Unexpected and irregular annual expenses can disrupt personal finances if not adequately planned for. These expenses, distinct from monthly bills or predictable costs, often arise infrequently but carry significant financial weight. Examples include home maintenance, medical bills, insurance premiums, holiday travel, vehicle registration, or property tax payments. Without a structured approach, irregular expenses can cause budget shortfalls, increase debt risk, or drain emergency funds. This article explores practical strategies to anticipate, budget, and manage irregular annual expenses effectively, ensuring financial stability and peace of mind.

Understanding Irregular Annual Expenses and Their Impact

Irregular expenses are those that do not occur monthly or with predictable frequency; instead, they might appear once or twice a year, or even less frequently. According to a 2023 report by The Balance, nearly 60% of households experience financial strain due to overlooked irregular expenses. These expenses often cause budget imbalances because they are not incorporated into the regular monthly budgeting routine.

For example, consider property taxes that are typically due once a year in most U.S. counties. If a homeowner does not prepare for this lump sum, they might face payment difficulties or be forced to cash in emergency savings. Similarly, car registration fees, which in some states recur annually or biennially, can be substantial. Medical deductible resets or elective dental procedures can also contribute to irregular costs that are challenging to predict.

Recognizing the nature and timing of these expenses helps in designing a sustainable financial strategy.

Categorizing Irregular Expenses: A Practical Framework

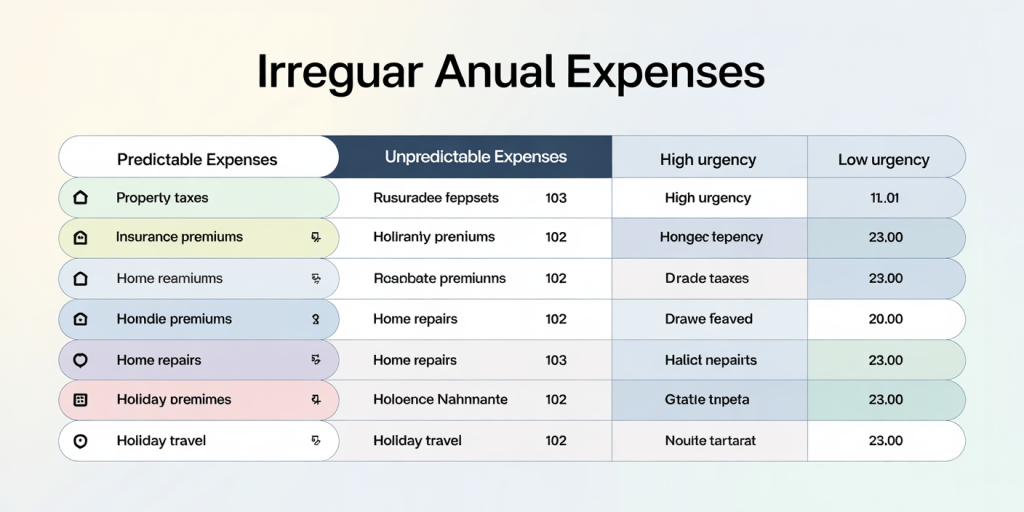

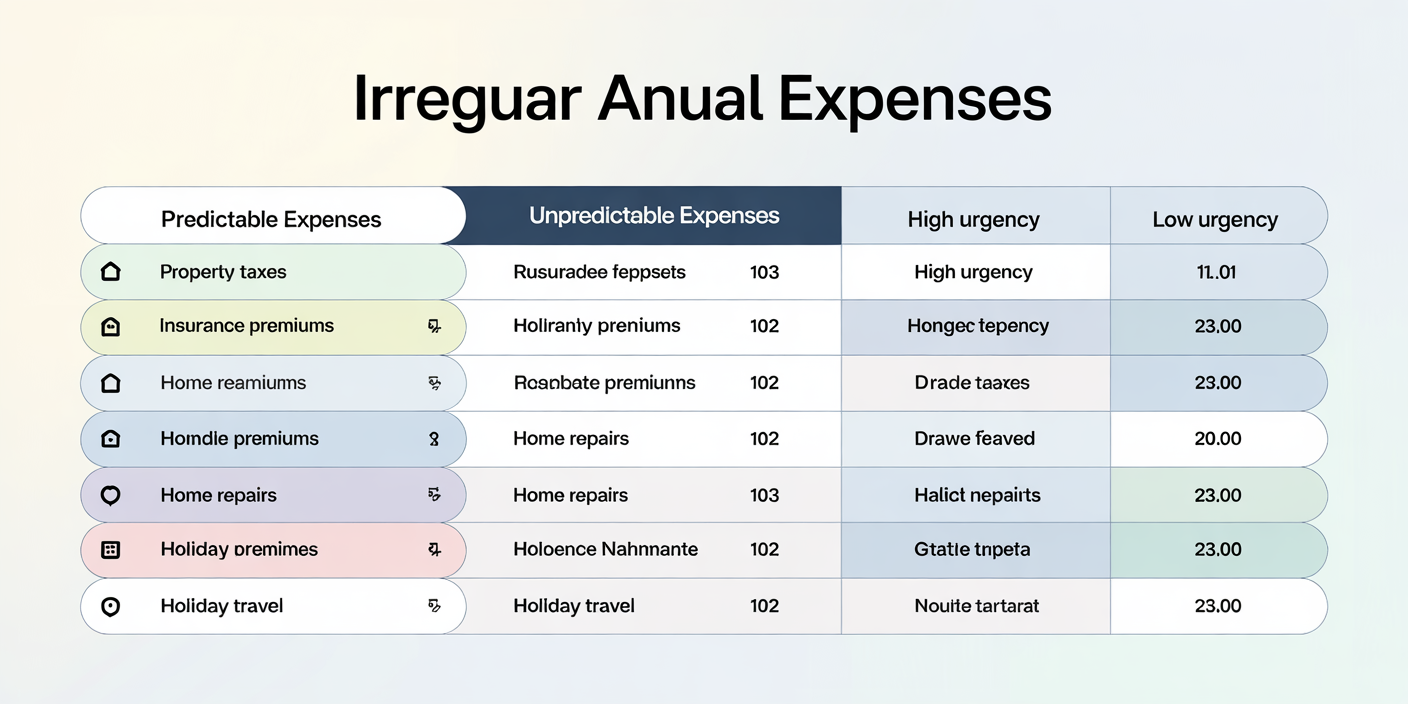

To effectively manage irregular annual expenses, categorization based on predictability, urgency, and magnitude is essential. This aids in prioritization and shaping saving strategies accordingly.

First, classify expenses into predictable vs. unpredictable. Predictable irregular expenses include annual insurance premiums, property taxes, or vehicle maintenance like tire replacement. These generally recur at known times and approximate amounts. Unpredictable irregular expenses might involve home appliance repairs or special medical treatments, where timing and amounts are uncertain.

Second, determine the urgency and consequence of not paying these expenses timely. For example, failing to pay property tax can lead to liens or foreclosure while delaying elective cosmetic procedures has less critical financial implications.

A comparative table below illustrates typical irregular annual expenses segmented by predictability and urgency:

| Expense Type | Predictability | Urgency | Example |

|---|---|---|---|

| Insurance Premiums | Predictable | High | Annual health or auto insurance |

| Property Taxes | Predictable | High | Annual local government taxes |

| Vehicle Registration Fees | Predictable | Medium | Renewals required yearly |

| Home Appliance Repair | Unpredictable | Medium to High | Unexpected refrigerator fix |

| Medical Deductibles/Procedures | Unpredictable | Varies | Non-emergency surgeries |

| Holiday Travel & Gifts | Predictable | Low | December holiday expenses |

This categorization allows households to allocate funds specifically rather than lumping all expenses under a general miscellaneous budget.

Creating an Irregular Expense Savings Fund

One of the most effective tactics to plan for irregular annual expenses is to establish a dedicated savings fund. This fund, often termed a “sinking fund,” involves setting aside money regularly, smoothing the financial impact of lump sum payments.

Start by estimating the total expected irregular expenses for the year. For example, if your property taxes amount to $2,400 annually, vehicle registration fees are $120, home maintenance averages around $1,000, and holiday spending is approximately $1,500, the total projection is $5,020.

Break this down monthly: $5,020 ÷ 12 months = around $418 per month.

By transferring this amount into a separate high-yield savings account every month, you build a buffer to meet these expenses as they come due. A real-life example comes from Jane, a 35-year-old professional who used this method. Previously, she struggled when paying her $1,800 property tax in one lump sum, often resorting to credit cards. After creating a sinking fund and contributing $150 monthly, she no longer experiences financial strain during tax season.

Automating these monthly transfers enhances discipline and reduces the temptation to spend these funds elsewhere. Besides smoothing out annual costs, this strategy benefits credit scores by preventing the use of emergency debt sources.

Budget Integration and Tracking Tools

Besides creating a sinking fund, integrating irregular expenses into monthly or yearly budgets ensures better forecasting and control. Many budgeting apps now offer features to allocate funds for irregular payments and track them separately.

For instance, tools like YNAB (You Need A Budget), Mint, or EveryDollar allow users to label an expense as ‘annual’ or ‘irregular’ and schedule reminders. This eliminates the problem of overlooking upcoming payments.

Tracking actual spending versus budgeted amounts offers valuable feedback. The U.S. Bureau of Labor Statistics reports that approximately 27% of households do not track irregular expenses, increasing the risk of financial surprises. By contrast, proactive trackers often reduce unplanned borrowing and increase savings rates by 15% or more.

An example: Michael, a self-employed consultant, uses YNAB to schedule an annual $1,200 estimate for professional license renewals and software subscriptions. By reviewing reports quarterly, he adjusted his monthly savings from $100 to $90 when the software subscription was replaced by a cheaper alternative, optimizing his budget.

Managing Unexpected Irregular Expenses

Despite the best efforts to plan, some irregular expenses are genuinely unforeseen and require an agile response. Emergency repairs like a sudden roof leak or unexpected medical bills can quickly derail finances.

Building an emergency fund distinct from sinking funds is crucial. Financial experts recommend saving at least three to six months’ worth of living expenses in a liquid account for such events. According to a 2022 survey by Bankrate, 39% of Americans cannot cover a $400 emergency without borrowing.

When an unexpected expense arises, it is critical to assess payment options: Short-term loans or credit cards: While convenient, these can lead to debt accumulation if not repaid promptly. Payment plans: Many service providers offer installment options. Insurance claims: If applicable, these can reduce out-of-pocket expenses. Delayed expenditure: Where possible, postponing non-critical expenses can relieve pressure.

Strategically, combining emergency funds with insurance protection and budgeting practices mitigates the financial impact.

Comparative Analysis of Saving Strategies

Households commonly use various methods to manage irregular expenses, including:

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Sinking Funds | Regular savings allocated for known irregulars | Predictable, reduces debt risk | Requires discipline |

| Emergency Funds | Savings reserved for unexpected expenses | Provides safety net | May not cover large planned irregulars |

| Credit Cards | Using credit for lump sums | Instant access | High-interest risk |

| Payment Plans | Installments with service providers | Spreads cost over time | Possible fees, credit checks |

| Irregular Expense Budgeting Apps | Digital tools for tracking and reminders | Enhances planning, real-time monitoring | Still requires manual input and discipline |

Among these, sinking funds coupled with budget apps are generally most effective for regular irregulars, while emergency funds play a crucial role when unpredictability is high.

Anticipating Future Trends in Irregular Expense Management

Looking forward, technology and financial products will continue evolving to address the challenges of irregular annual expenses. Artificial intelligence-driven personal finance tools are expected to provide hyper-personalized expense prediction and automated saving adjustments. Financial institutions may increasingly offer specialized accounts or “smart funds” that automatically debit based on anticipated irregular costs.

Additionally, the rise of subscription-based services could shift certain irregular expenses into predictable monthly fees, simplifying budgeting. However, the changing economic environment, such as inflation and evolving taxation policies, may increase the magnitude of irregular payments like property taxes or insurance premiums.

Given rising uncertainties in healthcare and housing markets, proactive planning equipped with intelligent tools will gain prominence. Financial advisors encourage incorporating scenario analysis to prepare for variable expense outcomes, further enhancing readiness.

Businesses are also exploring embedded finance solutions allowing consumers to finance irregular payments upfront but pay them over manageable installments seamlessly.

In summary, future strategies will likely blend automation, data analytics, and flexible financial products to create more resilient approaches to irregular expenses, reducing stress and improving cash flow management.

Deixe um comentário