Creating a financial vision board is an empowering step toward achieving financial goals. It acts as a visual representation of one’s aspirations, from saving for a home to planning retirement or building an investment portfolio. Traditionally, vision boards are physical collages of images and affirmations. However, in the digital age, a financial vision board can be built online, offering more flexibility, interactivity, and accessibility. This article explores various tools that enable users to create personalized, inspiring financial vision boards digitally, complete with practical examples, comparisons, and informed insights.

The Power of a Financial Vision Board in Achieving Goals

A financial vision board is more than just decoration; it serves as a motivational tool. Research by Dominican University (2015) found that individuals who explicitly write down goals and share progress are 42% more likely to achieve them. A vision board, by extension, helps solidify those goals visually, making them concrete and accessible daily.

For example, consider Sarah, a 30-year-old marketing professional who wanted to save $50,000 for a down payment on a house within three years. By creating a digital vision board filled with images of the dream house, key saving milestones, and inspirational quotes, she stayed focused and increased her savings rate by 15% within six months. This demonstrates how visualization tools can influence financial behaviors positively.

Key Features to Look for in Digital Vision Board Tools

Choosing the right tool depends on personal preferences and the desired level of sophistication. Generally, effective financial vision board applications share key features: Customizability: Users should tailor layouts, colors, and fonts, integrating personal financial goals and motivational elements. Ease of Use: Intuitive interfaces minimize the learning curve, allowing users to focus on goal visualization. Multimedia Integration: Incorporating images, videos, text, and links enhances engagement and clarity. Accessibility: Cloud-based options facilitate access across devices, ensuring users can revisit and modify their boards anytime. Collaboration: Some tools offer sharing or collaborative features, useful for couples or financial advisors working with clients.

Before selecting a platform, users should assess their comfort with technology, the complexity of their financial goals, and desired visual elements.

Popular Digital Tools for Creating Financial Vision Boards

Several digital tools stand out for creating financial vision boards, from general design platforms to vision-board-specific apps. Below is an overview of some notable options:

Canva

Canva is a widely-used graphic design tool suitable for vision boards due to its drag-and-drop interface and extensive template library. Users can import pictures, add text overlays, and select from thousands of free and premium graphics.

Use Case: John, who dreams of early retirement by 50, uses Canva’s finance-themed templates to place images of his goal date, desired passive income streams, and inspirational quotes from successful entrepreneurs. He updates his board quarterly to reflect progress and new aspirations.

Trello

While primarily a project management tool, Trello can be adapted to create dynamic vision boards using cards and boards. Each card can represent a goal, with attached images, due dates, checklists, and comments.

Use Case: Emily, aiming to eliminate $30,000 in student debt, creates Trello cards for monthly payment milestones. She attaches motivational images and tracks progress with checklists, turning her vision board into an actionable financial plan.

Pinterest offers a visually-rich platform where users create “boards” by pinning images, articles, and quotes. While less customizable in layout, it excels in content discovery and serves as an inspiration repository.

Use Case: Alex, seeking to build wealth through investing, curates a Pinterest board featuring infographics about compound interest, screenshots of his brokerage account growth, and motivational sayings, creating a steady reminder of his goals.

Milanote

Milanote caters to creatives who want flexible, customizable mood and vision boards. It supports multimedia content, notes, links, and drag-and-drop arrangement on infinite canvas.

Use Case: Grace, managing complex financial goals including savings, investments, and side-business revenue, uses Milanote to create interconnected vision boards showing these projects’ timelines and objectives. The visual coherence helps her stay organized and inspired.

Vision Board Apps: DreamItAlive and Hay House

Dedicated vision board apps such as DreamItAlive and Hay House provide specialized features tailored for goal setting, visualization, and affirmations, including daily reminders and community sharing.

Use Case: Mark uses DreamItAlive because it integrates goal tracking with visualization, sending him push notifications to reflect on his financial progress, thus keeping momentum high.

Comparative Analysis of Top Tools

| Feature | Canva | Trello | Milanote | DreamItAlive | |

|---|---|---|---|---|---|

| Customizability | High | Medium | Low | Very High | Medium |

| Ease of Use | High | Medium | High | Medium | High |

| Multimedia Support | Images, Video | Images, Links | Images, Links | Images, Video | Images, Wishes |

| Accessibility | Web, Mobile | Web, Mobile | Web, Mobile | Web | Web, Mobile |

| Collaboration | Yes | Yes | No | Yes | Yes |

| Cost | Free + Premium | Free | Free | Free + Premium | Free + Premium |

This comparative table helps users select the best tool fitting their needs. Canva and Milanote offer robust customization suited for detailed boards. Trello appeals to those wanting goal tracking plus visualization. Pinterest suits casual, inspiration-focused users. Dedicated apps like DreamItAlive provide motivation but with limited design flexibility.

Practical Tips for Crafting an Effective Digital Financial Vision Board

1. Define Clear Financial Goals: Use SMART criteria—Specific, Measurable, Achievable, Relevant, Time-bound—to pinpoint targets. For example, “Save $10,000 for an emergency fund by December 2024” is specific and measurable.

2. Gather Motivational Visuals: Find images symbolizing your goals—luxury cars, vacation spots, or charts reflecting debt-free status. Free sites like Unsplash provide high-quality visuals.

3. Incorporate Affirmations: Combine positive financial affirmations such as “I am a disciplined saver” to reinforce mindset shifts.

4. Use Progress Indicators: In platforms like Trello or Milanote, adding checklists or deadlines transforms the board into an actionable plan.

5. Regularly Update and Reflect: Revisiting and modifying the board every month ensures relevance and maintains enthusiasm.

6. Share with Accountability Partners: Collaborating with a partner or coach can provide motivation and external accountability.

Financial therapist Paula Pant emphasizes that visualization combined with consistent behavioral adjustments leads to superior financial outcomes, underscoring the importance of interactive and evolving vision boards.

Leveraging Data and Statistics in Vision Boards

Including financial data and statistics on your vision board clarifies objectives and tracks progress. For instance, embedding charts showing compound interest growth can illustrate the impact of regular investing. Using spreadsheets or data visualization tools and embedding snapshots into the vision board bridges inspirational imagery with factual performance.

Data from Fidelity Investments indicates that individuals who automate savings and investments grow wealth 20% faster than those who don’t. Visual reminders about automation strategies on your vision board can promote such habits effectively.

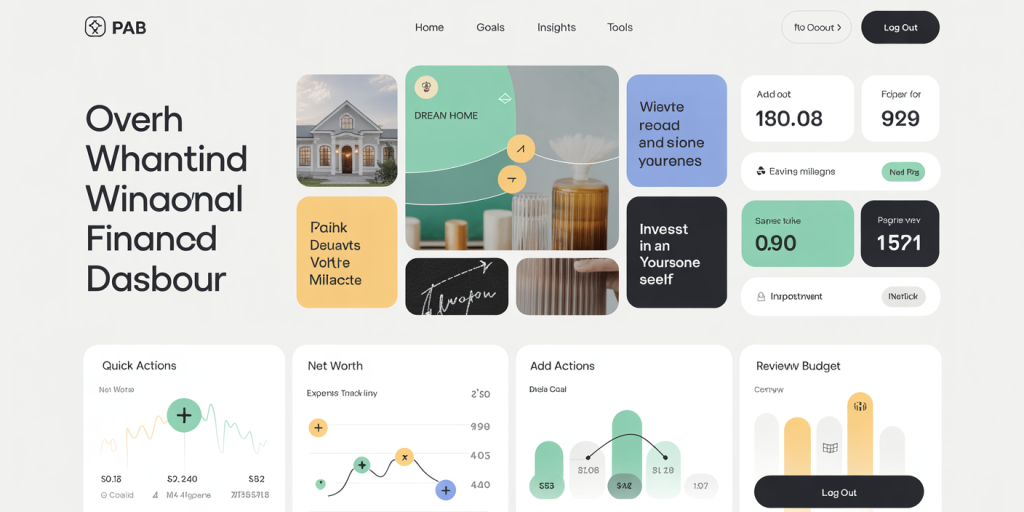

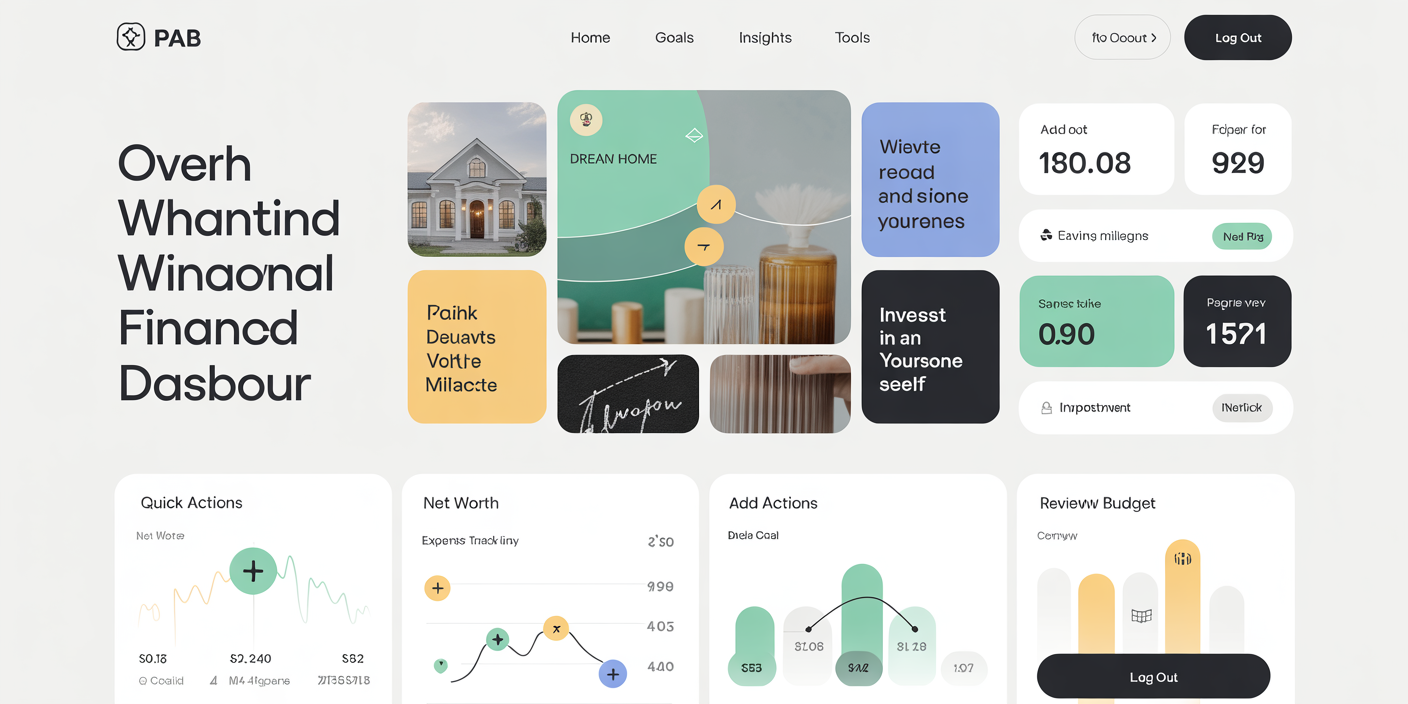

Future Perspectives: The Evolution of Digital Financial Vision Boards

The landscape of digital vision boards continues evolving with technological innovations: Artificial Intelligence Integration: AI-driven tools could generate personalized financial vision boards based on user spending habits, goals, and risk tolerance, providing dynamically tailored content. Augmented Reality (AR) and Virtual Reality (VR): Emerging AR/VR applications will allow immersive visualization experiences. Imagine walking through a virtual house you plan to buy or simulating your retirement lifestyle in VR. Enhanced Community Features: Future platforms might emphasize social accountability through shared boards, group challenges, and live financial coaching. Integration with Financial Management Apps: Seamless syncing of vision boards with budgeting, investment, and credit tracking apps could enable real-time progress measurement, making vision boards interactive financial dashboards. Gamification Elements: Adding rewards, badges, and game-like progress features will boost user engagement, making financial goal-setting a more enjoyable experience.

An example of forward-thinking is the app “VisionaryMoney” (hypothetical), which blends AI recommendations with mood-based adjustment features, empowering users to adapt their financial vision board as circumstances change dynamically.

As digital tools mature, they will increasingly blend motivational and practical functionalities, further empowering individuals to achieve lasting financial success.

Deixe um comentário