In today’s fast-paced world, managing personal finances and self-improvement goals can be challenging, especially without proper tools. Free printable trackers offer a practical, tangible way to organize and monitor progress for debt repayment, savings accumulation, and habit formation. These trackers serve as visual reminders and motivational aids, fostering a sense of accountability and achievement. With digital distractions on the rise, many individuals find that physical printouts enhance focus and deliver clearer progress insights.

By adopting free printable trackers tailored for debt, savings, and habits, users can optimize their financial and personal growth efforts. This article delves into the advantages of using printable trackers, provides concrete examples, compares different types of trackers, and highlights practical ways to integrate them into everyday life.

The Importance of Tracking: Why Printable Trackers Work Better Than Apps

Financial statistics reveal that approximately 60% of Americans do not have a budget, and nearly 40% live paycheck to paycheck (Federal Reserve, 2023). Whether managing debt or savings, the ability to visualize progress is critical. While digital apps offer convenience, many users struggle with engagement and consistency, often abandoning the platforms after a few weeks.

Printable trackers, in contrast, provide tactile interaction that can enhance commitment and mindfulness. Physical checklists or charts positioned in prominent spaces, such as refrigerators or work desks, create constant visual cues. According to a study by the University of Toronto (2017), people who physically write down goals are 42% more likely to achieve them compared to those who don’t.

Moreover, printables require no Wi-Fi or device dependency, making them reliable in any environment. With free, easily downloadable templates available, individuals can customize trackers to their specific circumstances without investing in costly software or subscriptions.

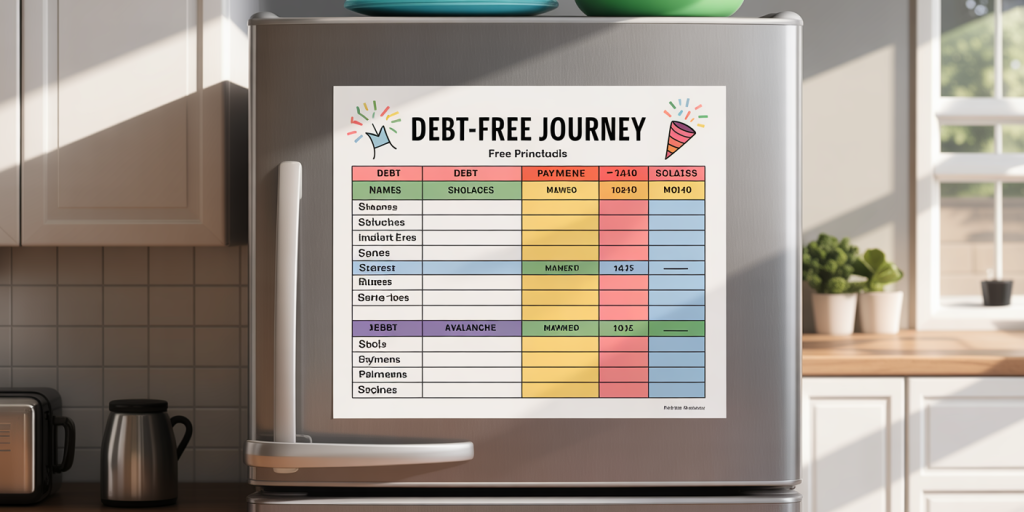

Debt Trackers: Mapping the Journey to Financial Freedom

Debt repayment can feel overwhelming without a clear roadmap. Free printable debt trackers offer a structured way to track multiple loans, credit cards, or other liabilities in one place. Popular formats include snowball trackers (pay shortest debts first) and avalanche trackers (pay highest interest first).

For example, Maria, a 32-year-old teacher, used a printable debt snowball tracker to repay $15,000 of credit card and student loan debt over 18 months. By visually shading repayments and marking milestones, she stayed motivated and adjusted payments proactively. Users list debt balances, interest rates, monthly payments, and track the reduction progress visually.

Below is a comparative table outlining features of common printable debt trackers:

| Tracker Type | Focus | Best For | Visual Features | User Complexity |

|---|---|---|---|---|

| Snowball Tracker | Paying smallest debts first | Motivation through quick wins | Debt boxes to color/shade | Beginner-friendly |

| Avalanche Tracker | Paying highest interest first | Minimizing interest costs | Bar graphs and progress lines | Intermediate |

| Amortization Chart | Payment schedule and interest | Detailed loan breakdown | Monthly payment rows | Advanced |

Using these printables can reduce the stress of debt management by turning financial obligations into measurable steps. Transparent progress also encourages better financial habits like avoiding new debt and increasing monthly payments when possible.

Savings Trackers: Visualizing the Path to Financial Goals

Saving money often feels intangible until a goal is reached. Printable savings trackers bridge this visualization gap by transforming savings into something achievable and fun. Common types include goal thermometers, envelope trackers, and calendar-based savings logs.

For example, John, a 45-year-old freelancer, set a goal of saving $10,000 for an emergency fund using a printable thermometer tracker. Each time he deposited money, he colored the corresponding section of the thermometer. The visual appeal helped him prioritize saving during months of irregular income and celebrate small wins.

Data from the National Foundation for Credit Counseling (2023) shows that 69% of Americans without emergency savings cite lack of planning as a major factor. Using printable savings trackers can counter this by promoting disciplined, incremental saving habits.

Here is a comparison of popular savings tracker types:

| Tracker Type | Goal Visualization | Ideal Uses | Customization Options | User Engagement |

|---|---|---|---|---|

| Thermometer Tracker | Percentage of goal completed | Specific financial goals | Color-coded sections | High |

| Envelope Tracker | Budget allocation | Monthly expense management | Multiple savings categories | Moderate |

| Calendar Tracker | Daily or weekly savings log | Habit building for saving | Space for notes & reminders | High |

Printable savings trackers are also useful tools for families teaching children about money management, as they allow visual and interactive learning.

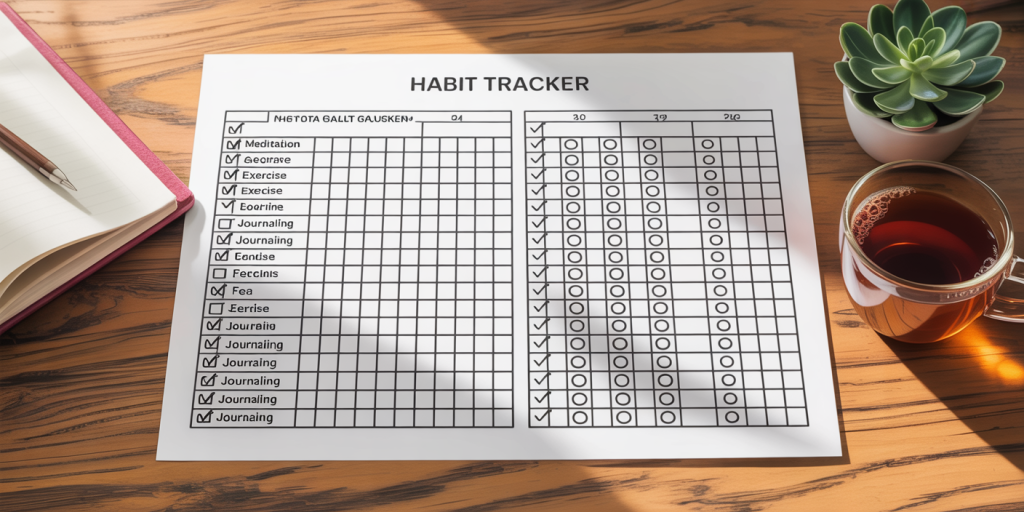

Habit Trackers: Building Consistency for Lasting Change

Forming new habits or breaking old ones requires consistent effort over time. Printable habit trackers simplify this process by providing checkboxes or grids to mark daily successes or failures. The key advantage is the creation of a tangible streak that users strive to maintain.

Behavioral science research (Lally et al., 2010) indicates that it takes an average of 66 days to form a new habit. By tracking daily adherence on a printable sheet, individuals can better maintain motivation and identify patterns or obstacles.

A practical example is Sarah, an entrepreneur who used a habit tracker to develop a morning routine including meditation, exercise, and journaling. By marking each completed activity daily on her printable sheet, she increased her routine consistency from 30% to 85% within three months.

Common habit tracker formats include grids, chain trackers, and weekly focus sheets:

| Tracker Style | Tracking Method | Suitable Habits | Visual Feedback | Flexibility |

|---|---|---|---|---|

| Grid Tracker | Daily checkbox/clink | Multiple habits, daily goals | Clear visual chains | High |

| Chain Tracker | Linking successful days | Single habit, streak building | Emphasizes continuity | Moderate |

| Weekly Focus Sheets | Weekly goal assessment | Complex or varied habits | Allows reflection & resets | High |

Printable trackers complement digital habit apps by minimizing distractions and improving the physical act of goal monitoring, which enhances cognitive engagement.

Integrating Trackers into Daily Life: Best Practices and Tips

Adding printable trackers into daily routines involves more than just downloading and printing sheets. Placement and visibility are crucial for consistent use. Experts recommend positioning trackers in frequently visited areas such as bedroom walls, kitchen fridges, or work desks. This creates natural reminders without needing extra mental effort.

Pairing trackers with rewards also helps maintain motivation. For example, reaching a savings milestone could trigger a small treat or experience reward. Clear milestones—such as paying off one credit card or hitting 25% savings goal—enable users to celebrate incremental achievements and avoid burnout.

Practical advice from financial coaches includes setting realistic, measurable goals, updating trackers promptly after transactions or habits, and reviewing progress weekly to adjust strategies. For instance, if debt repayment is slower than planned, a tracker highlighted with notes can guide reallocating budgets or seeking additional income sources.

Engagement can also improve by involving accountability partners. Sharing printable trackers with a spouse or friend fosters supportive encouragement, while participation in community challenges offers social reinforcement.

Future Perspectives: The Evolving Role of Printable Trackers

While digital solutions dominate personal productivity and finance management, printable trackers remain relevant due to their simplicity, accessibility, and psychological benefits. Emerging research on hybrid tracking systems combines physical printables with digital apps via QR codes or companion apps, enhancing flexibility.

The rise of personalized finance management tools opens avenues for customizable printable trackers designed with user data, integrating AI-suggested goals or improvements. Environmental considerations are also driving innovations in printable materials—such as recyclable or seed paper—that align with broader lifestyle values.

On a societal level, free printable trackers have the potential to bridge digital divides by offering cost-effective, offline solutions. According to Pew Research Center (2023), about 25% of low-income individuals lack reliable smartphone or internet access, limiting their usage of digital applications.

In the future, printable trackers may increasingly feature collaborative formats for families, workplaces, and educational institutions, fostering collective financial literacy and habit development.

Ultimately, the endurance of printable trackers lies in their unique capacity to connect behavioral psychology, financial management, and daily life in a straightforward, user-friendly manner. Their evolving designs and integrations will support ongoing personal and collective growth in a complex, rapidly changing world.

Deixe um comentário