How to Create a Zero-Based Budget

Creating a sustainable and practical financial plan remains a cornerstone for achieving long-term financial stability. Among the myriad budgeting techniques available, zero-based budgeting (ZBB) stands out for its precision and comprehensive control over income and expenses. Zero-based budgeting ensures that every dollar of income is assigned a specific purpose, leaving no money unallocated. This method promotes mindful spending, reduces wastage, and enhances savings. According to a 2023 survey by the National Endowment for Financial Education, individuals practicing zero-based budgets reported a 30% higher savings rate compared to those using traditional budgeting methods.

For both individuals and businesses, adopting a zero-based budget requires discipline and a systematic approach to planning finances. From understanding monthly expenses to setting actionable financial goals, zero-based budgeting provides a framework that tailors to all financial situations. Whether one is embarking on managing household expenses or structuring a company’s financial year, mastering the zero-based budgeting method equips users to maximize financial efficacy.

Understanding Zero-Based Budgeting: The Core Concept

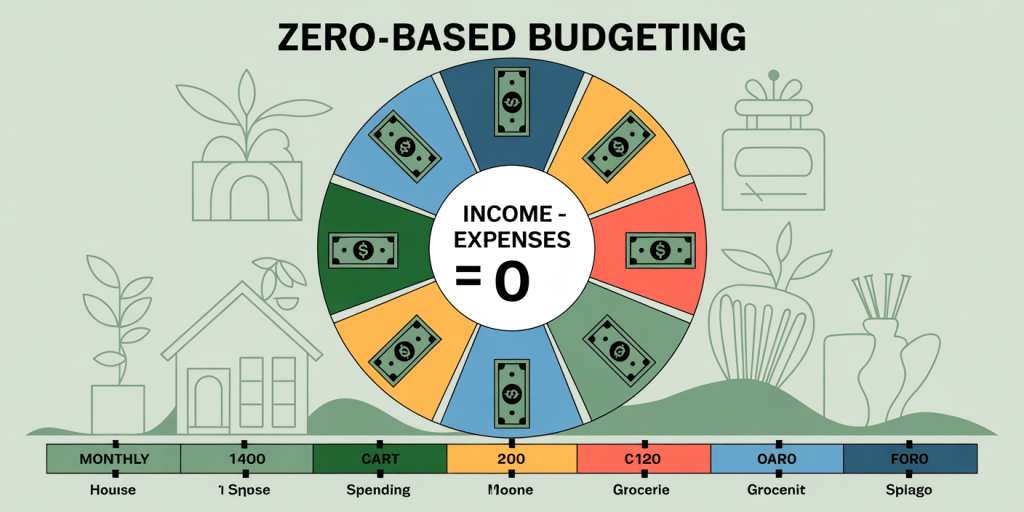

Zero-based budgeting diverges fundamentally from incremental budgeting, where past budgets form the basis for future expenditure allocation. Instead, ZBB starts from scratch each budgeting period, justifying every spending category regardless of historical data. The core principle is to allocate all incoming money to specific purposes until the net income minus expenses equals zero. This approach promotes financial transparency and accountability as every expense must be validated.

For example, consider a monthly income of $4,000. In a zero-based budget, every dollar—whether going to rent, groceries, or savings—must be accounted for so that total expenses equal exactly $4,000. If the budget ends in a surplus or deficit, adjustments are required preemptively. Unlike traditional budgets where surplus might remain unassigned or lead to overspending, zero-based budgeting leaves no room for ambiguity.

An illustrative case is Sarah, a freelance graphic designer earning irregular monthly incomes between $3,000 and $4,500. By adopting zero-based budgeting, Sarah plans her month based on the minimum expected income and allocates each dollar upfront, prioritizing essentials like rent, utilities, software subscriptions, and emergency savings. If a month yields higher income, she assigns the surplus to debt repayments or investments rather than discretionary spending. This method has helped Sarah avoid lifestyle inflation and steadily reduce her credit card debt by 25% in six months.

Step 1: Calculate Your Total Monthly Income Accurately

The foundational step in creating a zero-based budget is calculating your total monthly income. This goes beyond just your salary and includes all sources of income such as freelance earnings, dividends, rental income, side gigs, and any government benefits, if applicable. According to the U.S. Bureau of Labor Statistics, the average American adult earns an additional 15% of their base income from side gigs or informal work, illustrating the importance of accounting for all income streams.

For instance, John, a marketing professional, receives a monthly salary of $5,000 but also earns about $500 monthly through part-time consulting. To create an effective zero-based budget, John has to include the full $5,500 as his total income, using the lower expected amount if income varies monthly. Accurate income calculation ensures every dollar is allocated responsibly and provides a realistic view of financial capabilities.

In cases where income fluctuates, it is prudent to use the lowest expected income figure for conservative budgeting or calculate an average over six months. This prevents overspending during low-income months and builds a buffer for periods when finances are tighter.

Step 2: Track and Categorize Every Expense

Once the total income is established, the next important step is to meticulously track every expense. This includes fixed costs (rent/mortgage, utilities, insurance) and variable costs (groceries, entertainment, dining out). Tracking expenses can be facilitated through financial apps like Mint, YNAB (You Need A Budget), or even manual spreadsheets. It’s crucial to maintain detailed records for at least one full month to capture the true spending pattern.

Consider Maria, who initially underestimated her variable entertainment expenses. After diligent tracking using YNAB, she realized she spent 20% more on dining out than planned. By categorizing her spending, Maria adjusted her budget to reflect realistic amounts, avoiding any surprises or budget deficits.

Expense categorization can be broken down into essentials, financial priorities (debt repayment, savings), and discretionary spending. Separating wants from needs assists in reallocating funds if income changes or unexpected expenses arise. For example:

| Expense Category | Estimated Monthly Amount | Notes |

|---|---|---|

| Housing (Rent + Utilities) | $1,200 | Fixed expense |

| Transportation | $300 | Gas, maintenance |

| Groceries | $400 | Average variable expense |

| Debt Payments | $350 | Credit card and student loans |

| Savings/Investments | $600 | Emergency fund, 401(k) |

| Entertainment | $250 | Movies, dining out, hobbies |

| Miscellaneous | $150 | Unexpected or irregular costs |

| Total Expenses | $3,550 |

This granular categorization helps visualize budgeting needs and identify areas to optimize.

Step 3: Assign Every Dollar a Purpose

The hallmark of zero-based budgeting is allocating every dollar so that income minus expenses equals zero. After listing all expenses, subtract their sum from total income. If the difference is positive (surplus), allocate that remainder to additional savings, debt repayment, or specific goals. If the difference is negative (deficit), reassess expenses by cutting unnecessary costs first, especially in the discretionary categories.

Using Lucy’s budgeting example, with a net income of $3,500 and planned expenses totaling $3,200, she allocates the remaining $300 as an extra emergency fund deposit. Conversely, if expenses total $3,600, Lucy must reduce costs—perhaps by trimming entertainment or choosing more affordable grocery options—to match or beat the $3,500 income figure.

This step brings both discipline and flexibility. For instance, people typically underestimate small irregular expenses such as subscription services. Assigning every dollar allows the opportunity to evaluate and prevent unwanted budget drift.

Adopting a zero-based budget enforces proactive choices: instead of spending first and saving what is left, saving and investing are treated as expenses, ensuring they are prioritized.

Step 4: Monitor and Adjust Your Budget Regularly

Creating the initial zero-based budget is important, but its effectiveness depends on consistent monitoring and periodic adjustments. Monthly review sessions help identify budget variances, understand causes, and refine future allocations. Budget adjustments should reflect real-life changes in income, expenses, or financial goals.

Let’s consider Greg, who followed a strict zero-based budget but encountered increased medical expenses mid-year. By tracking and adjusting his budget immediately, Greg reduced his entertainment and miscellaneous categories to cover these costs without disrupting essential payments or dipping into savings.

Many budgeting experts recommend scheduling monthly financial reviews, noting the actual spend vs. planned amounts, and recalibrating accordingly. For fluctuating income earners like contractors or freelancers, this practice ensures financial control regardless of income volatility.

Automated apps and software add convenience to this process by syncing bank accounts and categorizing transactions in real time, providing budget alerts when limits are near. According to a 2022 report from Deloitte, digital budgeting tools improve adherence to budget plans by 40%, emphasizing the value of regular monitoring.

Comparing Zero-Based Budgeting to Other Budgeting Methods

Understanding how zero-based budgeting fares against other methods helps highlight its unique benefits and challenges.

| Budgeting Method | Core Approach | Pros | Cons |

|---|---|---|---|

| Zero-Based Budgeting | Allocate every dollar to specific purpose | Total control, eliminates waste, boosts savings | Time-intensive, requires discipline |

| 50/30/20 Rule | 50% needs, 30% wants, 20% savings | Simple to follow, flexible | Less precise, may overlook irregular expenses |

| Envelope System | Cash envelopes for each category | Physical control, limits overspending | Impractical for digital transactions |

| Incremental Budgeting | Adjusts prior budget based on growth | Easy to implement | Encourages perpetuation of unnecessary costs |

| Pay-Yourself-First | Prioritize savings before expenses | Promotes saving habits | May neglect necessary expense planning |

Zero-based budgeting excels in providing clarity and preventing financial complacency, especially for those seeking tight budget management and aggressive debt payoff or saving objectives.

Future Perspectives: The Role of Technology and Behavioral Insights

Looking ahead, the practice of zero-based budgeting is evolving alongside technological advancements and new behavioral finance insights. Artificial intelligence-powered budgeting platforms are poised to make zero-based budgeting more accessible by automating income/expenditure allocation, forecasting, and personalized recommendations.

For instance, apps integrating machine learning algorithms can anticipate future expenses based on historical data, suggesting optimized budget changes before financial shocks occur. According to a 2024 market analysis by Statista, fintech budgeting tool adoption is expected to grow by 25% annually, reflecting consumer demand for smart financial management.

Moreover, behavioral science research continues to inform budgeting tactics by emphasizing the psychological aspects of spending and saving. Zero-based budgeting’s insistence on assigning every dollar a role aligns well with commitment devices that reduce impulsive purchases and improve financial self-control.

In corporate finance, zero-based budgeting is gaining traction for strategic resource allocation. Its practice forces managers to justify expenditures annually, cutting redundant costs, and reallocating funds toward growth areas. Organizations like Unilever and Kraft Heinz have reported savings of up to 15% through disciplined ZBB processes.

In summary, zero-based budgeting is not just a static method but a dynamic tool adapting to individual needs and technological evolutions. Embracing its principles today lays the foundation for more resilient and goal-oriented financial futures.

Deixe um comentário