Living with ADHD (Attention Deficit Hyperactivity Disorder) or executive dysfunction imposes unique challenges on daily tasks, including managing finances effectively. Executive functions such as planning, organization, prioritization, and impulse control are critical in maintaining a balanced budget and financial security. However, for people with ADHD or executive dysfunction, these abilities may be compromised, leading to money management difficulties that can negatively affect both short-term comfort and long-term financial goals.

According to the National Institute of Mental Health, approximately 4.4% of adults in the United States have ADHD, while executive dysfunction affects an even broader population across various neurological and psychological conditions. These challenges often translate to impulsive spending, difficulty tracking expenses, and trouble saving for important expenses. This article outlines practical strategies and tools that can empower individuals with ADHD or executive dysfunction to regain control of their money, avoid debt traps, and build financial resilience.

—

Understanding the Impact of ADHD and Executive Dysfunction on Financial Behaviors

One of the hallmark difficulties faced by those with ADHD is impulsivity, which directly impacts spending habits. Impulsive purchases may provide immediate gratification but often lead to overspending and financial strain. For instance, someone might buy an expensive gadget on a whim, later regretting the decision when bills pile up. According to a 2018 study published in the _Journal of Attention Disorders_, adults with ADHD report spending up to 20% more on non-essential items compared to neurotypical counterparts.

Executive dysfunction further complicates money management due to impaired organizational skills and difficulties in task initiation and follow-through. A person may struggle to keep track of bills or miss payment deadlines, incurring late fees and damaging credit scores. For example, forgetting to pay a utility bill or failing to reconcile bank statements are common scenarios. The cognitive overload caused by such repeated financial mistakes can lead to stress and avoidance behaviors, creating a cycle of financial hardship.

—

Effective Budgeting Strategies Tailored for ADHD and Executive Dysfunction

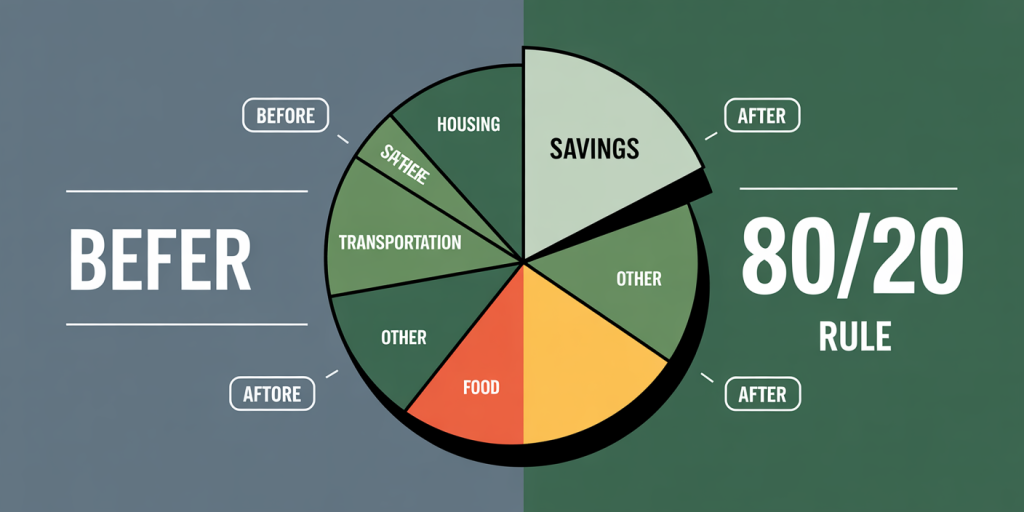

Creating a comprehensive yet straightforward budget is foundational to improving financial wellbeing. However, traditional budgeting methods that require detailed tracking and long-term planning can be overwhelming for those with executive function challenges. Simplified budgeting techniques that minimize decision fatigue and enhance clarity often work better.

One effective strategy is the “envelope system,” which involves allocating a set amount of cash for specific spending categories such as groceries, entertainment, and transportation. Once the cash in a category is spent, no more spending is allowed until the next budgeting period. This tangible method reduces the temptation to overspend, as physical cash provides immediate feedback that credit or debit cards do not. Maya, a 32-year-old graphic designer with ADHD, shared her experience: “Using envelopes helped me stop overspending on coffee runs and impulsive online buys. It was easier to visualize where my money went.”

Another approach is to utilize automated budgeting apps designed with simplicity in mind. Applications such as YNAB (You Need A Budget) or Simplifi by Quicken allow users to categorize transactions with minimal manual entry and offer alerts for upcoming bills. Automation reduces the cognitive load and helps maintain consistency without requiring constant active management.

| Budgeting Method | Pros | Cons | Best For |

|---|---|---|---|

| Envelope System | Tangible, reduces impulsivity | Requires cash handling, less flexible | Those who respond to physical cues |

| Automated Budget Apps | Convenient, minimal active input | May require tech literacy | Tech-savvy individuals seeking ease |

—

Tackling Impulsivity and Avoiding Unplanned Purchases

Impulsive spending presents a significant challenge, but developing small habits can help manage this tendency. One immediately effective tactic is instituting a mandatory “cooling-off” period before making non-essential purchases. For example, enforcing a rule where any item over $20 requires a 24-hour reconsideration period can temper spur-of-the-moment decisions.

John, a 27-year-old software engineer, noted the difference this made: “I used to buy things right when I saw them online. Now, if I want something, I save it to a wishlist and revisit it the next day. Most times I decide I don’t need it after all.”

Another useful tool is removing easy access to credit cards or online payment information. Keeping credit cards in a hard-to-reach place or deleting saved payment information from shopping sites increases the friction involved in impulsive purchases, giving the person more time to think through expenses.

Combining these techniques with mindfulness practices can enhance self-awareness around spending triggers. Apps like Headspace or Calm include brief sessions tailored to ADHD symptoms, promoting better emotional regulation and controlled spending.

—

Streamlining Bill Payments and Financial Record Keeping

Missed payments and disorganized financial records are common problems that exacerbate money management difficulties. A practical step toward resolution is automating bill payments wherever possible. Most banks and service providers offer autopay options that debit amounts directly from checking accounts on predetermined dates. This prevents late fees and maintains credit health.

However, automation must be monitored. Setting calendar reminders or alarms a few days before payment dates fosters awareness and ensures sufficient funds are available to avoid overdrafts. Sarah, a 45-year-old teacher with executive dysfunction, stressed the importance of this balance: “Autopay stopped my late fees, but I still check my accounts weekly to make sure nothing unexpected debited.”

Digitizing financial documents helps streamline record-keeping. Using cloud-based tools like Google Drive or Evernote to store receipts, tax documents, and budgeting summaries simplifies access and reduces paper clutter. Labels and folders can be color-coded or tagged for easy searching, accommodating different cognitive preferences.

—

Leveraging Support Systems and Professional Resources

Managing finances with ADHD or executive dysfunction does not have to be an isolated effort. Support networks, whether professional or personal, play a critical role. Enlisting trusted family members or friends as accountability partners provides motivation and oversight. For example, monthly check-ins with a partner about spending habits and goals can offer encouragement and constructive feedback.

Professional help from financial advisors trained to work with neurodiverse clients can tailor strategies to individual needs and limitations. These specialists understand the nuances of executive dysfunction and can recommend suitable tools, investment choices, and debt management plans.

Additionally, some people benefit from working with ADHD coaches who specialize in skill-building around organization and self-regulation. These coaches can help integrate financial goals into wider life management strategies, promoting consistency and improved executive functioning over time.

—

Future Perspectives: Innovations and Tools for Financial Empowerment

Technological advancements continue to offer promising solutions for individuals with ADHD or executive dysfunction managing money. Emerging AI-driven financial assistants are capable of learning user habits and providing personalized spending advice in real-time. These assistants can send reminders, warn about over-budget categories, and recommend saving opportunities – all tailored to executive function challenges.

Wearable technology might soon integrate finance management into daily routines more seamlessly. Imagine smartwatches that detect physiological signs of impulsivity and prompt users to pause before making purchases. Such biofeedback could revolutionize impulse control practices.

On a broader front, awareness of neurodiversity in financial services is increasing, encouraging the development of inclusive banking products and educational programs. Governments and non-profits are also investing in financial literacy initiatives designed specifically for neurodiverse populations, recognizing the economic benefits increasing independence can bring.

As research continues to expand, understanding ADHD and executive dysfunction’s impact on finances will sharpen, empowering healthcare professionals and financial planners to collaborate on comprehensive, adaptive support systems.

—

Managing money with ADHD or executive dysfunction involves recognizing specific cognitive challenges and applying tailored, practical tools to reduce stress and improve financial health. By simplifying budgeting, curbing impulsive spending, automating payments, leveraging support, and embracing technology, individuals can overcome obstacles to money management and build a stable financial future. Awareness and ongoing innovation promise a more inclusive and effective approach to financial empowerment for neurodiverse communities.