Money matters remain one of the most sensitive and often contentious issues within any relationship. Despite its importance, couples frequently avoid open conversations about finances, fearing conflict or feeling ill-equipped to handle the subject. However, discussing money transparently and constructively is essential for building trust and ensuring long-term relational stability. This article explores practical approaches, backed by data and real cases, to help couples navigate the delicate but necessary conversations about money.

—

The Importance of Financial Communication in Relationships

Open communication about finances can significantly reduce stress and misunderstandings between partners. According to a 2020 survey by SunTrust Bank, 35% of respondents identified money as the primary source of conflict with their partners. Moreover, the National Endowment for Financial Education (NEFE) reports that couples who discuss money regularly are 60% more likely to report relationship satisfaction and financial harmony.

The lack of money talks often leads to assumptions, financial secrecy, or power imbalances. For example, one partner might hide debt or expenses out of embarrassment, resulting in trust erosion when discovered. Furthermore, without agreed-upon goals involving savings or spending, couples might struggle to align their future plans, whether buying a home or planning for children. Therefore, financial communication is not only about balancing budgets but about understanding shared values and goals.

—

Preparing for the Money Conversation: Timing and Setting

Choosing the right moment and environment is crucial when initiating talks about money. Rather than broaching the subject during a stressful event, such as after an argument or when financial pressure peaks, select calm, distraction-free occasions where both partners are receptive and relaxed.

One practical example comes from the story of Sarah and Mark, who scheduled monthly “money dates” where they reviewed their budget, discussed upcoming expenses, and shared perspectives on savings without judgment. This intentional habit helped them avoid surprise financial stress while fostering teamwork.

Additionally, facts back this approach. Psychology Today emphasizes that setting a non-confrontational tone and framing the conversation as a joint problem-solving session significantly improves outcomes. Couples can start by agreeing on basic ground rules: listening without interruption, showing empathy, and being honest about financial feelings and mistakes.

—

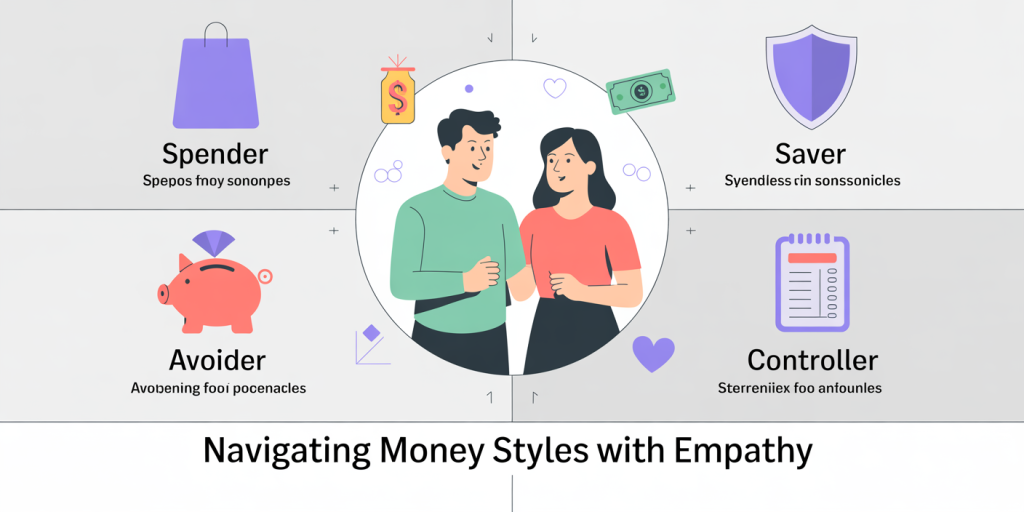

Different Financial Styles and How to Navigate Them

Understanding individual money personalities is vital for constructive communication. Research conducted by the University of Texas reveals that money attitudes fall broadly into categories like “spenders,” “savers,” “avoiders,” and “controllers.” Conflicts arise when these differing styles clash without acknowledgment.

To illustrate, Alicia is a cautious saver who finds comfort in budgeting every penny, while her partner, James, enjoys spontaneous purchases as a form of stress relief. Without a mutual understanding, Alicia might view James as reckless, while James feels controlled or mistrusted.

A practical approach includes identifying each partner’s financial values and preferences through questionnaires or informal discussions. Couples can then negotiate compromises, such as setting individual discretionary spending limits or creating joint savings while allowing personal spending money. This strategy fosters respect and reduces hidden resentments.

Comparative Table: Common Financial Styles and Communication Tips

| Financial Style | Description | Communication Tips |

|---|---|---|

| Spender | Enjoys using money for immediate gratification | Establish clear budgets and “fun money” allowance |

| Saver | Prioritizes security and long-term savings | Share goals and celebrate milestones to build trust |

| Avoider | Dislikes discussing or managing money | Gently introduce regular check-ins and use neutral language |

| Controller | Likes managing finances and making decisions | Encourage shared control and value partner input |

—

Setting Shared Financial Goals and Priorities

Money discussions become purposeful and effective when couples focus on shared goals rather than just income and expenses. Establishing clear objectives—whether it’s buying a house, traveling, or retirement planning—aligns partners and motivates collective action.

Jenna and Carlos provide a relevant case study. Early in their relationship, they discovered divergent savings habits; Jenna saved aggressively, while Carlos preferred investing in experiences. By creating a joint vision board detailing what they wanted to achieve together, from a vacation home to early retirement, both partners learned to allocate funds toward priorities that mattered to both.

Data supports the value of shared goals. A 2021 Fidelity study revealed that 82% of couples who set financial goals together report higher satisfaction in their relationship and are twice as likely to achieve those goals. Clear goals also facilitate budgeting, as couples can categorize spending under “needs,” “wants,” and “future investments,” avoiding unnecessary conflicts over discretionary expenses.

—

Managing Debt and Expenses Transparently

Debt remains a significant stress factor in relationships, especially when one or both partners bring existing financial burdens into the partnership. According to a 2022 survey by Experian, 50% of couples admitted they hid debt from their partners at some point, leading to a loss of trust when discovered.

Transparency is therefore crucial. Couples should openly disclose all debts, including credit cards, student loans, and mortgages. Together, they can create a realistic repayment plan that considers both incomes and priorities. For example, Lisa and Tom tackled Tom’s credit card debt by setting up automate monthly payments from their joint account, agreed on spending limits, and celebrated each milestone to stay motivated.

Additionally, tackling everyday expenses equitably helps maintain fairness. Different arrangements—such as splitting bills 50/50, proportional to income, or pooling resources entirely—work for different couples. The key is to discuss preferences openly and revisit arrangements regularly. The following table compares common expense-sharing methods:

| Method | Description | Pros | Cons |

|---|---|---|---|

| 50/50 Split | Each pays half of joint expenses | Simple; encourages equality | May be unfair if incomes differ significantly |

| Proportional Sharing | Expenses shared based on income ratio | Reflects financial capacity | Requires transparency of income |

| Joint Pooling | Combining all incomes into one fund | Simplifies budgeting; promotes unity | Loss of individual financial independence |

—

Building Healthy Financial Habits for Long-Term Success

Sustained financial harmony requires more than one-time talks; it demands ongoing habits that reinforce collaboration and transparency. Couples who develop routine check-ins, shared budgeting tools, and financial education together tend to experience fewer conflicts and better decision-making.

Practical examples include using apps like Mint or YNAB (You Need a Budget) to monitor spending and progress toward goals, setting automatic transfers to savings accounts, and scheduling quarterly “financial touchpoints” to adjust plans as life changes.

Moreover, mutual financial education increases confidence. Attending workshops, reading books together, or consulting a financial advisor can demystify complex topics like investments or tax planning. In doing so, couples build a partnership where money is no longer a taboo subject but a shared responsibility.

—

Future Perspectives: Navigating Financial Conversations in a Changing World

As societal norms evolve and economic challenges increase, the ways couples discuss money must adapt accordingly. The rise of digital banking, cryptocurrency, and changing workforce dynamics mean financial conversations will become increasingly multifaceted.

Future couples may need to integrate discussions on not only day-to-day finances but also digital asset management, financial privacy online, and ethical investing aligned with personal values. Additionally, with increasing life expectancies and shifts in retirement planning, conversations about long-term wealth transfer and legacy will gain prominence.

Furthermore, given the increase in dual-income households and blended families, financial communication must encompass navigating varied financial histories and responsibilities. Building flexibility, empathy, and adaptability into money talks will remain crucial.

In sum, proactive financial communication is a cornerstone of modern relationships. By approaching money as a shared journey rather than a source of tension, couples can cultivate stronger, more resilient partnerships equipped to face present and future challenges together.

Deixe um comentário