In today’s digital era, a strong online personal brand has become an essential asset for professionals seeking to advance their careers, expand their influence, or pivot into new industries. Whether you are an entrepreneur, freelancer, corporate executive, or creative professional, your digital presence can dramatically impact how peers, employers, and clients perceive you. Building a personal brand online is no longer optional; it is a strategic career move.

According to a 2023 LinkedIn survey, over 70% of recruiters consider a candidate’s online presence before making hiring decisions, underscoring the power of digital reputation. More than just a digital résumé, personal branding involves communicating your unique skills, values, and personality to create recognition and trust in your field. This article delves into actionable strategies on how to effectively build your personal brand online, supported by practical examples and data-driven insights.

—

Defining Your Unique Value Proposition (UVP) and Brand Identity

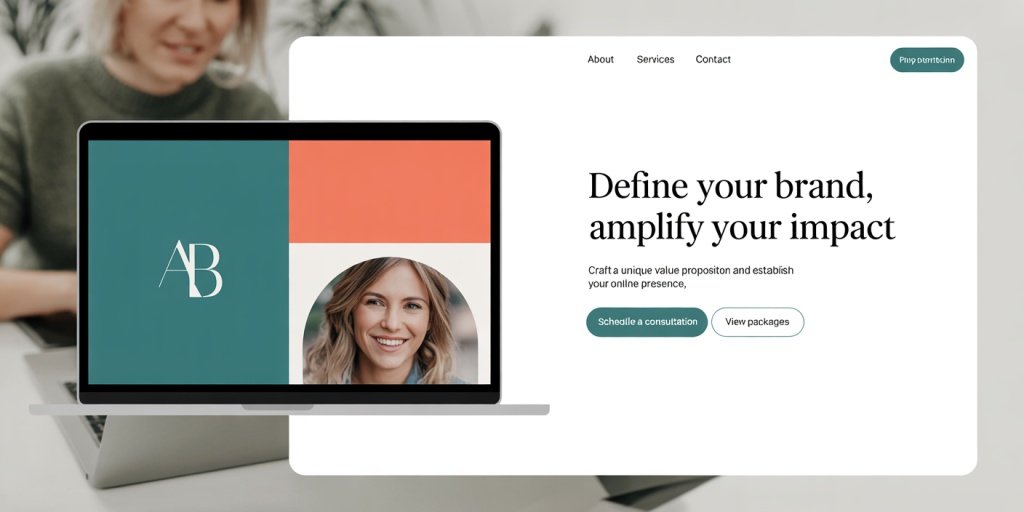

The foundation of a robust personal brand lies in clearly defining what sets you apart from others within your professional space. Your Unique Value Proposition (UVP) articulates the combination of skills, experiences, and qualities that make you valuable to your target audience.

Start by conducting a self-assessment that highlights your core competencies, industry expertise, passions, and professional achievements. For example, Simon Sinek, the renowned motivational speaker, built his brand around the idea of “Why” — focusing on leadership and purpose — which resonates deeply with professionals worldwide. Similarly, Rachel Hollis combined lifestyle coaching with real-life storytelling, creating a strong, approachable voice.

Once your UVP is clarified, reflect it consistently in your online presence — from your LinkedIn headline and biography to your Twitter handle and personal website. Consistency ensures that visitors immediately understand who you are and what you bring to the table.

Moreover, define your personal brand’s visual identity. This includes choosing a professional profile photo, color schemes, fonts, and logo (if applicable). Research shows that posts with images receive 94% more total views on LinkedIn (LinkedIn, 2022). Therefore, visuals are essential in making your brand memorable. Tools like Canva and Adobe Spark can help non-designers create polished visual elements.

—

Creating and Curating High-Quality Content to Showcase Expertise

Content is king in the online branding realm. Sharing valuable information through blog posts, videos, podcasts, or social media posts bolsters your authority and helps attract a dedicated audience. According to HubSpot’s 2023 report, 72% of marketers say relevant content creation is the most effective SEO tactic, which extends to personal branding strategies.

Start by choosing content formats that align best with your strengths and audience preferences. For instance, if you enjoy writing, maintain a blog or LinkedIn newsletter. Neil Patel, a digital marketing expert, leveraged his blog to build a worldwide brand and become a top influencer in SEO consultancy. Conversely, Gary Vaynerchuk’s brand thrives on constant, engaging video content distributed via YouTube and Instagram.

Content topics should address pain points or common questions in your industry. For example, a financial consultant might publish articles on “Effective Budgeting Strategies for Millennials” or “Navigating Tax Season for Freelancers.” Using keyword research tools like Ahrefs or SEMrush can help you identify popular search terms, enhancing your SEO and increasing organic reach.

In addition to creating content, curating third-party relevant material demonstrates that you are well-informed and engaged with industry trends. Sharing insightful articles alongside your commentary contributes to community building and sparks meaningful conversations with followers.

—

Leveraging Social Media Platforms Strategically

Different social networks serve distinct professional purposes, so careful platform selection is critical to maximize your personal branding efforts. LinkedIn remains the premier channel for professional networking and thought leadership. Research by LinkedIn in 2023 shows that users who share content weekly on the platform receive up to 5x more profile views and 9x more connection requests than those inactive.

Twitter offers immediacy and influence in fast-moving industries such as tech, journalism, and politics, allowing professionals to participate in relevant conversations and build network connections quickly. Instagram and TikTok, usually perceived as lifestyle and entertainment platforms, are becoming important for creative professionals and entrepreneurs to visually tell their brand stories, as demonstrated by entrepreneurs like Marie Forleo offering motivational content in bite-sized videos.

Create platform-specific strategies that involve posting frequency, content types, and engagement with followers. Here is a comparative table outlining some key platforms for personal branding:

| Platform | Primary Use | Ideal Content Types | Engagement Tips | Audience Examples |

|---|---|---|---|---|

| Professional networking | Articles, posts, videos | Respond to comments, join groups | Corporate professionals, recruiters | |

| Real-time updates, thought leadership | Tweets, threads, polls | Use hashtags, engage in discussions | Journalists, tech experts | |

| Visual storytelling | Photos, Reels, stories | Use hashtags, interact via DMs | Creators, entrepreneurs | |

| TikTok | Short-form video content | Educational clips, trends | Post consistently, leverage trends | Young entrepreneurs, creatives |

Maximize your presence by optimizing profiles with keyword-rich summaries, professional images, and regular updates reflecting your current projects and ambitions.

—

Networking and Engagement: Building Authentic Relationships

Building an online personal brand does not equate to broadcasting messages into the void; it requires fostering genuine connections. Engagement is the currency of social media, and active participation in industry groups and conversations can significantly elevate your visibility.

For example, Melissa Ramos, a digital marketing consultant, increased her client base by 40% within six months by consistently commenting on LinkedIn posts and joining webinar discussions. She shared insights and best practices without overtly selling her services, positioning herself as a helpful authority.

Proactively reaching out to industry leaders for informational interviews or collaborations via LinkedIn messages can also open doors. The key is personalization and demonstrating sincere interest. Avoid generic “connect with me” notes; instead, mention specific content or achievements of the person to spark a meaningful connection.

Hosting or participating in Twitter Spaces, LinkedIn Live sessions, or Clubhouse discussions can also boost your presence. These interactive formats humanize your brand, allowing audiences to experience your personality and expertise in real time.

—

Tracking Progress and Adapting Your Strategy Based on Analytics

Consistently monitoring and analyzing key performance indicators (KPIs) allows you to refine your personal branding efforts for better results. Depending on your goals, relevant metrics might include follower growth, engagement rates, website traffic, search engine rankings, or conversion rates (e.g., inquiries or job offers).

Platforms such as LinkedIn provide analytics dashboards that display post impressions, engagement metrics, and audience demographics. Third-party tools like Google Analytics offer insights into your website users’ behavior and referral sources.

Suppose you notice that your video posts on LinkedIn receive twice the engagement of textual posts; this data suggests doubling your video efforts could optimize growth. Conversely, if you detect that certain topics resonate more, tailor content calendars to explore those themes deeper.

Below is a sample table showing hypothetical analytics data to illustrate how to interpret performance metrics:

| Content Type | Posts | Avg. Engagement % | Click-Through Rate (CTR) | Lead Inquiries/Month |

|---|---|---|---|---|

| Blog Articles | 8 | 6.5% | 3.2% | 12 |

| LinkedIn Videos | 5 | 12.1% | 4.5% | 25 |

| Twitter Threads | 10 | 4.8% | 2.1% | 5 |

By understanding which types of content and platforms drive the best engagement and leads, you can allocate time and resources more effectively.

—

Emerging Trends: The Future of Personal Branding Online

Looking ahead, personal branding strategies are blending more sophisticated digital tools and interactive technologies. Artificial intelligence (AI) can now assist in content creation, audience analysis, and personalized messaging, enhancing efficiency and precision. For instance, AI-powered platforms like Jasper and Copy.ai help professionals generate SEO-optimized blog posts or social media captions tailored to their niche.

Video content, especially short-form videos on platforms like TikTok and Instagram Reels, is predicted to dominate as audiences increasingly prefer engaging, bite-sized information. The rise of augmented reality (AR) and virtual reality (VR) may soon create immersive personal branding experiences such as virtual networking events or digital portfolios in 3D spaces, providing unprecedented interaction levels.

Moreover, authenticity and vulnerability in personal branding will remain critical as digital audiences seek relatability beyond polished professional personas. Hybrid content that balances expertise with human stories builds trust and long-term relationships.

Lastly, data privacy concerns may lead professionals to adopt more transparent and ethical branding practices. Transparency about sponsored content and data handling will underpin credibility to maintain audience trust in evolving digital landscapes.

—

Building a personal brand online requires a strategic, consistent effort to communicate your unique value, engage meaningfully within your community, and adapt thoughtfully based on measurable insights. By harnessing the power of digital tools, diverse content formats, and authentic networking, any professional can position themselves for success in an increasingly connected world.