Navigating personal finances during your 20s and 30s is crucial for building a stable financial future. These decades often involve major life transitions such as entering the workforce, pursuing higher education, or starting a family. Despite their importance, many individuals make costly financial errors during this period that can have long-lasting effects. Understanding which mistakes to avoid can set you on a path toward financial independence and security. This article will discuss common financial pitfalls, practical examples, and strategies to help you make smarter money decisions.

Overreliance on Credit Cards

Credit cards can be convenient tools for managing everyday expenses and building credit history. However, overreliance on credit cards is a prevalent mistake among young adults, often leading to mounting debt and financial stress. According to a 2023 report from the Federal Reserve, the average credit card debt for individuals aged 25-34 was approximately $3,500, highlighting the widespread nature of this issue.

Many in their 20s and 30s fall into the trap of spending beyond their means, driven by lifestyle inflation, instant gratification, or emergencies. Take the example of Sarah, a 29-year-old marketing professional who accumulated $8,000 in credit card debt within two years by frequently dining out, purchasing electronics, and taking vacations without budgeting. High-interest rates, often exceeding 18%, make repayment difficult, trapping individuals in cycles of debt.

To avoid such traps, it is essential to use credit cards responsibly: pay full balances monthly to avoid interest charges, maintain utilization below 30%, and prioritize essential expenses. Establishing a monthly budget and emergency fund can reduce the temptation to rely on credit cards for non-essential spending.

Neglecting Retirement Savings Early On

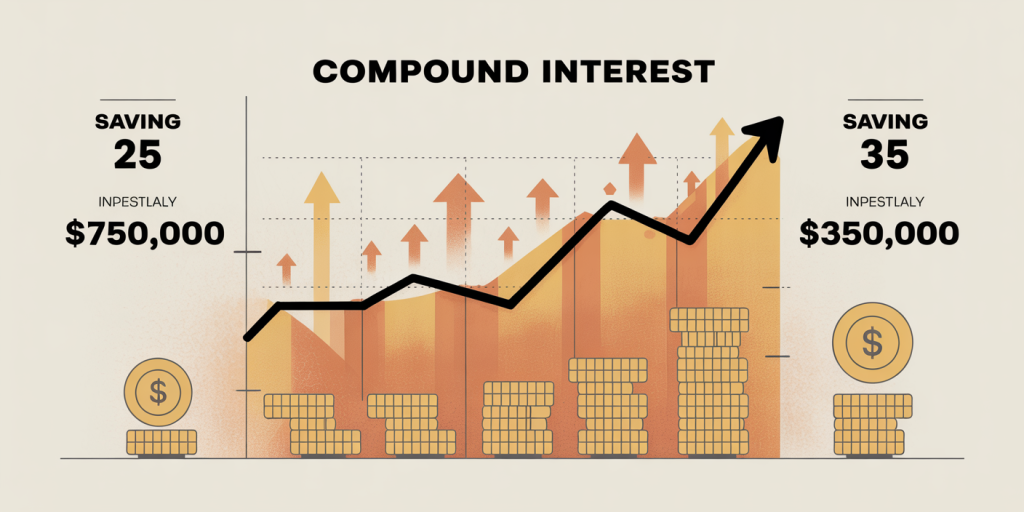

A common misconception among young adults is that retirement is far away, making early savings unnecessary. However, delaying retirement contributions can severely impact future financial security. Thanks to compound interest, money invested early grows exponentially over time.

For example, consider two individuals: Julia starts saving $200 monthly at age 25, while Mike begins the same at 35. Assuming a 7% annual return, Julia will have approximately $395,000 by age 65, whereas Mike will have around $160,000. This significant difference results from Julia’s earlier start and the power of compounding over ten additional years.

Despite this, a 2021 survey by the National Institute on Retirement Security found that nearly 40% of millennials had no retirement savings at all. Contributing to employer-sponsored plans like 401(k)s or individual retirement accounts (IRAs) should be a priority in your 20s and 30s. Many employers offer matching contributions, effectively providing free money toward your retirement—a benefit that should not be overlooked.

Ignoring Budgeting and Tracking Expenses

Budgeting is often viewed as limiting or tedious, but ignoring it is a critical financial mistake. Without a clear picture of where money is going, overspending becomes likely, making it difficult to save or pay down debt.

Take John, a 32-year-old software engineer who assumed he “knew” his expenses but never tracked them. Consequently, he was shocked to find after a month-long review that approximately 25% of his income was spent on dining and subscription services he didn’t fully use. With inconsistent monitoring, John was unable to allocate funds appropriately toward savings or loan repayments.

In contrast, creating a detailed budget allows transparency and greater control over finances. Apps like Mint or YNAB (You Need a Budget) facilitate real-time expense tracking. According to a 2022 study by Experian, individuals who budget regularly save an average of 33% more than those who do not, illustrating the tangible benefits of this practice.

| Budgeting Benefits | With Budget | Without Budget |

|---|---|---|

| Monthly Savings Rate | 20-30% of income | 5-10% of income |

| Debt Payoff Time | 2-3 years for moderate debts | 5+ years |

| Financial Stress Level | Reduced | Increased |

A disciplined approach to budgeting can dramatically improve savings behavior and debt management.

Underestimating the Importance of Emergency Funds

Life is unpredictable, and unexpected expenses such as medical emergencies, car repairs, or sudden unemployment can derail financial plans. Yet, many young adults enter adulthood without a dedicated emergency fund, leaving them vulnerable.

Financial advisors often recommend building an emergency fund covering three to six months of essential living expenses. Unfortunately, the Federal Reserve’s 2023 data shows that 36% of Americans would struggle to cover a $400 unexpected expense without selling belongings or borrowing money. This lack of cushion can lead to costly alternatives like payday loans or credit card borrowing.

Lisa, a 27-year-old teacher, experienced this firsthand when her car broke down without any savings to cover repairs. Her only option was to put the $1,200 repair on her credit card, resulting in interest accumulation and financial strain. Had she accumulated an emergency fund gradually, she could have avoided debt.

The best practice is to automate monthly transfers to a separate savings account earmarked for emergencies. Even $50 a month can replenish an emergency fund over time, providing peace of mind and financial resilience.

Failing to Manage Student Loan Debt Strategically

Student loans remain a significant financial burden for many young adults. According to the Federal Reserve, total student loan debt in the United States reached $1.7 trillion in 2024, with approximately 42 million borrowers affected. While pursuing higher education is an investment in future earning potential, mishandling repayment plans or deferring loans unnecessarily can cause financial hardship.

A practical example involves Mark, a 31-year-old who opted for income-driven repayment plans without assessing their long-term implications. While this reduced his monthly payments, the prolonged repayment period increased total interest paid by thousands of dollars over time.

Strategic management of student loans includes understanding the terms, exploring refinancing options at lower interest rates, and making payments above the minimum when possible to shorten payoff time. Utilizing employer assistance programs or public service loan forgiveness options can also alleviate the debt burden.

| Repayment Strategies | Pros | Cons |

|---|---|---|

| Standard 10-year plan | Faster payoff, less interest paid | Higher monthly payments |

| Income-driven repayment | Affordable monthly payments | Longer repayment, more interest |

| Refinancing | Potentially lower interest rates | Loss of federal loan benefits |

| Public Service Loan Forgiveness | Debt forgiveness after 10 years | Requires qualifying employment |

Understanding these options early can minimize long-term costs and improve credit scores.

Future Financial Perspectives: Building a Strong Foundation

Looking forward, the financial habits developed in your 20s and 30s play a defining role in wealth accumulation and financial freedom in later decades. Avoiding the mistakes highlighted above helps create a solid foundation that enables greater flexibility, opportunity, and security.

Continual financial education is key to adapting to changing circumstances such as marriage, homeownership, or entrepreneurship. Incorporating diversified investments beyond retirement accounts—such as real estate, stocks, or small business ventures—can enhance wealth-building potential.

Moreover, utilizing technology and seeking advice from certified financial planners can further optimize financial strategies. As you age, risks and priorities evolve; for example, insurance needs may increase, and estate planning becomes important. Proactive management ensures you stay on track toward long-term goals.

Statistically, according to a 2023 CFP Board report, individuals who start financial planning before age 35 have nearly twice the net worth of those who begin later. This underscores the profound impact early and careful financial decision-making has on future prosperity.

In essence, avoiding major financial missteps during your 20s and 30s is about developing discipline, knowledge, and foresight. By doing so, you will be better positioned to enjoy the benefits of financial stability and the freedom to pursue your aspirations confidently.

Deixe um comentário