The FIRE movement, an acronym for Financial Independence, Retire Early, has gained tremendous popularity among individuals seeking to reclaim control over their time and finances. At its core, FIRE focuses on aggressive saving and investing strategies designed to achieve enough wealth to cover living expenses indefinitely, allowing early exit from traditional employment. This article explores the essential investment approaches, strategies, and tools to attain FIRE, supported by practical examples and comparative insights to streamline your path to financial freedom.

Understanding FIRE: The Financial Framework

FIRE is not merely about quitting your job early; it encompasses a disciplined approach towards generating sustainable passive income. The philosophy revolves around saving and investing around 50% or more of one’s income to accumulate a portfolio sizable enough to sustain lifestyle expenses, commonly measured by the 4% safe withdrawal rate rule. This rule suggests that retirees can withdraw 4% of their investment portfolio annually without depleting their principal, ensuring longevity of funds.

For example, if your annual expenses amount to $40,000, achieving a FIRE number of $1,000,000 ($40,000 ÷ 0.04) becomes the primary objective. This sum is the corpus you need to accumulate for financial independence. Many FIRE adherents achieve this by combining high savings rates, frugal living, and long-term investing through tax-advantaged accounts and diversified portfolios.

According to a 2023 report by Fidelity Investments, early retirees often aim for portfolio values between $1 million to $3 million depending on their desired lifestyle, indicating the importance of scale and personal expense management.

Selecting the Right Investment Vehicles for FIRE

Investing is the cornerstone of the FIRE strategy, but the choice of vehicles significantly impacts growth potential and risk management. The optimal approach balances equities, bonds, real estate, and tax-efficiency.

Stock Market Investments

Equities offer the highest potential for growth and compound returns over long periods, critical for early accumulation of wealth. Historically, the U.S. stock market has returned an average of 7% after inflation per year (Morningstar data, 1928-2022). FIRE followers often favor low-cost index funds like the S&P 500 or total market funds as a core investment, maximizing market exposure while minimizing fees.

For instance, consider two investors both investing $20,000 annually. If Investor A chooses a low-cost S&P 500 index fund averaging 7% returns, and Investor B picks a high-fee actively managed fund averaging 5%, after 20 years, Investor A could accumulate approximately $917,000, while Investor B might reach only about $672,000—a significant difference driven largely by cost and returns.

Bonds and Fixed-Income Assets

Bonds provide portfolio stability and reduce volatility. Especially for those closer to their target FIRE date, shifting some assets from equities to bonds helps preserve capital and reduce drawdown risk. A common FIRE portfolio might shift from an 80% equity-20% bond split during accumulation phases to a more conservative 60%-40% or even 50%-50% in the withdrawal phase.

Real Estate Investments

Real estate is a powerful asset class in FIRE investing due to its potential for passive rental income and appreciation. Many early retirees acquire rental properties as part of their portfolio to generate consistent cash flow. Real estate investment trusts (REITs) provide an accessible alternative for diversification without requiring direct property management.

Tax-Advantaged Accounts

Maximizing contributions to 401(k)s, IRAs, and HSAs can improve capital efficiency by reducing taxes. For example, a Roth IRA grows tax-free, making it valuable for early retirees who will depend on investment withdrawals. Strategic use of these accounts minimizes tax drag, preserving more capital towards reaching FIRE.

| Investment Vehicle | Average Return (Annualized) | Risk Level | Tax Efficiency | Typical Role in FIRE Portfolio |

|---|---|---|---|---|

| S&P 500 Index Funds | ~7% (after inflation) | High | Moderate | Growth engine during accumulation |

| Bonds (Government & Corporate) | ~3-4% | Low to Medium | Moderate | Capital preservation, income generation |

| Real Estate / REITs | ~6-8% | Medium | Varies | Income generation, inflation hedge |

| Tax-Advantaged Accounts | Depends on holdings | Depends on assets | High | Tax efficiency, accelerates growth |

Building a Sustainable FIRE Investment Portfolio

Diversification and risk management are key in FIRE investing to mitigate the risks of market downturns, inflation, and lifestyle changes. A balanced portfolio aligns with the target retirement date and risk tolerance.

The 4% Rule and Withdrawal Strategies

The 4% withdrawal rule implies a $25 withdrawal for every $1,000 invested annually. This has been conventional wisdom but is subject to debate given market conditions and life expectancy changes. Many FIRE advocates adjust this rule down to 3.5% or develop “bucket strategies” that allocate assets between short-term cash reserves and longer-term growth portfolios.

Consider the case of Mr. Johnson, an early retiree who retired at age 45 with a $1.5 million portfolio. Applying a conservative 3.5% withdrawal rate, he can safely withdraw $52,500 annually. To mitigate sequence-of-returns risk, he maintains two years of living expenses in a liquid account while the remainder stays invested.

Dollar-Cost Averaging and Lump-Sum Investing

For early retirees, timing asset allocation shifts is vital. Dollar-cost averaging (investing fixed sums regularly) minimizes risk entering volatile markets, while lump-sum investing optimizes growth when capital availability allows. Many FIRE achievers initially grow wealth via dollar-cost averaging but roll into bonds and cash through lumpsum moves approaching FIRE.

Case Studies of Successful FIRE Investors

Case 1: The Frugal Engineer

Jessica, 35, accumulated $750,000 within 10 years by living well below her means and investing 60% of her $80,000 salary primarily in broad market ETFs. Her investment approach emphasizes low fees, tax optimization through a Roth IRA and 401(k), and reinvesting dividends. She plans to retire by 45 with an expected portfolio value exceeding $1.5 million considering continued passive growth.

Jessica’s disciplined mindset highlights the effectiveness of consistently high savings rates paired with diversified equity investments for accelerating wealth.

Case 2: Real Estate as a FIRE Lever

Mark and Linda, a couple in their early 40s, pursued a FIRE path focusing on rental properties. Starting with two duplexes generating $3,000 monthly net income on combined expenses of $4,000, they gradually expanded holdings using financing and reinvestment. Their real estate produces cash flow, which complements their equity investments.

Their portfolio mitigates inflation impacts as rental income tends to rise, and diversification from stocks offers additional growth. It showcases the advantage of hybrid investment strategies in FIRE.

Managing Risks and Market Volatility on Your Path to FIRE

Market volatility poses the biggest threat to early retirees relying on investment portfolios. The 2008 financial crisis, for example, reduced average portfolios by 30-40%, endangering withdrawal sustainability.

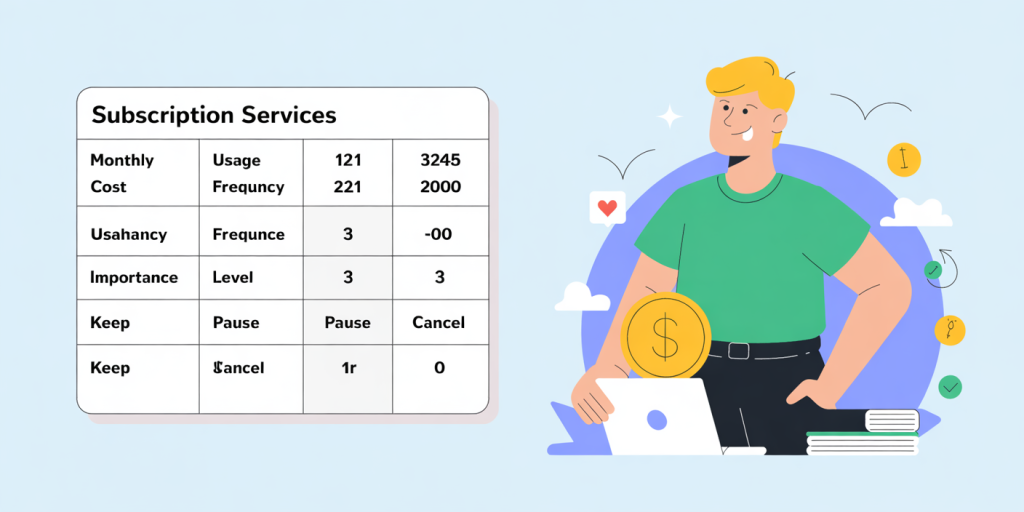

Importance of Emergency Funds and Cash Buffers

Maintaining liquidity equivalent to 12-24 months of expenses is advised. These funds prevent forced asset sales during downturns, protecting long-term capital and psychological well-being.

Adjusting Lifestyle Flexibility

FIRE proponents advocate for dynamic withdrawal strategies: reducing spending during down markets, increasing savings during up years, or even returning to part-time work if necessary. Flexibility improves sustainability, reducing portfolio longevity risk.

Future Perspectives: Investing for FIRE in an Evolving Economic Landscape

The financial world is continually evolving due to technological innovation, economic cycles, and changing tax legislations which influence FIRE strategies.

Impact of Inflation and Interest Rates

In 2023-2024, inflation surged to over 6%, a level unseen in decades, reducing purchasing power and forcing investors to reconsider asset allocations. Inflation-protected securities like TIPS, real estate, and equities with pricing power become increasingly crucial for preserving FIRE portfolios.

Interest rate hikes influence bond returns and borrowing costs, affecting mortgage-backed real estate investments and bonds yields. FIRE investors need to remain adaptable, incorporating macroeconomic trends in their allocation models.

Increasing Accessibility to Alternative Investments

New platforms democratizing access to private equity, cryptocurrencies, and peer-to-peer lending offer higher returns but also increased risks. FIRE seekers must evaluate these options carefully, diversifying without overexposure.

Digital Tools and Robo-Advisors

Technology-driven investing through robo-advisors allows automated, low-cost portfolio management tailored to FIRE goals. These platforms enable sophisticated risk assessment, rebalancing, and tax-loss harvesting that were previously accessible mostly to high-net-worth individuals.

Environmental, Social, and Governance (ESG) Investing

ESG investing aligns financial goals with ethical considerations. FIRE investors increasingly adopt ESG funds to support sustainable businesses, reflecting a cultural shift in investment choices while maintaining financial returns.