In today’s consumer-driven world, spending money is often more than a mere economic transaction—it’s an emotional act. Emotional spending influences millions of people worldwide, driving choices that frequently contradict their financial goals. This behavior, far from trivial, can lead to long-term financial instability and psychological stress. To navigate personal finance effectively, it’s crucial to understand the underlying triggers behind emotional spending, recognize patterns, and develop practical strategies to mitigate its effects.

Emotional spending, also known as retail therapy or impulsive buying, stems from complex psychological mechanisms. Market research indicates that nearly 69% of consumers admit to making purchases triggered by emotions, as per a 2021 Nielsen report. Such spending often correlates with transient feelings—happiness, sadness, loneliness, or even boredom—creating a feedback loop between emotional states and financial decisions. Therefore, comprehending emotional spending enables more mindful consumption and fosters healthier financial habits.

—

The Psychology Behind Emotional Spending

At its core, emotional spending is tied to the brain’s reward system. When a person purchases something, the brain releases dopamine, a neurotransmitter linked to pleasure and satisfaction. This physiological response reinforces repetitive behavior, often regardless of the buyer’s actual need for the item. For example, someone feeling stressed after a difficult day might buy a luxury item or impulse snack online, seeking an immediate mood boost.

Moreover, emotional spending is connected to how individuals cope with negative feelings. Psychologists differentiate between adaptive and maladaptive coping mechanisms, where emotional spending falls into the latter category. It temporarily alleviates feelings such as anxiety or loneliness but fails to address the root cause, often resulting in regret later. Recent studies from the American Psychological Association reveal that 7 in 10 people engage in emotional spending as a coping strategy, yet 60% of these consumers experience significant guilt afterward.

Real-life case studies underscore this phenomenon. Consider the example of Sara, a 32-year-old marketing executive who struggled with financial planning despite a steady income. Her emotional spending skyrocketed during periods of workplace stress, where she turned to online shopping to find relief. This pattern not only depleted her savings but also amplified her anxiety due to accumulating debt. Such stories highlight how emotional spending intertwines psychological well-being with fiscal responsibility.

—

Common Money Triggers That Lead to Emotional Spending

Understanding the triggers that prompt emotional spending is essential for identifying and controlling such behavior. These triggers vary widely across individuals but often cluster around key emotional states:

1. Stress and Anxiety: High-stress levels can lead to impulsive purchases as a distraction or mood enhancer. A survey by Credit Karma found that 41% of respondents shop to relieve stress. 2. Boredom: When people feel unstimulated, shopping provides excitement or a temporary sense of purpose. This can lead to unnecessary and frequent purchases.

3. Loneliness: Particularly heightened during social isolation periods like the COVID-19 pandemic, loneliness drives consumers to buy items in an attempt to fill emotional voids.

4. Social Pressure: Purchasing items to fit in or appear successful to peers is a powerful motivator, especially among younger demographics influenced by social media trends.

The following table categorizes these triggers alongside common spending behaviors and their typical outcomes:

| Trigger | Common Spending Behavior | Typical Outcome |

|---|---|---|

| Stress/Anxiety | Impulse buying, luxury goods | Temporary relief, long-term regret |

| Boredom | Frequent small purchases, snacks | Financial drain, clutter |

| Loneliness | Online shopping, gifts for self | Short-lived happiness, debt accrual |

| Social Pressure | Trendy items, status symbols | Overspending, peer validation |

For instance, during the COVID-19 lockdowns, many individuals reported increased spending on home décor, gadgets, and clothing, motivated by loneliness and the desire for social engagement. Research by McKinsey supports this, revealing a 23% rise in impulse online purchases in 2020 compared to the previous year.

—

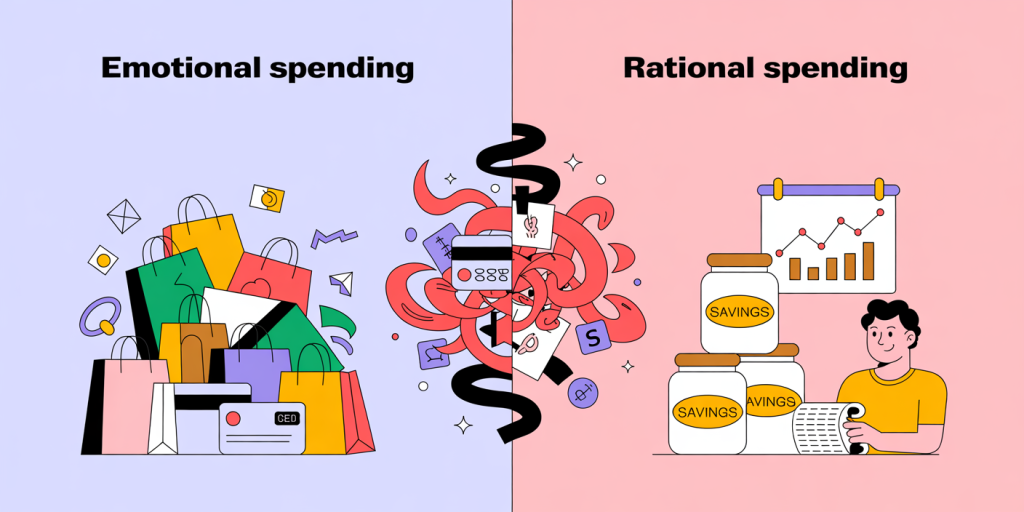

Emotional Spending vs. Rational Spending: Key Differences

Differentiating emotional from rational spending is critical for financial health. Rational spending involves deliberate, budgeted choices based on need and long-term goals, while emotional spending is impulsive and tied to momentary feelings. To illustrate this contrast, consider Sarah and Tom, two colleagues handling discretionary income differently.

Sarah meticulously plans her purchases, understands her monthly budget, and prioritizes essentials and savings. Tom, on the other hand, buys clothes and gadgets impulsively when feeling down or bored, without evaluating whether he truly needs the items. Consequently, Sarah saves consistently, while Tom struggles to pay credit card bills.

The table below summarizes pivotal distinctions:

| Aspect | Emotional Spending | Rational Spending |

|---|---|---|

| Decision Process | Impulsive, driven by emotions | Thoughtful, based on need and budget |

| Time Perspective | Immediate gratification | Long-term financial health |

| Outcome | Potential debt and regret | Financial stability and planning |

| Frequency | Often frequent and irregular | Controlled and routine |

According to a 2019 report by Experian, those who practice rational spending habits are 40% more likely to have emergency savings compared to habitual emotional spenders. This data underscores the tangible benefits of consciously managing emotional responses in financial decisions.

—

Strategies to Manage and Mitigate Emotional Spending

While emotional spending is common, it’s manageable through deliberate strategies. Financial coaches recommend a mix of psychological awareness and practical financial tools to combat impulsivity effectively.

1. Awareness and Tracking: The first step is increasing self-awareness regarding spending triggers. Maintaining a spending journal or using budgeting apps like Mint or YNAB (You Need a Budget) helps capture real-time emotions linked to purchases. For example, Jane, a client of a financial advisor, noted that logging her purchases revealed a correlation between weekend stress and excessive online shopping.

2. Delayed Purchases: Implementing a waiting period (24-48 hours) before making non-essential purchases reduces impulse buying. This cooling-off period allows emotions to stabilize and encourages rational evaluation of the purchase.

3. Budget Allocation for Fun: Setting aside a designated “fun money” budget acknowledges emotional needs without jeopardizing financial goals. This approach was validated in a 2022 behavioral finance study, where participants with allocated discretionary funds reported reduced guilt and better overall financial control.

4. Alternative Coping Mechanisms: Replacing spending with healthier coping strategies, such as exercise, meditation, or socializing, addresses emotional triggers without financial consequences. Therapists emphasize incorporating mindfulness practices to manage stress and prevent the urge to overspend.

5. Professional Support: Financial counseling or therapy can be valuable for those experiencing chronic emotional spending issues. Combining cognitive behavioral therapy (CBT) with financial planning has shown significant improvement in self-control and money management skills.

—

Long-Term Impacts of Emotional Spending on Financial Health

Unchecked emotional spending can have serious repercussions, extending beyond immediate budget concerns. Chronic impulsive purchases contribute to debt accumulation, eroding credit scores and raising financial stress. According to Experian’s 2023 Financial Well-being Report, 53% of consumers cited emotional spending as a primary factor in credit card debt.

Moreover, emotional spending often hinders wealth-building opportunities. Money wasted on impulsive purchases reduces savings potential, retirement contributions, and investment capital. Over time, the compound interest lost by not investing early can amount to tens of thousands of dollars, severely limiting financial independence.

The psychological effects are equally significant. Persistent anxiety over money, regret following impulsive buys, and the shame associated with poor financial decisions can degrade mental health. A study published in the Journal of Financial Therapy (2021) revealed a positive correlation between emotional spending and symptoms of depression and anxiety, emphasizing the need for holistic approaches in treatment.

Consider the example of Mark, a 40-year-old engineer, whose emotional spending escalated after his divorce. His credit card balances ballooned, and he missed crucial retirement savings, jeopardizing his future plans. Through professional financial counseling and behavioral therapy, Mark managed to restructure his finances and regain control over his spending habits.

—

Emerging Trends and Future Perspectives in Emotional Spending

The intersection of technology, behavioral finance, and consumer psychology is shaping the future landscape of emotional spending. With the rise of digital wallets, “buy now, pay later” services, and targeted advertising powered by AI, consumers face unprecedented ease and temptation to engage in impulsive purchases.

Retailers increasingly use data analytics to personalize marketing strategies, identifying emotional triggers and nudging consumers toward spending. For instance, Amazon’s one-click purchases and flash sales capitalize on emotional urgency, influencing buying behavior subconsciously. This digital environment amplifies the challenge of managing emotional spending but simultaneously offers new solutions.

Emerging financial technologies focus on embedding behavioral nudges and interventions into apps. Examples include: Spending alerts that notify users when purchases deviate from typical patterns. Automated savings tools that redirect funds away from discretionary spending. Virtual financial coaches that provide timely, personalized advice.

Furthermore, ongoing research in neuroscience and behavioral economics promises deeper insights into emotional spending’s cognitive underpinnings, facilitating more effective preventative measures and therapeutic approaches.

In addition, societal shifts toward financial literacy and mental health awareness are encouraging more open discussions about emotional spending. Schools and workplaces increasingly incorporate financial wellness programs, helping individuals cultivate emotional resilience and sound money management simultaneously.

Future strategies may increasingly blend technology with psychology, creating personalized, adaptive frameworks that empower consumers to make better financial decisions—even in emotionally charged situations. The ongoing focus on sustainable consumption and ethical consumerism also adds a new dimension, encouraging spending aligned with personal values rather than fleeting emotions.

Deixe um comentário