Burnout is increasingly recognized as a significant occupational hazard in today’s fast-paced work environment. According to a 2023 Gallup study, over 50% of employees reported feeling burned out at their current jobs “very often” or “always.” Burnout, characterized by chronic physical and emotional exhaustion, cynicism, and reduced professional efficacy, can severely impact both personal well-being and organizational productivity. However, quitting your job is not the only solution. There exist multiple effective strategies to combat burnout while remaining in your current role. This article explores practical ways to handle burnout without quitting, backed by data, real-life examples, and actionable guidance.

Understanding Burnout: More Than Just Stress

Burnout is often confused with general job stress, but it is a more profound and chronic state. The World Health Organization (WHO) classifies burnout as an occupational phenomenon stemming from prolonged unmanaged workplace stress. Unlike typical stress, which tends to be acute and sometimes motivating, burnout is persistent and debilitating.

Consider the case of Sarah, a project manager at a marketing firm. Initially enthusiastic about her role, Sarah found herself feeling emotionally drained and increasingly detached after months of tight deadlines and unrealistic expectations. Her performance suffered but quitting wasn’t an immediate option due to financial commitments. Recognizing burnout helped her take proactive steps instead of resigning.

Understanding burnout’s nuances is crucial because it sets the stage for targeted interventions. It also helps employers recognize warning signs early to foster better workplace health policies.

Identifying the Warning Signs and Triggers

Early identification of burnout symptoms can prevent long-term consequences. Common signs include constant fatigue, irritability, difficulty concentrating, and feelings of inefficacy. Physical symptoms, such as headaches or insomnia, are frequent as well.

A 2022 survey by the American Psychological Association found that 79% of employees experiencing burnout reported decreased job satisfaction, and 67% experienced conflicts at work. By tracking such signs, individuals can seek corrective measures before burnout deepens.

Recognizing triggers is just as important. Triggers might include excessive workload, lack of control, unclear job expectations, or poor workplace relationships. For example, Tom, a software developer, noticed that most of his stress stemmed from poor communication and frequent scope changes in projects. By pinpointing these triggers, he was able to discuss adjustments with his manager.

Practical Strategies to Manage Burnout While Staying at Work

Handling burnout effectively requires a proactive approach combining personal habits and workplace adjustments. One reliable method is implementing regular breaks during work hours. Studies from the Draugiem Group showed employees who took short breaks every 52 minutes increased productivity by 30% and suffered less mental fatigue.

Incorporating mindfulness and relaxation techniques has also shown measurable benefits. Mindfulness exercises reduce cortisol levels—the body’s stress hormone—by up to 30%, according to a 2021 meta-analysis published in the Journal of Occupational Health Psychology. Simple practices like deep breathing or short meditation sessions can be easily included in a busy schedule.

Adjusting workload and expectations is another key component. Employees should engage in open communication with supervisors to negotiate reasonable deadlines or redistribute tasks. This requires building a culture of transparency and trust within teams.

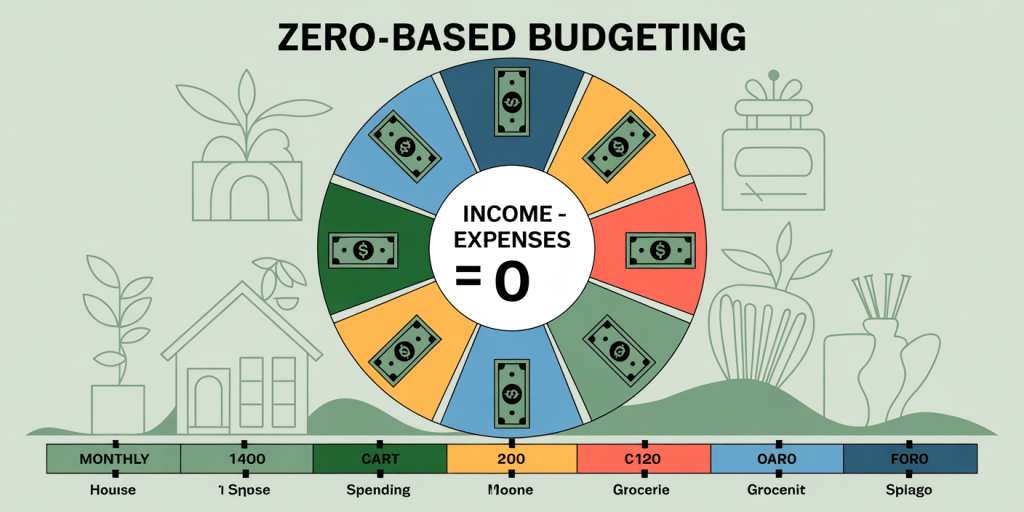

Consider the following table comparing common burnout management techniques for effectiveness, feasibility, and impact:

| Strategy | Effectiveness | Feasibility | Impact on Burnout Reduction |

|---|---|---|---|

| Regular Breaks | High | High | Significant |

| Mindfulness Practices | Moderate | High | Moderate to High |

| Workload Adjustment | High | Moderate | Significant |

| Social Support Seeking | Moderate | Moderate | Moderate |

| Physical Exercise | High | Moderate | Significant |

Real-life application matters. Brittany, an account executive, found that combining short walks during lunchtime with open dialogue about workload helped her regain enthusiasm without quitting.

Building a Support System at Work and Beyond

Burnout can be isolating, but it doesn’t have to be. Social support is a critical buffer against occupational stress. Colleagues, supervisors, friends, and family each play unique roles in offering emotional and practical assistance.

Workplaces promoting peer support and mentorship programs help employees create bonds that reduce feelings of loneliness and alienation. For instance, a 2023 LinkedIn survey revealed that 70% of employees with strong workplace friendships reported low burnout symptoms compared to 40% without such connections.

Outside work, friends and family provide emotional stability and encourage healthy lifestyle habits. Tom, the developer mentioned earlier, joined a local running club and reconnected with old friends, which improved his mental state significantly.

Developing this network requires vulnerability and communication skills but pays off with increased resilience. Joining support groups or professional counseling can further reinforce coping strategies.

Enhancing Work-Life Balance to Sustain Energy and Motivation

Achieving a sustainable work-life balance is fundamental to managing burnout. Overworking without sufficient downtime leads to mental fatigue and diminished motivation over time.

Setting boundaries is a practical starting point. Avoiding after-hours emails and dedicating time to hobbies or family strengthens individuality and prevents emotional exhaustion. A 2022 OECD report noted that countries with higher work-life balance ratings had 25% lower burnout rates among employees.

Prioritization also helps. Learning to say no to non-essential tasks or delegating work can lighten one’s mental load. Rachel, a senior analyst, shared that implementing “no meeting Fridays” at her company allowed her uninterrupted focus time, reducing stress significantly.

Technology can help maintain this balance through calendar management apps or email automation but should not add layers of complexity.

Future Perspectives: The Evolving Approach to Burnout Management

The awareness and management of burnout are set to evolve rapidly. Organizations are increasingly integrating mental health into their human resources agenda, recognizing it as integral to productivity and employee retention.

Emerging trends include the adoption of AI-driven wellness platforms that provide personalized stress management coaching. For example, companies like Unmind and Ginger provide apps that analyze employee mood data and suggest tailored interventions, boosting overall mental health outcomes.

Data analytics and machine learning will further empower managers to identify burnout risks proactively through behavioral indicators, enabling timely support.

Meanwhile, telework and flexible work models continue gaining traction. Research by FlexJobs in 2023 found that employees with flexible schedules reported 44% less burnout. Hybrid work environments can facilitate better work-life integration, although they require effective management to avoid blurring professional boundaries.

On an individual level, genetic and neuroscience research may soon offer insights into personalized approaches for resilience building and stress reduction.

In conclusion, facing burnout in today’s dynamic work environments demands strategic and multifaceted approaches. Understanding burnout mechanisms, recognizing early signs, leveraging supportive networks, and balancing work and personal life are foundational steps. Combined with emerging technological tools and evolving workplace cultures, these strategies provide hope and practical means to thrive without quitting your job. Prioritizing mental well-being is not just good for employees—it is essential for sustainable career success and organizational health.