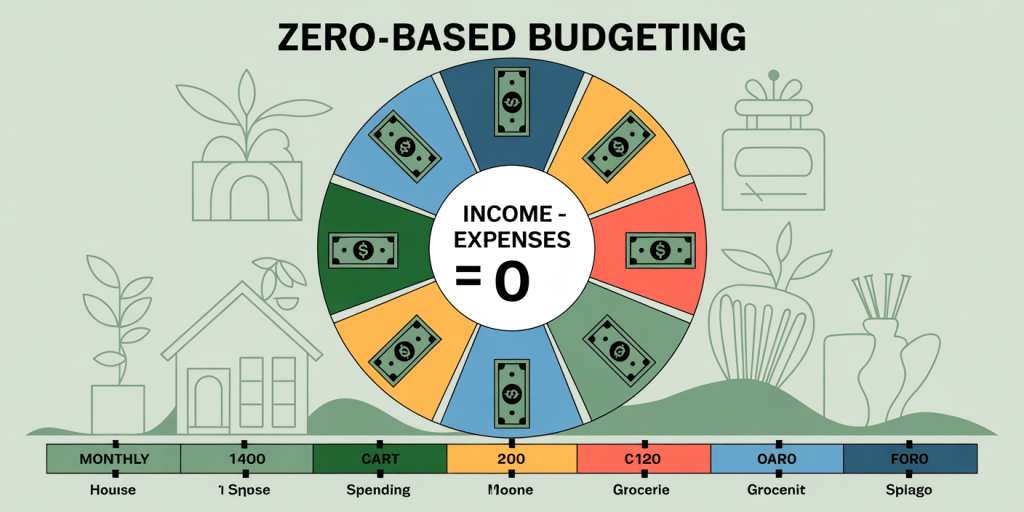

Creating an Investment Plan: Diversification and Budgeting

Once armed with knowledge, crafting a detailed investment plan tailored to specific objectives is essential. This plan acts as a roadmap, minimizing emotional or impulsive decisions.

Begin by determining what portion of monthly income can be allocated toward investments without jeopardizing short-term financial needs, such as emergency funds. Financial advisors typically recommend putting 15-20% of income toward retirement and investment goals early on.

Asset allocation is critical; it involves spreading investments across asset classes to reduce risk. For example, a typical balanced portfolio might include 60% stocks and 40% bonds for moderate risk tolerance. Younger investors might lean more heavily on stocks due to longer time horizons allowing them to weather market fluctuations.

Dollar-cost averaging — investing fixed sums at regular intervals regardless of market conditions — helps mitigate timing risks and builds discipline.

Case Study: Sarah had $50,000 in savings but wanted to grow her wealth strategically. After consulting an advisor, she allocated 70% to diversified stock ETFs and 30% to bond funds. Over 10 years, this diversified strategy outperformed her previous savings returns by a significant margin while maintaining manageable risk.

| Strategy Component | Description | Benefit |

|---|---|---|

| Budgeting | Allocating funds monthly for investment | Ensures consistent growth |

| Asset Allocation | Diversifying across stocks, bonds, others | Reduces risk and volatility |

| Dollar-cost Averaging | Spreading out purchases over time | Avoids market timing risk |

| Emergency Fund | Maintaining 3-6 months of expenses in liquid assets | Provides safety net |

—

Overcoming Psychological Barriers to Investing

Many savers hesitate to invest due to fear of losing money, complexity, or lack of confidence. Behavioral finance studies reveal that emotional biases such as loss aversion, confirmation bias, and herd mentality often inhibit sound investment choices.

To overcome these barriers, strategic investors adopt evidence-based practices and maintain discipline during market cycles. Real-world examples such as Warren Buffett’s long-term buy-and-hold approach highlight the value of patience and resisting panic selling.

Practical steps include starting with small amounts to build confidence, using robo-advisors that automate portfolio management, and setting clear rules for rebalancing or adjusting investments based on predetermined criteria rather than emotions.

A study by Fidelity Investments found that investors who stick to their plans through market downturns significantly outperform those who panic sell, showing that behavioral control is a major factor in successful investments.

—

Monitoring and Adjusting Your Portfolio for Optimal Returns

Investing, unlike saving, requires ongoing monitoring and occasional adjustments. Markets evolve, personal circumstances change, and asset performances fluctuate.

Regular portfolio reviews — recommended at least annually — ensure alignment with changing goals and risk tolerance. For example, a portfolio heavily weighted in stocks might need rebalancing after a market surge to reduce potential risk exposure.

Technology simplifies tracking investments via apps and dashboards that provide real-time data. Additionally, tax implications must be considered; strategic investors optimize investments to minimize tax liability, such as using tax-advantaged accounts like IRAs or 401(k)s.

Real case example: John, a mid-career professional, reviews his portfolio yearly, adjusting allocations by selling appreciated assets and buying underperforming ones to maintain balance. This disciplined approach has added approximately 1-2% in returns annually over 15 years compared to a static approach, illustrating the compounding effect of small optimizations.

—

Future Perspectives: Evolving From Strategic Investor to Wealth Builder

The journey from saver to strategic investor doesn’t end once investments are made. As financial knowledge deepens and wealth accumulates, investors often pursue advanced strategies such as real estate ownership, alternative investments (private equity, cryptocurrencies), and philanthropic giving.

Emerging trends in automatic investing, AI-driven portfolio management, and sustainable investing offer new opportunities to tailor investments aligning with personal values and long-term prosperity.

Furthermore, integrating estate planning and intergenerational wealth transfer becomes crucial as portfolios grow. Strategic investors increasingly work with professional advisors and utilize technology to maintain, grow, and protect wealth.

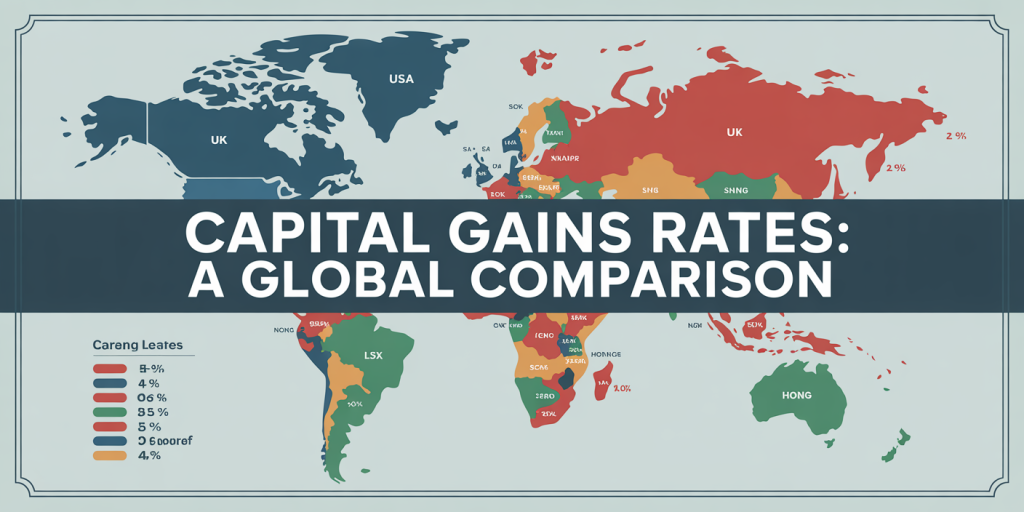

Looking ahead, continuous learning and adaptability will define successful investors. The global financial landscape evolves with economic shifts, regulatory changes, and new asset classes emerging regularly. Savvy investors who stay informed and agile can capitalize on these trends to compound their wealth sustainably.

—

Transitioning from a saver to a strategic investor represents a pivotal step toward financial empowerment and independence. By recognizing the limitations of merely saving, adopting an investing mindset, gaining financial education, building a deliberate investment plan, overcoming psychological hurdles, and maintaining regular portfolio oversight, individuals can maximize their wealth-building potential.

The data-driven and case-based strategies discussed here serve as a foundation to confidently take this leap and participate actively in wealth creation, setting a solid path toward long-term financial success.