Managing finances as a couple can be a complex yet rewarding experience. Financial harmony significantly contributes to a healthy relationship, and utilizing the right budgeting tools can be the key to achieving that balance. According to a 2023 survey by the National Endowment for Financial Education, 35% of couples reported money disagreements as a top stressor in their relationship. Therefore, adopting appropriate budgeting tools tailored for couples is not merely practical but essential for long-term financial wellness.

Budgeting tools designed for couples enable transparency, shared goal setting, and efficient tracking of expenses and savings. They provide practical solutions that accommodate differing income levels, spending habits, and financial priorities. This article explores some of the top budgeting tools for couples, highlighting their unique features, benefits, and suitability through real-life examples, analytical comparisons, and relevant data.

—

The Importance of Shared Budgeting for Couples

Financial compatibility is an often overlooked yet critical factor in relationship satisfaction. A study published in the Journal of Family and Economic Issues found that couples who regularly discuss their finances are 30% more likely to report higher relationship satisfaction. Shared budgeting fosters accountability and helps couples avoid misunderstandings related to money management.

Consider the case of Jenna and Mark, a married couple in their early 30s who struggled with managing shared expenses from their joint household and personal spending. Before using budgeting tools, they often faced issues regarding unplanned expenses and savings contributions. After adopting couple-friendly budgeting software with synchronized accounts, they could clearly outline budgets, categorize expenses, and track progress toward buying their first home together.

Budgeting as a unit also reflects the changing dynamics of modern relationships, including dual incomes, blended finances, and varying financial goals. Transparency is critical; it empowers each partner with insights into their joint financial health and paves the way for collaboration instead of conflict.

—

Top Budgeting Apps and Their Features

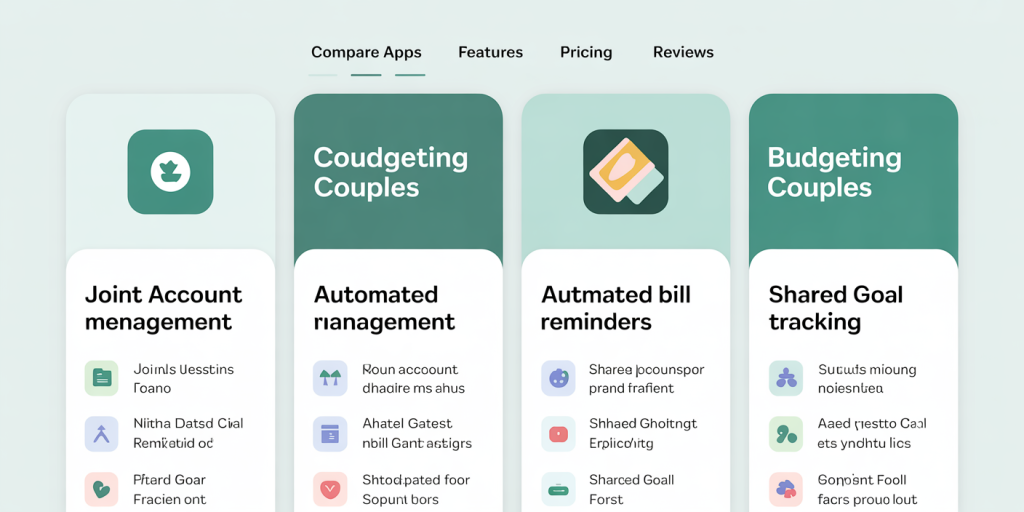

Selecting the right budgeting app often depends on ease of use, compatibility with financial institutions, and specifically, features tailored to couples. Below is an analysis of five leading budgeting tools well-suited for couples managing money together.

| Budgeting Tool | Key Features | Platform(s) | Cost | Couple-Specific Perks |

|---|---|---|---|---|

| Honeydue | Account aggregation, bill reminders, chat feature for transactions | iOS, Android | Free | Joint budgeting, instant messaging, currency conversion for international couples |

| YNAB (You Need A Budget) | Zero-based budgeting, goal tracking, debt payoff planner | Web, iOS, Android | $14.99/month or $99/year | Shared budget access, real-time sync, extensive educational resources |

| Goodbudget | Envelope budgeting method, debt tracking | Web, iOS, Android | Free & Paid Versions | Multiple device sync, envelope sharing, spending reporting |

| Zeta | Designed exclusively for couples, bill splitting, tracking joint & separate finances | iOS, Android | Free | Custom categories for joint and separate expenses, calendar view for bills |

| EveryDollar | Simple interface, Dave Ramsey methodology, goal tracking | Web, iOS, Android | Free & Paid Versions | Shared budgeting, debt elimination focus |

Honeydue’s standout feature is its social aspect; couples can chat within the app, discuss bills, and notify each other of upcoming expenses. Jenna and Mark, previously mentioned, found this feature highly useful for maintaining open communication about their finances.

Alternatively, YNAB’s structured zero-based budgeting approach forces every dollar to be “assigned” a job, reducing wasteful spending. Couples aiming for precise control and comprehensive financial education might find it especially valuable. Goodbudget’s envelope system appeals to partners who prefer a tangible, category-driven spending approach.

Zeta is rapidly gaining popularity among younger couples due to its flexibility in distinguishing joint and separate accounts—a real-world consideration for modern relationships featuring varying financial independence. EveryDollar advocates for stewardship in line with Dave Ramsey’s philosophy, focusing on eliminating debt and saving systematically.

—

Comparing the Effectiveness of Budgeting Tools Through Data

Effectiveness of budgeting apps can be measured by user retention, financial outcomes, and satisfaction surveys. According to a 2024 Consumer Financial Protection Bureau report, couples using dedicated budgeting apps saved, on average, 18% more toward joint goals compared to those managing finances without digital tools.

The table below compares app-specific performance metrics from recent user data:

| Budgeting Tool | Average Monthly Savings Increase | User Satisfaction Rating (out of 5) | Recommended For |

|---|---|---|---|

| Honeydue | 15% | 4.3 | Couples needing communication tools |

| YNAB | 25% | 4.7 | Budgeting enthusiasts, goal-driven |

| Goodbudget | 12% | 4.1 | Envelope budgeting advocates |

| Zeta | 17% | 4.4 | Couples with combined and separate finances |

| EveryDollar | 20% | 4.5 | Debt reduction focused couples |

These statistics emphasize that while all these apps improve budgeting outcomes, the best choice depends on a couple’s financial style and goals. For example, YNAB leads in increasing savings but requires more user commitment and learning. Honeydue appeals to couples prioritizing smooth communication and joint transparency.

—

Practical Tips for Using Budgeting Tools Effectively as a Couple

While the right app is foundational, maximizing its benefits requires strategic use. First, both partners must commit to regular budgeting sessions—typically weekly or biweekly. This practice ensures syncing of finances, adjustment of budget lines, and open dialogue about unexpected expenses.

Take the example of Sofia and Mark, a couple managing two jobs with different pay schedules. They scheduled Sunday evenings as their budgeting time using Zeta for bill tracking and separation of personal vs. joint expenses. Their deliberate routine drastically reduced missed payments and fostered mutual trust.

Secondly, setting clear financial goals is critical. Whether saving for a vacation, home purchase, or emergency fund, couples should align on priorities within the app. Tools like YNAB provide goal-setting modules, allowing tracking of month-by-month progress. This transparency encourages both partners to stay motivated and accountable.

Another valuable tip is to incorporate periodic financial reviews, perhaps quarterly, to reassess budgets, categorize new expenses, and recalibrate goals. This habit responds dynamically to life changes such as employment shifts or new family members.

—

Addressing Common Challenges Couples Face in Budgeting

Despite helpful tools, couples may encounter challenges while managing money collaboratively. Conflict often arises from differences in spending habits or lack of financial literacy. According to a 2023 study by the American Psychological Association, 45% of couples cite money disputes as a leading cause of tension, indicating a strong need for structured budgeting frameworks.

One common obstacle is uneven contribution to joint expenses. For instance, if one partner earns significantly more, they may feel overburdened or may unconsciously allow the other less say in budget decisions. Apps like Zeta and Honeydue facilitate transparency by allowing flexible allocation of expenses and income percentages, fostering equity.

Another challenge is the emotional aspect tied to money. Spending behavior is often influenced by personal history and stress. Couples need to use budgeting tools not just to track dollars but also as opportunities to communicate openly. Features such as transaction comments or in-app messaging can open dialogue channels.

Moreover, privacy concerns regarding shared financial information can arise. Choosing apps with robust security protocols and agreeing on boundaries around shared visibility of accounts contribute to building trust.

—

Emerging Trends in Couples’ Budgeting Technology

The future of budgeting tools for couples looks promising, driven by artificial intelligence (AI), machine learning, and integration with wider financial ecosystems. AI-powered financial advisors are becoming more accessible within apps, providing personalized advice on spending reduction and investment opportunities based on couple behaviors.

Additionally, blockchain technology offers potential for enhanced security and transparency in joint financial management. Smart contracts could automate bill payments and savings transfers, reducing manual input and potential conflicts.

Integration with other life management tools—such as calendar apps, health trackers, and even relationship coaching platforms—might further customize budgeting experiences tailored to couples’ lifestyles.

Furthermore, the rise of global remote couples challenges traditional budgeting boundaries. Apps incorporating real-time currency conversions and international banking capacities, like Honeydue, will become increasingly essential.

Finally, as financial wellness is now recognized as integral to mental health, future tools are likely to embed emotional health check-ins, providing holistic support for couples beyond mere dollar tracking.

—

Effective money management for couples is both a practical necessity and a pathway to relational harmony. The right budgeting tools can transform potentially stressful financial discussions into collaborative planning sessions, helping couples achieve shared goals with transparency and trust. By choosing tools that align with their unique needs and committing to open communication, couples can navigate the often-complex world of joint finances with confidence and success.

Deixe um comentário