Managing finances with a fluctuating income stream can be challenging, yet it is increasingly common in today’s gig economy and freelance workforce. According to the U.S. Bureau of Labor Statistics, nearly 36% of Americans engage in some form of freelance or side work, often experiencing irregular earning patterns. For many, this variability creates uncertainty in meeting monthly expenses, saving, and planning long-term financial goals. However, with practical budgeting strategies tailored to inconsistent income, financial stability is achievable.

This article explores effective ways to budget when your income is variable, armed with actionable tips, real-life examples, and data-driven insights. Whether you are a freelancer, hourly worker, seasonal employee, or entrepreneur, these strategies can help you navigate the peaks and valleys of irregular paychecks.

Understanding the Challenges of Variable Income

Living on an inconsistent income typically means your earnings fluctuate month to month. This can make classic budgeting difficult since fixed monthly expenses like rent, utilities, groceries, and loan payments remain constant, while available funds do not. Additionally, irregular income can create psychological stress, as uncertainty often zeroes down to how to prioritize bills and savings.

For example, consider Maria, a freelance graphic designer whose monthly earnings swing between $2,000 and $5,000 depending on project load. On a good month, she feels financially secure, but when income dips, she must make tough choices such as reducing discretionary spending or delaying savings contributions. According to a 2021 survey by QuickBooks, 61% of freelancers said inconsistent cash flow was their biggest financial challenge.

Recognizing these challenges is the first step in devising a sustainable budgeting approach. Unlike traditional fixed-income earners, those with variable earnings must adopt flexible systems that absorb income shocks rather than rely on predictability.

Creating a Baseline Budget: Prioritize Essential Expenses

When income isn’t stable, it becomes crucial to anchor your budget around essential, non-negotiable expenses first. These typically include housing costs, utilities, groceries, minimum debt payments, healthcare, and transportation. Using historical data on your expense patterns, calculate the minimum monthly amount needed to cover these essentials.

For example, using the case of Maria, her essential expenses—rent, utilities, groceries, and health insurance—total around $2,200 monthly. This figure forms her baseline budget target, which she prioritizes above all else. She uses her lowest earning months to ensure at least this amount is covered, preventing financial shortfalls.

A useful approach here is “zero-based budgeting,” where every dollar earned is assigned a purpose, with essentials fully funded first. Personal finance expert Dave Ramsey advocates for this system among freelancers, cautioning that non-essential spending must wait until after essentials and savings receive allocation.

Baseline Budget Example Table

| Expense Category | Monthly Amount | Priority Level |

|---|---|---|

| Rent/Mortgage | $1,200 | High (Essential) |

| Utilities (Electric, Water, Internet) | $300 | High (Essential) |

| Groceries | $400 | High (Essential) |

| Health Insurance | $200 | High (Essential) |

| Transportation | $100 | High (Essential) |

| Minimum Debt Payments | $150 | High (Essential) |

| Entertainment | $150 | Low (Discretionary) |

| Dining Out | $100 | Low (Discretionary) |

By establishing this baseline, you can better align your spending with the worst-case income scenario, ensuring necessary bills are always paid—even if income dips significantly.

Building an Emergency Fund: Your Financial Safety Net

With inconsistent income, building an emergency fund is one of the most effective safeguards against financial distress. This fund acts as a buffer when a low-income month hits or unexpected expenses arise. Financial advisors typically recommend saving three to six months’ worth of essential expenses in an easily accessible account.

Using Maria’s baseline budget of $2,200, she targets saving at least $6,600 to create a three-month emergency fund. While this may seem daunting initially, she began by setting aside a small percentage of her higher-income months to gradually build the fund. According to Bankrate’s 2023 survey, roughly 39% of Americans have sufficient savings to cover a $1,000 emergency, indicating room for improvement especially in gig-based income earners.

Besides protecting against income fluctuations, emergency funds can reduce reliance on high-interest debt in tough times. A good strategy is to treat contributions toward the emergency fund as a fixed monthly “expense” once your baseline budget is met, enhancing the discipline of saving even on uneven income.

Implementing a Two-Account System: Control and Clarity

A practical method for managing inconsistent income is maintaining two separate bank accounts: one for income and variable expenses, and one purely for essentials and savings. This system provides clarity on what funds are guaranteed for critical costs and prevents accidental overspending.

For instance, Maria funnels all project payments into her “income” account. From there, she transfers a fixed amount equivalent to her baseline budget ($2,200) into her “essential expenses” account monthly. She also allocates savings and debt payments from this account. This structure isolates funds needed for bills, reducing stress during months when income is uneven.

A 2022 study by the National Endowment for Financial Education suggests that compartmentalized budgeting systems improve spending control and savings outcomes, especially for variable earners.

Two-Account System Comparison Table

| Feature | Single Account Budgeting | Two-Account System |

|---|---|---|

| Visibility of Essentials | Low | High (Isolated essentials fund) |

| Overspending Risk | Higher | Lower (Control via separate accounts) |

| Savings Discipline | Variable | Higher (Savings assigned systematically) |

| Stress from Variability | Elevated | Reduced (Predictable essential expenses fund) |

This approach works well with digital tools that automate transfers based on pre-set rules, making money management smoother for inconsistent earners.

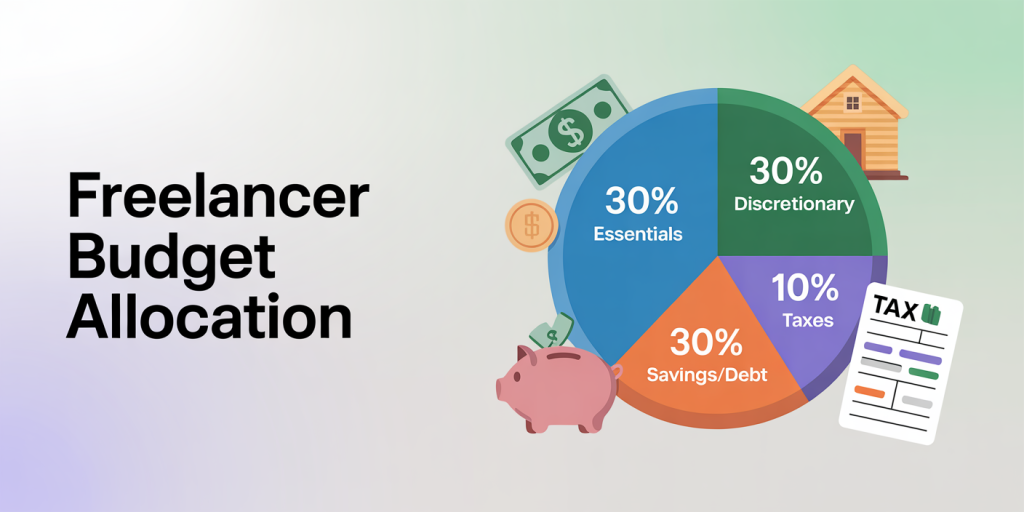

Using a Percentage-Based Budgeting Method

Another adaptable budgeting technique suited for fluctuating income is the percentage-based method, which assigns portions of income to different spending categories rather than fixed dollar amounts. This allows flexibility as income changes but maintains spending discipline proportional to earnings.

A popular version is the “30/30/30/10” rule often used by freelancers: allocate 30% to essentials, 30% to variable expenses/discretionary spending, 30% to savings/debt repayment, and 10% to taxes. Since applying this method depends on gross income, it effectively scales with your earning pattern.

For example, Sarah, a freelance photographer earning between $2,500 and $6,000 monthly, budgets as follows: Essentials (30%): $750 – $1,800 Variable/Discretionary (30%): $750 – $1,800 Savings/Debt (30%): $750 – $1,800 Taxes (10%): $250 – $600

In lower income months, she consciously reduces discretionary spending, while in higher earning months, she maximizes saving contributions.

According to a 2023 Fidelity study, allocating at least 20% of income toward savings and debt reduction is vital for financial health, which this flexible approach supports. Freelancers and contractors benefit from this adaptable framework as it aligns spending with actual inflows instead of rigid fixed budgets.

Leveraging Technology and Financial Tools

Modern budgeting apps and financial tools are key allies in managing inconsistent income. Apps like YNAB (You Need a Budget), Mint, and EveryDollar offer features that accommodate variable income, such as rolling over budgets, emergency fund tracking, and goal-oriented savings modules.

For example, Lopez Consulting, an agency employing freelance writers paid by assignment, adopted YNAB which helped writers visualize monthly income trends, categorize expenses accurately, and allocate funds for taxes proactively. Over a year, writers increased emergency savings by 40% on average and reduced overdraft incidents by 25%.

Additionally, automated transfers ensure that baseline amounts are moved into essential accounts immediately upon receiving income, reducing the temptation to overspend and improving financial resilience.

Integrating tools with bank accounts and digital calendars provides reminders for bill payments, tax deadlines, and savings milestones—helping freelancers stay on top of fluctuating finances without being overwhelmed.

Preparing for Taxes: Plan Ahead to Avoid Surprises

For many with inconsistent income, particularly freelancers and independent contractors, tax liabilities can be unpredictable. Unlike salaried employees with tax withheld from paychecks, many variable income earners must estimate and pay quarterly taxes themselves, which requires prudent budgeting.

The IRS recommends setting aside approximately 25-30% of income for federal, state, and self-employment taxes. For example, if a consultant earns $4,000 one month, they should ideally reserve $1,000 to $1,200 for taxes. Failure to do so can lead to surprise tax bills and penalties.

Comparatively, salaried employees see taxes withheld automatically, reducing the risk of underpayment. Freelancers must rely on their own discipline and accounting systems to avoid financial strain during tax season.

Using a dedicated tax savings account can prevent mixing these funds with regular spending. Many freelancers allocate a fixed percentage of every payment into this account, so taxes are effectively “prepaid.” Tax software like TurboTax Self-Employed often helps project quarterly payments and estimated tax obligations.

Emerging Trends and Future Perspectives in Budgeting Variable Income

As the gig economy continues to expand—with a projected 86.5 million freelance workers in the U.S. by 2027 (Freelancers Union)—managing inconsistent income will become an increasingly essential personal finance skill. Advances in financial technology are revolutionizing how variable earners budget, save, and invest, with AI-driven predictive analytics offering personalized income smoothing strategies.

Moreover, growing platforms offer hybrid income options, insurance products tailored for freelancers, and income stabilization services. Some fintech startups provide “earnings advances” or “income smoothing” loans to bridge low-income periods, a growing alternative to traditional credit.

Financial literacy programs dedicated to non-traditional income earners are on the rise, promoting practical budgeting, emergency fund building, and tax compliance skills. Employers and platforms engaging freelancers may increasingly offer access to benefits historically reserved for full-time employees, enhancing financial security.

In future, combining disciplined budgeting strategies with evolving tools and support systems will further empower those with irregular income to build wealth, reduce stress, and plan confidently for long-term goals.

—

In summary, budgeting with inconsistent income demands a strategic mindset centered on prioritizing essentials, building a robust emergency fund, implementing account segregation, using flexible percentage rules, and leveraging technology. With foresight and discipline, freelancers, gig workers, and independent contractors can transform income variability from a source of anxiety into an opportunity for financial empowerment.

Deixe um comentário